East African Community signals imminent functionality of Competition Authority

At a glance

- On 31 December 2024, the East African Community (EAC) promulgated and brought into effect an amendment to the East African Community Competition Act (Amendment Act), as well as new regulations which set out the applicable merger thresholds and filing fees in the EAC.

- The EAC Competition Authority (Competition Authority) is currently not operational. However, with the promulgation of the Amendment Act and its associated regulations, it is likely that the Competition Authority will, at the least, begin accepting merger notifications soon.

- In order to avoid surprises late in a transaction's timeline, firms active in EAC member states should remain aware of the imminent full operation of the Competition Authority.

The EAC consists of eight member states including Burundi, the Democratic Republic of the Congo (DRC), Kenya, Rwanda, South Sudan, Tanzania, Somalia and Uganda. Presently, the only EAC member states with active competition regimes are Kenya and Tanzania. With the recent promulgation of the Amendment Act and regulations signifying the imminent functionality of the Competition Authority, the impact on merger control across the region will be significant. Further, many of the EAC member states, such as Kenya, Burundi and the DRC, are also members of other regional bodies, including the Common Market for Eastern and Southern Africa (COMESA). Further, the Competition Authority has recently concluded a memorandum of understanding with the COMESA Competition Commission (COMESA Commission) aimed at addressing duplication in merger control and facilitating information sharing, also implying that the Competition Authority will likely soon be fully active.

The Amendment Act

The Amendment Act is a relatively extensive overhaul of some key provisions of the East African Community Competition Act (Competition Act). Section 5 of the Competition Act, which regulates horizontal restrictive practices between firms, has been amended to include agreements, that is, it has been expanded to apply beyond concerted practices. Additionally, section 5 has introduced a stricter approach in that it now prohibits agreements and concerted practices intended to have an anti-competitive effect over and above those having an anti-competitive effect.

In other words, it will now no longer be necessary for an agreement or concerted practice to have caused discernible anti-competitive effects in the market if the agreement or concerted practice was concluded with the intention of having anti-competitive effects, which may not have necessarily occurred.

The Amendment Act has also extended the merger review period from 45 days to 60 days. While the extension of the Competition Authority’s merger review period is not necessarily desirable, it is probably a more realistic review period for a new competition authority as it gets to grips with merger control.

With regard to abuse of dominance, section 9 of the Amendment Act introduces a prohibition of predatory practices and any other practices as determined by the Competition Authority. Previously, the prohibition was specifically against predatory pricing, therefore this amendment seems to widen the scope to include other types of predatory conduct. Further, the prohibition of “any other practice as determined by the Competition Authority” is concerning as there is no indication of how such a determination will be made. In our experience, where legislation prohibits conduct broadly with no indication of the specific type of conduct that may be impugned by that legislation, litigation floodgates are opened, and it may take an inordinate amount of time before the law settles on the issue.

Further, section 9 also includes a new prohibition against any practice that prevents or is intended to prevent, distort or restrict competition. Previously, section 9 prohibited practices that harm the competitive position of competitors on upstream or downstream markets.

The Amendment Act therefore widens the scope of practices which are prohibited for dominant firms and introduces a somewhat subjective assessment, similar to the Amendment Act’s approach to section 5. It is unclear whether the introduction of subjectivity to the assessment will have any meaningful effect as the intention of firms accused of contravening sections 5 and 9 will likely be difficult to prove.

The Amendment Act, in addition to replacing the entirety of the Competition Act’s section on mergers and acquisitions and substituting various definitions, also introduces financial and other penalties in respect of the failure to notify a merger. Previously, under the Competition Act, the Competition Authority could only order divestiture.

The regulations

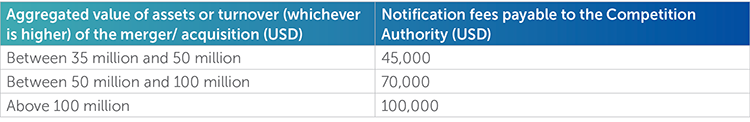

As a result of the promulgation of the regulations accompanying the Amendment Act, a merger is now notifiable if the combined turnover or assets (whichever is higher) of the merging parties in the EAC equals or exceeds USD 35 million, and at least two of the firms have a combined turnover or assets of USD 20 million. However, there is an exception where each party to the merger achieves at least two-thirds of its aggregate turnover or assets in the EAC within one and the same member state. In that case, transactions between firms will not be notifiable. This exception is similar to those which exist in the merger thresholds of other regional bodies, including the Economic Community of West African States (ECOWAS) and COMESA. Where a transaction is notifiable to the Competition Authority in the EAC, the following filing fees are applicable:

The promulgation of the Amendment Act and the regulations is significant progress in the scaling up of competition enforcement in the EAC Competition Authority. It is also a notable development in the trend towards regional competition enforcement in Africa, where the past two decades have seen COMESA and ECOWAS become fully operational. What remains to be seen, as the Competition Authority becomes operational, is the extent to which the EAC Competition Authority, COMESA Commission and ECOWAS Regional Competition Authority will be prepared to collaborate on mergers that raise their concurrent jurisdiction. Nevertheless, in order to avoid surprises late in a transaction’s timeline, firms active in EAC member states should remain aware of the imminent full operation of the EAC Competition Authority.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe