Streamlining enforcement: Key insights into the Competition Authority of Kenya’s Consolidated Administrative Remedies and Settlement Guidelines, 2023

At a glance

- The Competition Authority of Kenya has taken a significant step towards enhanced transparency and efficiency with the recent publication of the Consolidated Administrative Remedies and Settlement Guidelines, 2023 (Guidelines).

- The Guidelines now prescribe a clearer methodology for calculating financial penalties associated with anti-competitive practices. This methodology offers a more structured and transparent approach to determining fines.

- This move underscores a commitment to streamlined enforcement processes and predictable outcomes for businesses operating in Kenya.

Why these Guidelines matter

The Guidelines aim to replace a previously fragmented system in which different CAK departments relied on disparate rules for penalties and settlements, such as the Administrative Remedies Guidelines for Consumer Protection, 2017; Fining and Settlement Guidelines, 2018; and the Competition Administrative and Settlement Guidelines, 2020. This change addresses past concerns about inconsistency, promoting greater fairness and clarity for businesses.

The Guidelines also give meaningful effect to Kenya’s Constitution and the Competition Act, as well as its associated rules, ensuring consistency with this broader legal framework.

What’s new and what should businesses pay attention to?

Methodology for calculation of administrative penalties

The Guidelines now prescribe a clearer methodology for calculating financial penalties associated with anti-competitive practices. This methodology offers a more structured and transparent approach to determining fines.

The key elements of the methodology are:

- Base percentage: A base percentage of 10% of the offending undertaking’s preceding year’s gross turnover is established.

- Aggravating and mitigating factors: The severity of the infringement and the undertaking’s conduct are factored in through aggravating and mitigating factors. These include elements such as the infringement’s impact, duration, recidivism, co-operation with the investigation, and public interest considerations.

- Penalty adjustment: Each aggravating and mitigating factor is assigned a score (0%–3%), which can increase or decrease the final penalty.

- Maximum penalty: The maximum penalty is capped at 10% of the undertaking’s annual turnover.

The methodology for calculating the administrative penalties is divided into three broad areas: (i) restrictive trade practices and control of mergers, (ii) abuse of buyer power, and (iii) violations under consumer welfare.

The final penalty is determined using two formulas. The financial penalty is calculated by working out the appropriate penalty adjustment as follows:

- Penalty adjustment: Financial Penalty (Fp) = (Base Percentage + Aggravating Factors) - Mitigating Factors

Once the Fp is determined, the final penalty computation is worked out as follows:

- Final penalty: Fp x Relevant Turnover = Final Penalty Amount

The financial penalty contains a potential contradiction. While the Guidelines cap penalties at 10% of an undertaking’s annual turnover in alignment with the Competition Act, they also introduce a potential ambiguity. This is evident in scenarios where aggravating factors are present without any mitigation, causing the resulting penalty computed using the formula to surpass the prescribed 10% limit – yet only 10% can be charged because that is the prescribed cap contained in the Guidelines and in the Act.

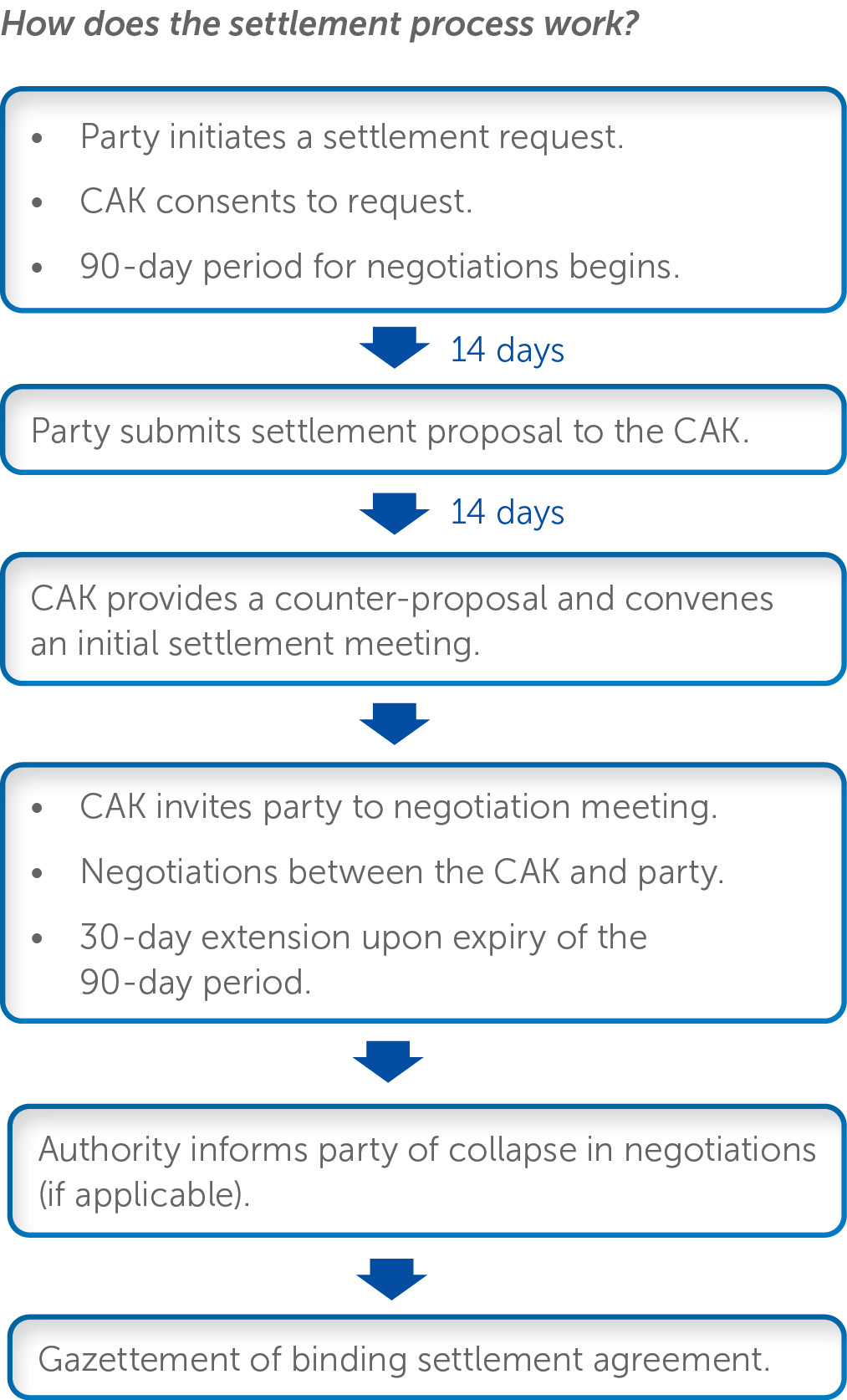

Settlement procedures

The Guidelines encourage alternative dispute resolution through a defined settlement negotiation process. Businesses facing potential penalties can proactively submit settlement proposals to the CAK, potentially achieving a more favourable outcome than through protracted litigation.

Key takeaways for your business

These changes offer several key considerations for businesses operating within Kenya:

- Enhanced predictability: While each case will still be decided on its own merits, the Guidelines offer clearer insight into how the CAK will calculate penalties, thereby providing certainty for businesses facing potential contraventions.

- The settlement advantage: The formalisation of settlement processes may offer a strategic path to resolving potential issues quickly and more favourably than through a drawn-out enforcement process.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe