Our team acts for a leading South Africa-based financial advisory services company

Our team acts for a leading South Africa-based financial advisory services company

Our team acts for a leading South Africa-based financial advisory services company in opposing a class action suit launched against several respondents who represent classes of shareholders in a defunct manufacturing and retail group.

You might also be interested in

3 Feb 2026

Annual increase to the national minimum wage, effective 1 March 2026

The National Minimum Wage Act 9 of 2018 (Act) was enacted to advance economic development and social justice by, inter alia, improving the wages of the lowest paid workers, and protecting workers from unreasonably low wages by establishing the national minimum wage (NMW).

Employment Law

1 min read

20 Nov 2025

by Alex Kanyi and Charity Muindi

Tax highlights from the Business Laws (Amendment) Bill, 2025

The Business Laws (Amendment) Bill, 2025 (Bill) proposes sweeping amendments to multiple statutes, with the overarching objective of enhancing the ease of doing business, promoting investment and aligning Kenya’s legal and regulatory framework with international standards. The Bill touches on key pieces of legislation, namely Special Economic Zones Act, Cap. 517A (SEZ Act), Export Processing Zones Act, Cap. 517 (EPZ Act), Stamp Duty Act, Cap. 480 (SDA), Income Tax Act, Cap. 470 (ITA), Excise Duty Act, Cap. 472, Miscellaneous Fees and Levies Act, Cap. 469C, and Value Added Tax Act, Cap. 476 (VAT Act).

Tax & Exchange Control

12 min read

4 Sep 2025

by Nadeem Mahomed and Sashin Naidoo

Publication of the 2025 Code of Good Practice: Dismissal

Today, 4 September 2025, the Minister of Employment and Labour published the final Code of Good Practice: Dismissal (the Code). The Code, effective from the date of publication, repeals the previous Schedule 8 Code of Good Practice on Dismissal and the Code of Good Practice Based on Operational Requirements

Employment Law

2 min read

21 Feb 2025

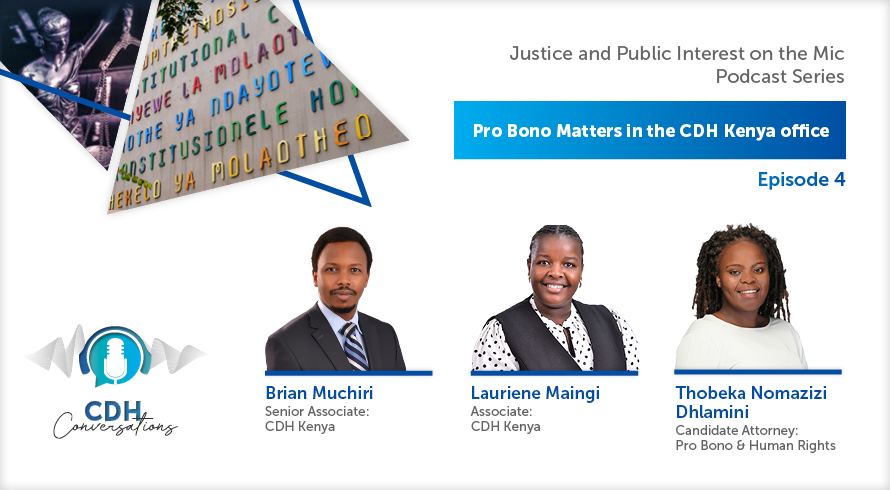

by Brian Muchiri, Lauriene Maingi and Thobeka Dhlamini

Justice and Public Interest on the Mic - Pro Bono Matters in the CDH Kenya office

Since 2013, CDH's Pro Bono & Human Rights practice (Pro Bono practice) has been at the heart of our firm's commitment to making a real difference. Over the past decade, our Pro Bono practice has passionately championed the cause of public interest, providing pro bono legal support to clients in need. The decision to establish a dedicated practice was motivated by our belief in giving back to the communities in which we operate and in the power of the legal profession to spark positive change.

Pro Bono & Human Rights

11:25 Minutes

2 Oct 2025

by Lloyd Smith and Ludwig Smith

The legal nature of preference share funding

On 16 August 2025 National Treasury and the South African Revenue Service published a Draft Taxation Laws Amendment Bill (TLAB), which proposed to amend section 8E of the Income Tax Act 58 of 1962 (ITA), by providing that any share treated as a “ financial asset ” under International Accounting Standard 32 would in the future be regarded as a hybrid equity instrument. The effect of that proposal, had it been adopted, was that dividends that became payable in respect of various instruments, including “ funding ” preference shares, would be treated as income and would accordingly be taxable.

Banking, Finance & Projects

6 min read

31 Oct 2025

by Gretchen Barkhuizen-Barbosa, Emily West and Danielle Goldschagg

Conclusion of a compromise with a creditor of a deceased estate requires explicit agreement

The case of FirstRand Bank Limited v Lourina Wilson NO and Another (373/2024) 149 (10 October 2025) dealt with an appeal to the Supreme Court of Appeal (SCA) which overturned the High Court’s decision that a debt against a deceased estate was fully settled through a compromise agreement.

Trusts & Estates Law

3 min read