Developments in Nigeria's merger regime under new competition regulations, operationality of authorities

At a glance

- Nigeria recently enacted the Federal Competition and Consumer Protection Act (the Act) and introduced the Nigerian Federal Competition and Consumer Protection Act Merger Review Regulations.

- The Act defines mergers and establishes notification thresholds based on turnover and asset values. Only large mergers require notification, and foreign-to-foreign mergers with a "local component" also fall under Nigerian jurisdiction.

- Public interest considerations, such as industrial sectors, employment, competitiveness, and small and medium enterprises, are taken into account when assessing mergers, and filing fees are calculated based on turnover or transaction consideration. The fees may be disproportionate and a cap on fees is yet to be determined.

Developments

While certain aspects of competition law had been regulated by the Consumer Protection Act (Cap C25, 1992), Nigeria did not have a dedicated competition regime prior to the new Act’s promulgation.

Following the passing of the Act into law, on 23 November 2020, the Nigerian Federal Competition and Consumer Protection Act Merger Review Regulations were published (the Regulations). The Regulations aim to provide the substantive and procedural requirements for the implementation of the Act’s framework. Most recently, on 4 March 2021, the Federal Competition and Consumer Protection Commission (Commission) and the Competition and Consumer Protection Tribunal (Tribunal) were inaugurated by the Minister of Industry, Trade and Investment.

Merger regulation and thresholds

The Act defines a merger as when one or more ‘undertakings’ directly or indirectly acquire or establish direct or indirect control over the whole or part of the business of another undertaking. A merger can be defined as small or large, depending on turnover and asset values of the firms involved in the transaction. Only large mergers require notification. The Regulations instruct the newly formed Commission to consider the acquisition of shareholding or voting rights above 25% as a likely merger based on a rebuttable presumption of conferring the ability to materially influence policy.

Notification must occur where a combined turnover equals / exceeds 1 billion Naira. Notification is also required if the target firm’s turnover exceeds or equals 500 million Naira regardless of the size of the acquiring firm. It is further noted that foreign merging parties will be required to appoint local legal representation to notify the merger to the Commission.

Prior to the promulgation of the Regulations, there was a lack of clarity regarding the notification requirements of foreign-to-foreign mergers. The Regulations now specifically grants jurisdiction to consider mergers that occur “purely as a result of a transaction involving undertakings wholly domiciled outside Nigeria” if the merger has a “local component”. This in turn requires the foreign enterprise to have a ‘local nexus’, such as subsidiaries in Nigeria, or for the foreign enterprise to meet the turnover requirements to be classified as a large merger (i.e. combined annual turnover of the acquiring undertaking and target undertaking in, into or from Nigeria equals or exceeds 1 billion. Naira or the annual turnover of the target undertaking in the preceding year equals or exceeds 500 million Naira) (Regulation 22).

Public interest considerations

In terms of section 94(4) of the Act, the following factors are taken into account when assessing public interest:

- a particular industrial sector or region;

- employment;

- the ability of national industries to compete in international markets; and

- the ability of small and medium scale enterprises to become competitive.

The legislation (at sections 94(1)(b)(ii) and 94(3)(b)) provides that the Commission shall determine whether a merger that appears likely to prevent or lessen competition can or cannot be justified on public interest grounds. Accordingly, the Commission may confirm a merger on the basis of public interest considerations even where the merger is likely to lessen competition.

However, section 94(1)(c) of the Act appears to open the door for the rejection of a merger that does not offend competition on the basis of public interest considerations as a standalone ground for determining whether a merger can be justified or not.

Fees payable

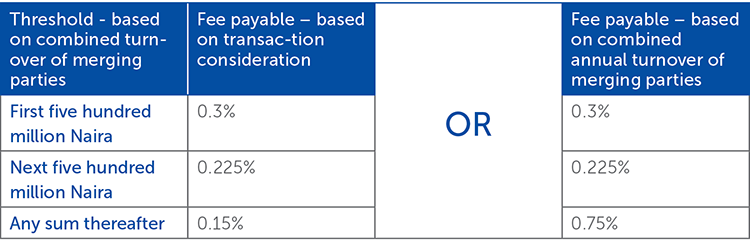

The merger filing fee is calculated on a sliding scale as a percentage of either the combined annual turnover of the merger parties in, into or from Nigeria or as a percentage of the transaction consideration, whichever is the higher:

The filing fees payable may be disproportionate to the impact that the merger may actually have in Nigeria, particularly in foreign-to-foreign transactions where a Nigerian business is a small part of the overall transaction value. It remains to be seen whether a cap will be introduced to limit the fees payable for a merger filing.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe