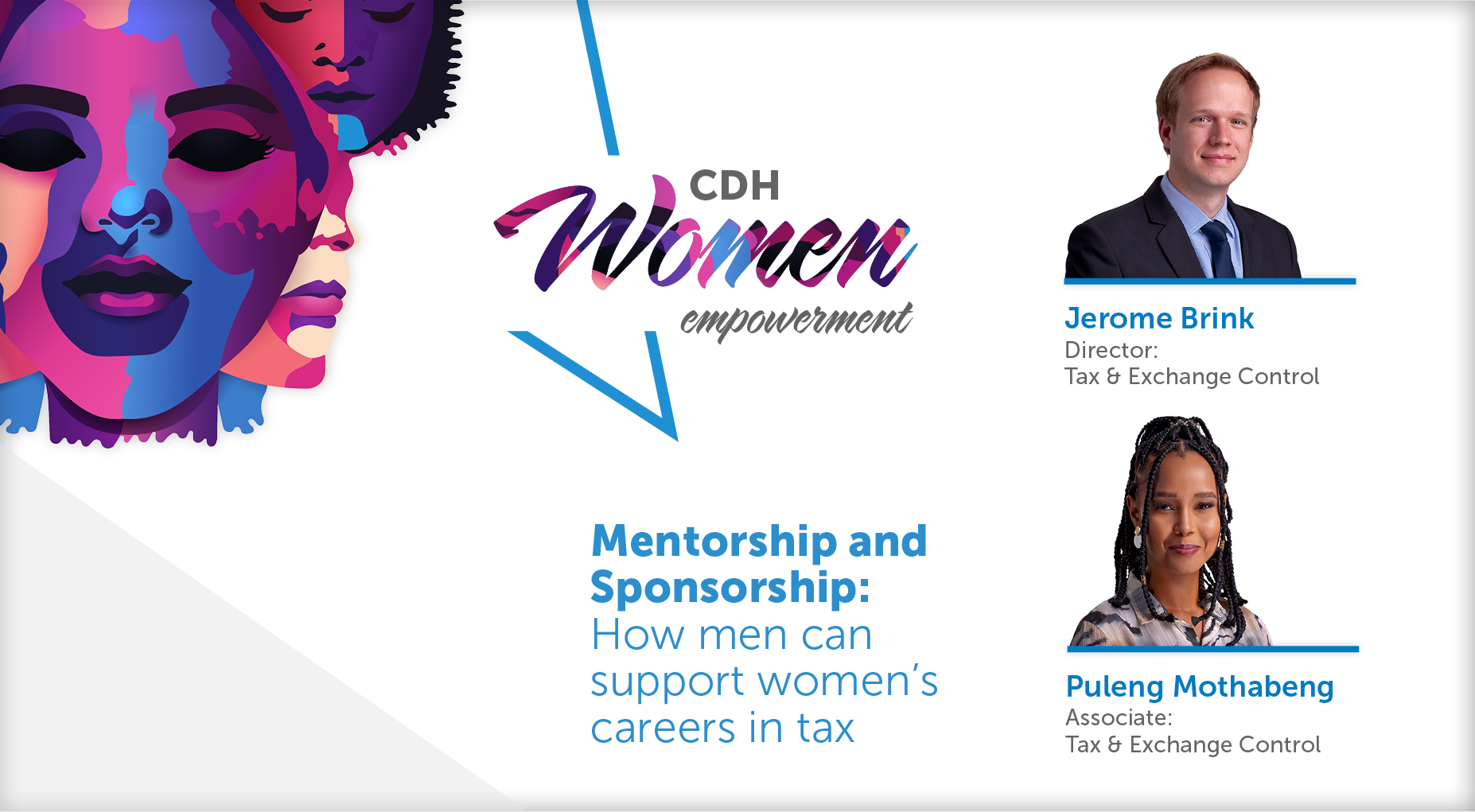

Jerome Brink

About Jerome

Jerome began his career in 2012 as a Candidate Attorney in the Tax Department at Edward Nathan Sonnenbergs Inc. (ENSafrica), where he was appointed as a tax Associate in 2014. Jerome joined Cliffe Dekker Hofmeyr as an Associate in the Tax & Exchange Control practice in 2016 and was promoted to Director in 2020.

Areas of expertise

Experience

Advised various taxpayers on the interpretation and application of various pieces of fiscal legislation, including double tax treaties in relation to a wide variety of commercial transactions and business activities.

Advised various taxpayers in relation to disposals, mergers and acquisitions of assets, including both domestic and cross-border transactions.

Assisted various taxpayers with the establishment and implementation of share incentive schemes, including in relation to notional vendor funding.

Advised various clients on the implementation of a range of commercial transactions, including commenting on commercial agreements from a tax perspective.

Assisted and provided tax structuring and advice regarding various listed and unlisted entities in respect of their South African operations, cross-border transactions, and inward/outward investments.

Provided tax advice pertaining to investment fund formations as well as the establishment and implementation of various section 12J venture capital companies. Also assisted in the establishment of various renewable energy green funds.

Assisted with providing tax advice to several JSE-listed companies regarding the structure and implementation of black economic empowerment transactions involving, amongst others, group reorganisations, financing and funding issues, as well as the establishment of share incentive schemes.

Assisted with the preparation, submission, and implementation of various advance tax ruling applications to the South African Revenue Service pertaining to, amongst others, structured investment products, share incentive schemes, and insurance products.

Provided advice to various listed REITs and unlisted property companies regarding relevant special taxation regimes.

Assisted a wide variety of taxpayers across sectors in relation to audits and disputes with the South African Revenue Service including in particular disputes relating to certain technical interpretational aspects of South African fiscal legislation.

In particular, Jerome has advised various multinationals on transfer pricing disputes with SARS.

Assisted with and made submissions to National Treasury and SARS in relation to amendments to fiscal legislation and issues in respect of interpretation.

Recognition

- Chambers Global 2026 ranked Jerome in Band 3 for Tax. 2024 - 2025 ranked him as an “Up & Coming” tax lawyer.

- The Legal 500 EMEA 2023-2025 recommended Jerome as a Next Generation Lawyer for tax.

- The Legal 500 EMEA 2022 recommended him for tax.

Credentials

Education

- BCom, Rhodes University

- LLB, Rhodes University

- LLM (Tax Law) cum laude, University of the Witwatersrand

- LLM (International Tax) cum laude, London School of Economics and Political Science (LSE)

- Certificate of Competence in Advanced Company Law I and II, University of the Witwatersrand

- Year of Admission as an Attorney: 2014

- Registered with the Legal Practice Council

Memberships

- South African Branch Chair of the International Fiscal Association (IFA) - Young IFA Network (YIN)

- Member of the Global YIN Committee

LANGUAGES

- English

- Afrikaans