Unpacking the IRP2025

At a glance

- Unlike the draft Integrated Resource Plan published for comment at the beginning of 2024, the recently gazetted Integrated Resource Plan 2025 (IRP2025) incorporates comprehensive analyses of power system adequacy, grid constraints, legal frameworks, macro trends and generation technology costs and performance, using improved modelling methodology, including transmission detail via linearised DC-OPF formulation.

- The IRP2025 represents a R2,23 trillion investment plan that defines South Africa's energy mix through a three-horizon approach: medium term (up to 2030), transition (2031–2040), and long term (beyond 2040), with the plan acknowledging a shift from policy risk to execution risk in South Africa's energy transition; and

- It presents an ambitious but complex energy transition plan that balances multiple policy objectives including energy security, environmental considerations and economic impact

Overview

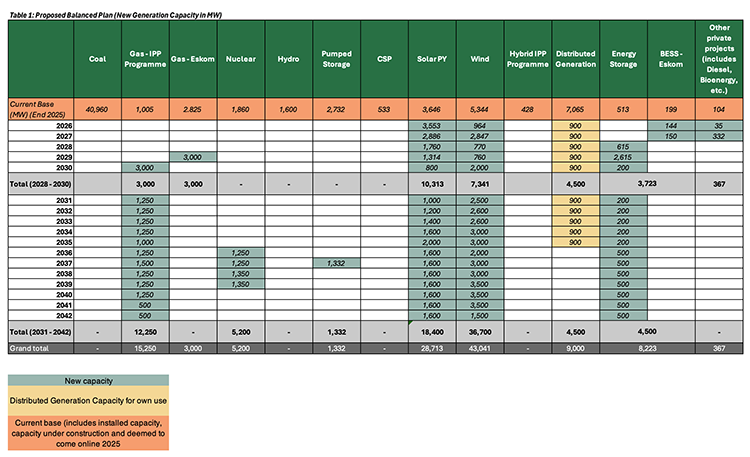

Having considered various scenarios across different government policy objectives (Reference Case, Gas at Risk Case, Nuclear Case, Aggressive Battery Learning, and Delayed Shutdown), the IRP2025 adopts a “Proposed Balanced Plan” (Balanced Plan), derived from characteristics of both the Gas at Risk and Nuclear Case scenarios, which scored highest in the evaluation matrix. It provides detailed capacity planning across the three horizons: medium term (up to 2030), transition (2031–2040), and long term (beyond 2040), with specific recommendations to 2042 and flexibility beyond 2040 to accommodate technological advancements.

Delivery of the projected Balanced Plan is premised on certain critical levers, as identified in the IRP2025. These include:

- Sustaining Eskom’s fleet performance at energy availability factor (EAF) levels above 60%, as any levels below this will result in a fragile power system unable to absorb negative contingencies or support economic growth aspirations.

- Commissioning 6 GW of Combined Cycle Gas Turbine (CCGT) capacity by 2030, which is crucial for maintaining security of supply when 8 GW of baseload coal-fired stations is shut down, with a minimum load factor of 50% necessary to anchor upstream gas processing infrastructure.

- Demonstration of clean coal technologies by 2030 to explore potentially cheaper and efficient options to significantly reduce both global and local emissions, which may influence country policy on the sustainable use of coal to power.

- Roll out of committed generation capacity, including renewables, peaking gas and storage.

- Implementation of long-lead time generation resources, including nuclear (with demonstration of multiple purpose nuclear reactors by 2032) and water pumped storage, as outlined in the Nuclear Industrialisation Plan.

- Implementation of transmission grid infrastructure per the Transmission Development Plan (TDP).

Unlike the Draft IRP2023, more details are provided in respect of the modelling approach and input assumptions, with the IRP2025 incorporating a comprehensive analysis of power system adequacy, challenging dynamics of the national grid, domestic legislative frameworks, economic and energy trends, and the costs and performance characteristics of evolving generation technologies.

Critical issues and considerations

Phased coal shutdown and clean coal demonstration plan

While no new generation capacity from coal is proposed under the IRP2025, the decommissioning of coal-fired power stations as envisaged in Eskom’s Generation Continued Operations shutdown plan is subject to certain contingencies, namely:

- Up until 2030, the retirement of 8 GW of coal generation capacity is dependent on the successful implementation of the gas procurement programme, with 6 GW of CCGT power required to come online by 2030. The Gas at Risk scenario in the IRP2025 demonstrates that without this gas capacity, the system would require approximately 3,5 GW of CCGT in the period between 2031 and 2035, highlighting the immediate need for mid-merit gas options to maintain security of supply.

- Potential delay in the retirement of coal-fired power plants, depending on the outcome of clean coal technologies’ demonstration by 2030, where positive results could “influence country policy on the sustainable use of coal to power”. The Delayed Shutdown scenario considers extending the operation of Kendal, Majuba, Lethabo, Matimba and Tutuka beyond their 50-year life by an additional 10 years, with maintenance and emission abatement retrofits to enable compliance with the National Environmental Management: Air Quality Act 39 of 2004 (NEMAQA). However, this scenario results in higher total system costs and reduced rate of CO2 emissions reduction compared to the reference case.

The IRP2025 assumes a phased shutdown of the coal fleet starting in 2029, with a significant reduction of 8 GW in coal capacity between 2029 and 2030, followed by a further decline of 15 GW between 2034 and 2042. The total coal capacity is projected to decline from the current approximately 42 GW to 28 GW by 2034.

Nuclear

The proposed Balanced Plan envisages 5,200 MW of new nuclear generation capacity coming online from 2036 and continuing through 2039. The IRP2025 indicates that a case for 10 GW of nuclear rests on the economic viability of re-establishing the nuclear fuel cycle, using nuclear for both power and industrial applications (non-power), which will be elaborated further in the Nuclear Industrialization Plan to be developed.

While nuclear does constitute a cleaner generation technology from an emissions perspective, several concerns have been raised regarding its role as part of South Africa’s future energy mix, including high capital costs; unclear financing strategies; opportunity cost of crowding out cheaper alternatives; and uncertainty over deployment of nuclear technology.

Gas to power

The significant gas to power allocation of 18,250 MW (comprising 6,000 MW committed by 2030 and an additional 12,250 MW between 2031 and 2042) faces material implementation risks: securing competitive gas supply and pricing; developing import, regasification and pipeline infrastructure (including potential links from Mozambique and coastal terminals); and ensuring transmission readiness at receiving nodes. The IRP2025’s Gas at Risk scenario quantifies system impacts if the gas build stalls, underscoring vulnerability should 6,000 MW of CCGT not be operational by 2030.

Recent litigation – including a Supreme Court of Appeal decision setting aside an environmental authorisation – also illustrates permitting and regulatory risk profiles for gas projects (which judgment we discussed in detail in our alert available here).

Grid dependency

Unlike previous iterations of the IRP, the IRP2025 explicitly models transmission constraints via a linearised DC OPF formulation, bringing locational realism into capacity expansion results. Nonetheless, the scale and pace of planned generation – especially wind/solar in the Cape corridors and coastal gas – risk outpacing both available capacity and current build schedules.

The TDP Plan 2024 identifies 14,494 km of new lines and 132,730 MVA of transformer capacity by 2034. Practical delivery is challenged by servitude acquisition and environmental approvals, global equipment lead times, capital intensity requiring cost reflective tariff determinations, and EPC capacity. The Independent Transmission Projects procurement is progressing under new regulations and draft cost recovery rules, but remains at an early stage, making timeline risk a central constraint for the execution of the IRP2025.

Without a commensurate acceleration in transmission investment and modernised grid operations, the ambitions for significant uptake of wind, solar and gas generated electricity are at risk.

Emission reduction and air quality

The IRP2025 affirms the commitment to achieving a net zero electricity sector by 2050 without compromising future security of supply, proposing CO2 emissions reduction from 168 Mt in 2030 to 142 Mt in 2035 (a 22% reduction), which aligns with anticipated sectoral emission targets under the Climate Change Act 22 of 2024. The electricity sector is projected to contribute 168 Mt (approximately 40%) of the total 420 Mt CO2-eq Nationally Determined Contribution (NDC) target in 2030. When applying the natural disturbance provision as per NDC accounting rules, total net greenhouse gas emissions are projected to be approximately 408–418 Mt CO2-eq by 2030, falling within the NDC target range of 350–420 Mt CO2-eq.

The IRP2025 nevertheless assumes continued partial compliance with the Minimum Emission Standards (MES) published in terms of the NEMAQA, without impact to capacity as provided by Eskom. This will, however, presumably be subject to the conditions imposed by the Minister of Forestry, Fisheries and the Environment in granting eight coal-fired power stations limited exemptions from complying with the MES, as discussed by us here.

Role of green hydrogen

The IRP2025 acknowledges the role of green hydrogen as outlined in the Cabinet-approved Hydrogen Society Roadmap (HSRM) of 2021, which envisions an inclusive, sustainable and competitive hydrogen economy by 2050. Green hydrogen is identified as a pivotal tool to decarbonise “hard-to-abate” sectors that cannot be directly electrified, including heavy industries such as iron and steel production, cement and chemicals manufacturing, and heavy-duty transport. The Department of Electricity and Energy will work in close collaboration with other departments to ensure successful realisation of the HSRM, with green hydrogen offering a pathway to cut emissions by replacing coal, gas or oil in high-temperature processes and fuel applications. However, while the IRP2025 focuses primarily on green hydrogen’s role in Power-to-X applications for industrial decarbonisation, it does not appear to acknowledge the potential role that green hydrogen could play in Power-to-Power applications for electricity grid balancing and storage.

No impact on electricity tariffs considered

The IRP2025 represents a R2,23 trillion investment plan, with total system costs exceeding R2 trillion across all scenarios studied. When questioned about electricity price path implications during the Minister’s briefing on the IRP2025, it was noted that tariff determination falls outside the IRP2025’s modelling scope. The plan acknowledges that it is “not an overall system cost technology plan but seeks to minimise the least-cost taking into account the impact on the economy” while balancing multiple policy objectives including energy security, environmental considerations, and economic impact.

Conclusion

The IRP2025 presents an ambitious but complex energy transition plan that balances multiple policy objectives, including energy security, environmental considerations, and economic impact. While the plan provides a pathway to achieve a net zero electricity sector by 2050, it faces significant implementation challenges, including substantial capital requirements, transmission infrastructure dependencies and technology deployment risks. The success of the plan hinges on critical levers, including maintaining Eskom plant performance above 60%, timely implementation of the gas-to-power programme, and co-ordinated development of transmission infrastructure. The multiple contingencies and policy adjustments incorporated suggest a need for adaptive implementation strategies and regular review to ensure alignment with evolving technological and economic conditions.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe