Finance Bill 2025 - Impact on the Financial and Investment Sector

At a glance

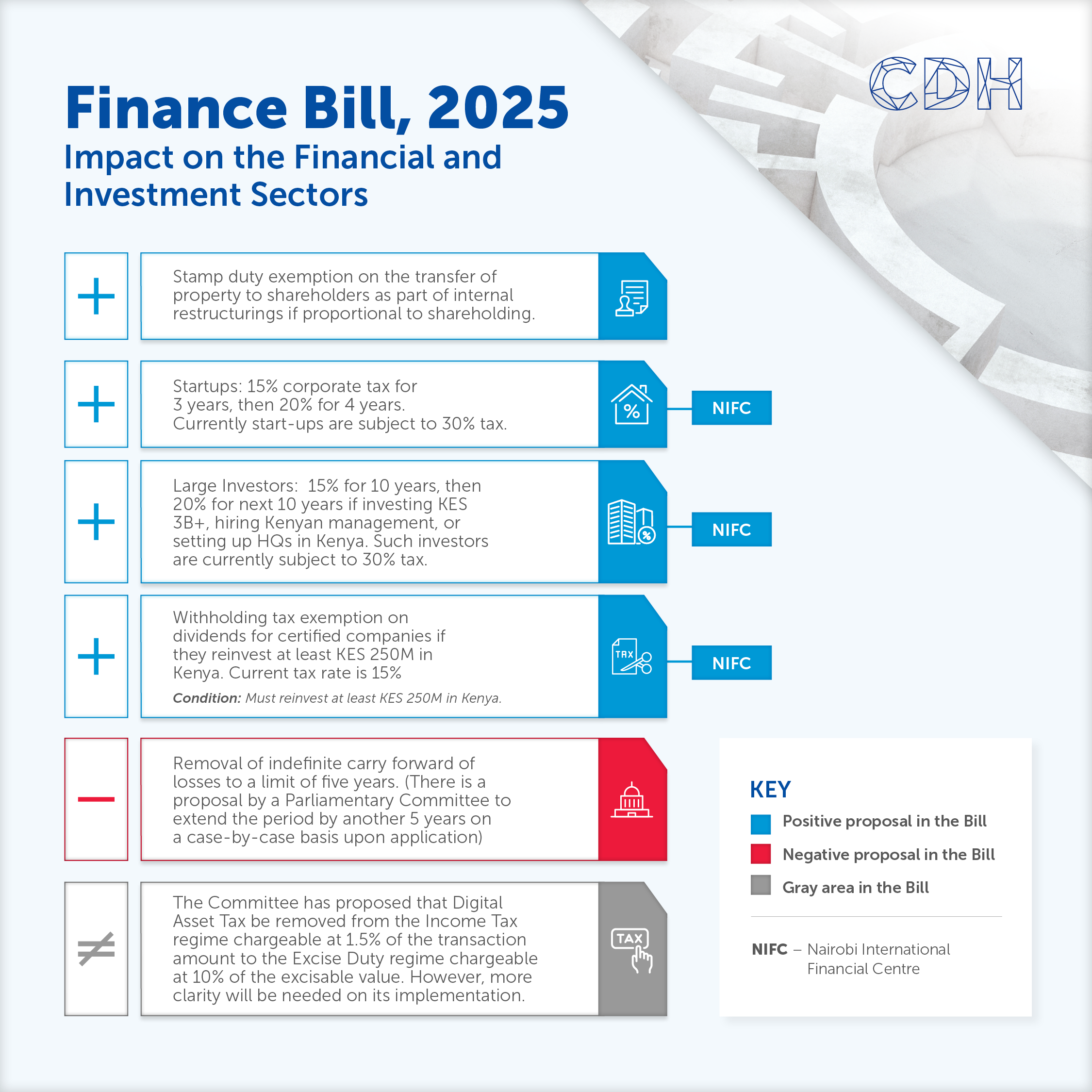

- Preferential tax rates at the Nairobi International Financial Centre (NIFC): The Finance Bill, 2025 proposes reduced corporate tax rates for startups (15% for 3 years, 20% for the following 4 years) and for large investors of at least KES 3 billion (15% for 10 years, then 20% for the next 10). Additionally, Certified companies reinvesting at least KES 250 million in Kenya will benefit from a withholding tax exemption on dividends currently subject to 15% tax. All these making Kenya more attractive for global investment through the NIFC

- Incentives for internal restructuring: Companies to get stamp duty exemption on the transfer of shares as part of internal restructurings if proportional to shareholding.

- Tax reforms affecting digital assets and tax loss carry-forwards: The Bill proposes changes including a shift in the digital asset tax from the income tax regime to the excise duty regime. Finally, the Bill also proposes capping tax loss carry-forwards to 5 years (with potential for a further 5 year extension).

Key proposals include preferential tax rates for startups and large investors operating through the Nairobi International Financial Centre (NIFC) and a withholding tax exemption on reinvested dividends. Further, the Bill also proposes a shift in the digital asset tax from the income tax regime to the excise duty regime. At the same time, the Bill proposes to cap the carry-forward of tax losses to 5 years (with a proposed 5 year extension on application).

Finally, the Bill also proposes a stamp duty exemption for property transfers as part of internal restructurings. If enacted, these changes could shape investor behaviour and influence capital flows in the years ahead.

We unpack the details here:

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe