The take-home pay illusion: Assessing the real impact behind the proposed 2026 PAYE changes on employees

At a glance

- The Cabinet Secretary, National Treasury, John Mbadi, has announced the Government’s plans to table a Tax Laws (Amendment) Bill, 2026 in Parliament that will reform the employment income tax structure.

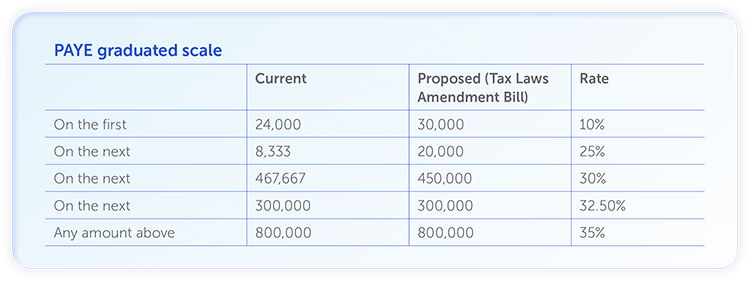

- The key proposals include expanding the band of income taxed at the lowest rate from KES 24,000 to KES 30,000 and introducing a 25% tax rate for monthly income between KES 30,000 and KES 50,000.

- While the proposed changes are intended to ease the tax burden on employees’ payslips, the Government’s heavy reliance on personal income tax continues to place a disproportionate burden on employees.

The key proposals include expanding the band of income taxed at the lowest rate from KES 24,000 to KES 30,000 and introducing a 25% tax rate for monthly income between KES 30,000 and KES 50,000. Subsequently, the new Pay-As-You-Earn (PAYE) bands are expected to be as follows:

While the Cabinet Secretary did not make any pronouncements on changes to the other tax bands, these reforms are intended to cushion low-income earners from high taxation and increase their disposable income. According to the 2025 Statistical Abstract Report from the Kenya National Bureau of Statistics (KNBS), approximately 1.36 million Kenyans earn below KES 50,000 per month and by the end of 2024, about 397,541 workers reported net monthly incomes exceeding KES 100,000.

The proposed reforms are aligned with recommendations from the World Bank’s Public Finance Review for Kenya, which has recommended reforms for efficiently and equitably taxing personal income tax. These reforms include funding health care through the national budget rather than through the Social Health Insurance Fund (SHIF) levy, repealing the housing levy for low-income earners and increasing the tax burden on top earners to 34.8%.

The Kenya Bankers Association (KBA) has also made proposals in relation to the revision of PAYE bands. It notes that the current tax rate on current PAYE bands as well as the current levies have reduced the purchasing power of individuals. In response, the KBA has proposed revised PAYE bands, which we generally support. However, we recommend that the highest tax band apply to monthly income exceeding KES 500,000, resulting in the PAYE bands as below:

These proposed tax changes come against the backdrop of an increase in National Social Security Fund (NSSF) contributions, where the 6% contribution will be applied across expanded earnings bands. Tier I contributions of 6% will apply to the first KES 9,000 of earnings, while Tier II contributions of 6% will apply to income between KES 9,001 and KES 108,000. The new NSSF contributions, effective from 1 February 2026, will increase as follows:

- The Tier I contribution will increase from KES 480 to KES 540.

- The Tier II contribution will increase from KES 3,840 to KES 5,940.

What are the implications of the proposed PAYE developments?

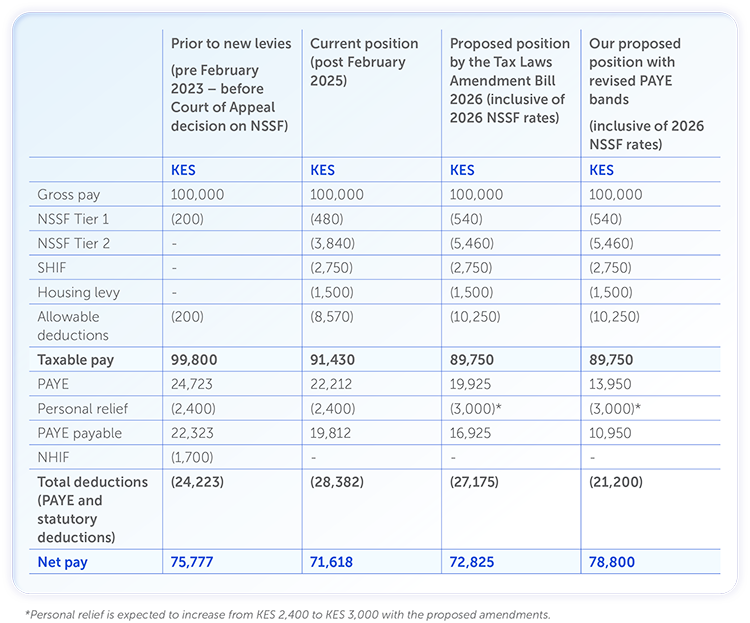

The proposed changes by the Cabinet Secretary may have a marginal effect on employees’ payslips, as illustrated in the table below.

*Personal relief is expected to increase from KES 2,400 to KES 3,000 with the proposed amendments.

The example above shows that the proposed changes by Government are expected to increase the net pay for individuals earning KES 100,000 by a meagre KES 1,207.10. While this represents an increase, it does not significantly ease the tax burden for salaried individuals. Similarly, for a low-income individual earning KES 30,000 the net increase will be meagre KES 1,361.25 due to the corresponding increase in NSSF which does not provide any significant reprieve as intended by the Government.

However, should National Treasury consider the proposals advanced by the KBA and ourselves, the PAYE framework would be more closely aligned with ability-to-pay principles and prevailing economic conditions. As demonstrated above, an individual earning KES 100,000 would experience a meaningful improvement in take-home pay, with a net increase of KES 7,182.10. Such an increase would not only increase the earnings but also enhance employees purchasing power allowing them to better absorb rising living costs and inflationary pressures.

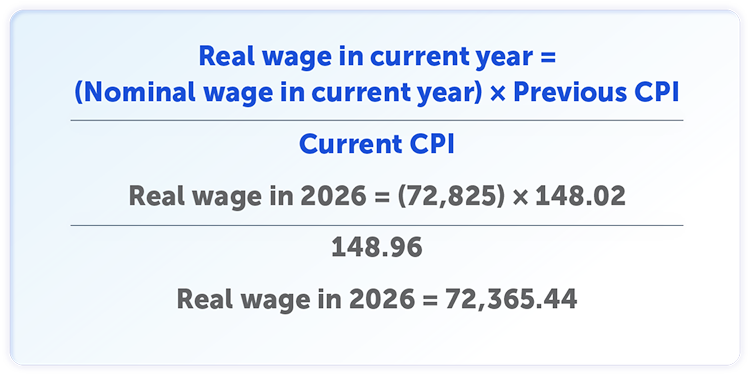

The 2026 KNBS consumer price index and inflation report revealed that the consumer price index (CPI) increased from 148.02 in December 2025 to 148.96 in January 2026. The annual consumer price inflation measured by CPI in January 2026 was 4.4%. As such, the real purchasing power of an individual earning KES 100,000 after the proposed changes measured against the inflation rate is as shown below:

Thus, the real increase in income after the introduction of the proposed changes by the Cabinet Secretary is a meagre KES 747.44, which is hardly significant in relieving the tax burden on employees’ payslips.

Conclusion

While the proposed changes are intended to ease the tax burden on employees’ payslips, the Government’s heavy reliance on personal income tax continues to place a disproportionate burden on employees. According to the 2025 KNBS Economic Survey, approximately 3.4 million individuals in Kenya are salaried, while about 17.4 million individuals are employed in the informal sector, representing 83.6% of the employed labour force, yet the Kenya Revenue Authority’s (KRA) FY2024/2025 annual revenue performance shows that PAYE alone accounted for KES 560.945 billion or 32.30% of the domestic revenue, making it the largest single tax head.

These numbers demonstrate the Government’s overreliance on earning revenue from the 16.4% of individuals in the formal employment sector, which disproportionately burdens their payslips. Therefore, it is important that the Government re-evaluates its tax policies to explore alternative revenue sources to relieve the tax burden on employees.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe