Competition law in Africa – merger control update

Eswatini

In terms of the Swaziland Competition Act 8 of 2007, there are no thresholds for merger notification in Eswatini; and all mergers, regardless of value, are notifiable. However, with regard to filing fees, mergers are classified as small or large. A merger is classified as small if the combined annual revenue or gross asset value of the merging enterprises is SZL8,000,000 or less; and as large if the combined annual revenue or gross asset value of the merging enterprises is more than SZL8,000,000.

A small merger does not attract a filing fee while a large merger attracts a filing fee of 0.1% of the merging parties’ combined global annual revenue or assets, whichever is greater, and is capped at SZL600,000. Despite opposition from merger parties and the legal fraternity, the Eswatini Competition Commission has recently confirmed its interpretation that this filing fee calculation is determined with reference global annual revenue or assets regardless of the fact that the merging parties’ local annual revenue or assets in Eswatini may be miniscule. This may result in a situation where, despite the merging parties’ local Eswatini annual revenue and/or asset value being only some SZL900,000, 0.1% of their global operations is valued well above SZL600,000, in which case the filing fee payable to the Eswatini Competition Commission for assessment of the merger would nonetheless be SZL600,000. The result being that parties become liable for payment of a filing fee that may well exceed the asset value and/or annual revenue derived in, into and from the Eswatini region by the businesses in question.

Botswana

On 2 December 2019, the Botswana Competition Act 2 of 2018 (Competition Act) came into force. The implications of the new Competition Act have been highlighted in a previous article which can be found here. Pursuant to the Competition Act, the Botswanan Competition and Consumer Authority (BCCA) issued regulations which prescribed various new forms to be submitted when notifying the BCCA. In terms of merger notifications, a new Form K (previously Form J) must be submitted. There are few differences between the forms, with the schedules remaining largely the same. However, notable changes include the addition of questions 19 – 24 on Form K which now requires the merging parties to (inter alia):

- indicate the potential impact the transaction may have on: (1) employment creation/maintenance, (2) skills transfer, (3) foreign direct investment, (4) citizen economic empowerment, (5) small, medium and micro-sized enterprise advancement and (6) consumer benefits;

- indicate any other business interest that the shareholders have in Botswana, presumably including non-controlled interests;

- state any previous acquisitions that the merging parties have been involved in for the past 5 years in Botswana.

Nigeria

In January 2019, Nigeria enacted the Federal Competition and Consumer Protection Act 1 of 2019, (FCCPA) which introduced a consolidated competition law framework in Nigeria. Prior to the enactment of the FCCPA, Nigeria did not have a dedicated competition law regime and mergers and acquisitions were generally regulated by various sector-specific pieces of legislation and the Investment and Securities Act, 2007 (ISA) with the Securities and Exchange Commission (SEC).

In essence, the FCCPA repealed certain sections pertaining to mergers, acquisitions and business combinations in the ISA which effectively stripped the SEC of its powers to relation to private companies and makes provision for the Federal Competition and Consumer Protection Commission (FCCPC) as the new regulatory body empowered to deal with mergers, acquisitions and business combinations by or involving private companies. However, the SEC still functions in regulating the capital market in Nigeria in relation to considering the fairness among shareholders in mergers and acquisitions by or involving public companies. The SEC states that approval from both the FCCPC and SEC will be required for mergers by public companies. Mergers by or involving private companies are not required to clear this additional hurdle and need approval only from the FCCPC.

The SEC and FCCPC issued a joint advisory notice in May 2019, providing that notifications were to be submitted to the FCCPC and would be jointly reviewed by the SEC and FCCPC (under the SEC rules) until the new regime implemented the necessary regulations and guidelines.

On 9 September 2019, the FCCPC adopted thresholds for mandatory merger notification, with the effect that transactions satisfying one of the following legs will be notifiable:

(i) the combined annual turnover of acquiring firm and the target firm in, into or from Nigeria equals or exceeds N1,000,000,000; or

(ii) the annual turnover of the target firm in, into or from Nigeria equals or exceeds N500, 000,000.

The FCCPA distinguishes between large and small mergers. According to the FCCPA, large mergers are mergers above the prescribed threshold, and small mergers are those below the prescribed threshold. Small mergers are not mandatorily notifiable before the FCCPC and may be implemented without approval. However, the FCCPC may require parties to a small merger to notify it within six months of implementation if it is of the opinion that the merger may lessen competition. Large mergers are required to be notified before the FCCPC and may not be implemented prior to receiving approval. It is unclear whether the above thresholds determine notifiability before the SEC as well, since the FCCPA repealed the section on merger thresholds in the ISA. In respect of transactions by or involving public companies, it is also uncertain whether implementation is prohibited until approval by both the SEC and the FCCPC is obtained.

The thresholds do not prescribe the presence of the target enterprise in Nigeria as a requirement to trigger mandatory notification. In lieu hereof, the FCCPC published the Guidelines on Simplified Process for Foreign-to-Foreign Mergers with Nigerian Component (Guidelines) in November 2019, which deals with transactions involving merging parties which are domiciled outside of Nigeria.

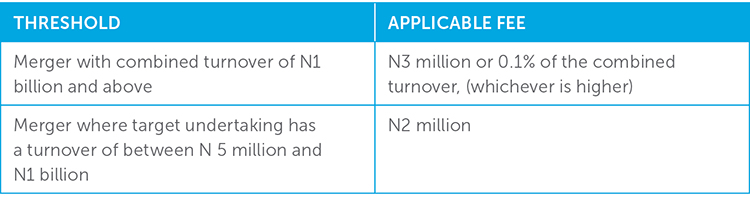

Although the relevant procedures for other mergers has yet to be published, the Guidelines set out relatively standard requirements for foreign-to-foreign mergers. In terms of fee structure for foreign-to-foreign mergers, the filing fees are determined as follows:

Notably, there is no cap for the fees under the combined leg which may result in filing fees approaching extremely high levels to the detriment of the commerciality of deals. In addition, the Guidelines provide for foreign-to-foreign merger notification on an expedited basis subject to an additional fee of N5,000,000.

However, no further particulars (such as review periods) are provided for in respect of non-expediated foreign-to-foreign mergers. In addition, it is not clear what the filing fee structure would be for all other mergers (which has yet to be announced) and/or whether this filing fee will be affected by a merger also required to be filed with the SEC.

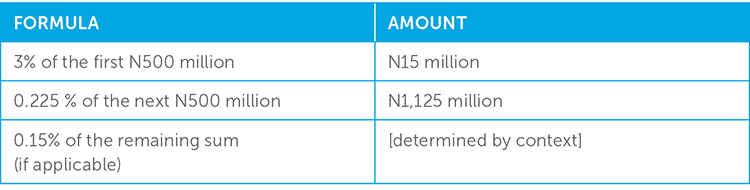

In terms of the latter, the filing fee for pre-merger notice before the SEC is N50,000. The filing fee for merger notification to the SEC is determined by the value of the scheme shares, or the value of the company or asset being acquired, in cases of acquisition, on a scale as follows:

Kenya

On 25 November 2019, the Competition (General) Rules 2019 (General Rules) were introduced.

In relation to merger control, the General Rules distinguish between mergers mandatorily notifiable before the Competition Authority of Kenya (CAK), mergers which can be considered for exclusion from notification before the CAK, and mergers that need not be notified before the CAK at all. Further, the provisions relating to merger filing fees, abandonment of mergers, dual notifications and mergers which have been implemented without the CAK’s approval have also been changed. The CAK has confirmed that these General Rules are currently being applied.

Transactions always subject to notification

Mergers mandatorily notifiable before the CAK must meet any of the following thresholds:

- a minimum combined turnover or assets (whichever is higher) in Kenya of KES 1,000,000,000 and the turnover or assets (whichever is higher) of the target firm is above KES 500,000,000;

- the turnover or assets (whichever is higher) of the acquiring firm is above KES 10,000,000,000 and the merging parties are in the same market or can be vertically integrated, unless the transaction meets the COMESA merger notification thresholds;

- in the carbon-based mineral sector, if the value of the reserves, the rights and the associated assets to be held as result of the merger exceeds KES 10,000,000,000;

- where the firms operate in the COMESA region, the combined turnover or assets (whichever is higher) is between KES 500,000,000 – 1,000,000,000 and two thirds (66.66%) or more of their turnover or assets (whichever is higher) is generated or located in Kenya.

Transactions (potentially) excluded from notification

There are certain mergers which may be considered for exclusion from notification, upon the approval of the CAK. These include:

where the combined turnover or assets (whichever is higher) is between KES 500,000 and KES 1,000,000,000;

if, irrespective of asset value, the firms are engaged in prospecting in the carbon-based mineral sector.

Transactions excluded from notification

Mergers entirely excluded from notification are those where:

- the combined turnover or assets (whichever is higher) does not exceed KES 500,000,000; or

- the merger meets the COMESA merger notification thresholds and at least two-thirds (66.66%) of the turnover or assets (whichever is higher) is generated or located outside of Kenya.

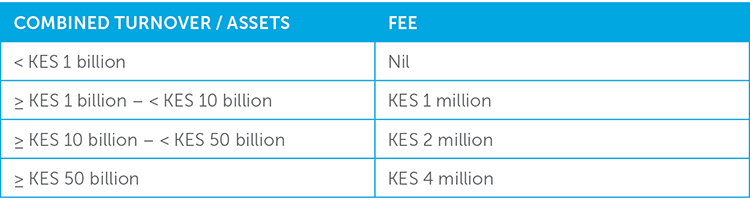

Merger filing fees

The applicable merger filing fees have also been updated and are reflected below:

Merger abandonment

If a party files a merger but does not provide further information requested by the CAK within 21 days of the request, the merger will be considered abandoned and all filing fees paid are forfeited.

Dual filings

In terms of the General Rules, a domestic merger notification to the CAK is not necessary if the proposed transaction meets the COMESA merger notification thresholds. Firms must now merely inform the CAK within 14 days that a transaction, which would otherwise fall under CAK authority, has been notified before the COMESA Competition Commission.

Implementation without CAK approval

The General Rules identify several factors to be taken into account by the CAK in determining whether mergers have been implemented without the requisite approval. These include whether there has been:

- an actual integration of any aspect of the firms, including (but not limited to) the integration of infrastructure, information systems, employees, corporate identity or marketing efforts;

- placement of employees from the target firm to the acquiring firm;

- an effort by the acquiring firm to influence or control any competitive aspect of the target firm’s business, such as setting prices, limiting discounts or restricting sales to certain customers or certain products;

- an exchange of strategic information between the firms for purposes other than valuation, or on a need-to-know basis during due diligence, or in ways compromising the strategic independence of each firm.

COMESA

On 6 February 2020, COMESA published a notice stating that the review periods in terms of Phase 1 and Phase 2 of the COMESA Merger Assessment Guidelines (COMESA Guidelines) will be suspended until further notice. In terms of the COMESA Guidelines, the COMESA Competition Commission (Commission) must make a decision on a merger within 120 days after receiving a complete notification.

During Phase 1, and provided that the Commission is of the view that the merger will not lead to a substantial lessening of competition with no further evidence or investigation being required, the Commission must make a determination on the merger within 45 business days after the merger has been notified (taking into account that an extension of up to 30 business days may be sought).

If during Phase 1 of its investigation, the Commission determines that a merger may lead to a substantial lessening of competition or further investigation and evidence is required before a decision can be reached, the assessment proceeds to a Phase 2 investigation. Phase 2 may continue until the expiry of a 120 business day period (taking into account that any extensions sought by the Commission from its Board of Commissioners must not cumulatively exceed 30 business days.

The decision to suspend the operation of the Phase 1 and Phase 2 review periods is due to the Commission’s ongoing consultations with member states regarding optimum merger review periods.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe