New accountable institutions beware: Deadline ahead for submission of a risk and compliance return

At a glance

- Under Directive 7 in terms of section 43A(3)(a) of the Financial Intelligence Centre Act 28 of 2001 (FIC Act) accountable institutions have to submit a risk and compliance return to the Finance Intelligence Centre (FIC) by 17h00 on 31 July 2023.

- Credit providers, SA Postbank, high-value goods dealers, the SA Mint Company and crypto asset service providers need to complete the return covering the reporting period from 1 January 2023 to 30 June 2023, both dates inclusive.

- The information obtained from the return will assist the FIC in forming an understanding of the levels of risk awareness and compliance of the responding accountable institution with the FIC Act and in identifying the money laundering, terrorist financing and proliferation financing risks facing different accountable institutions.

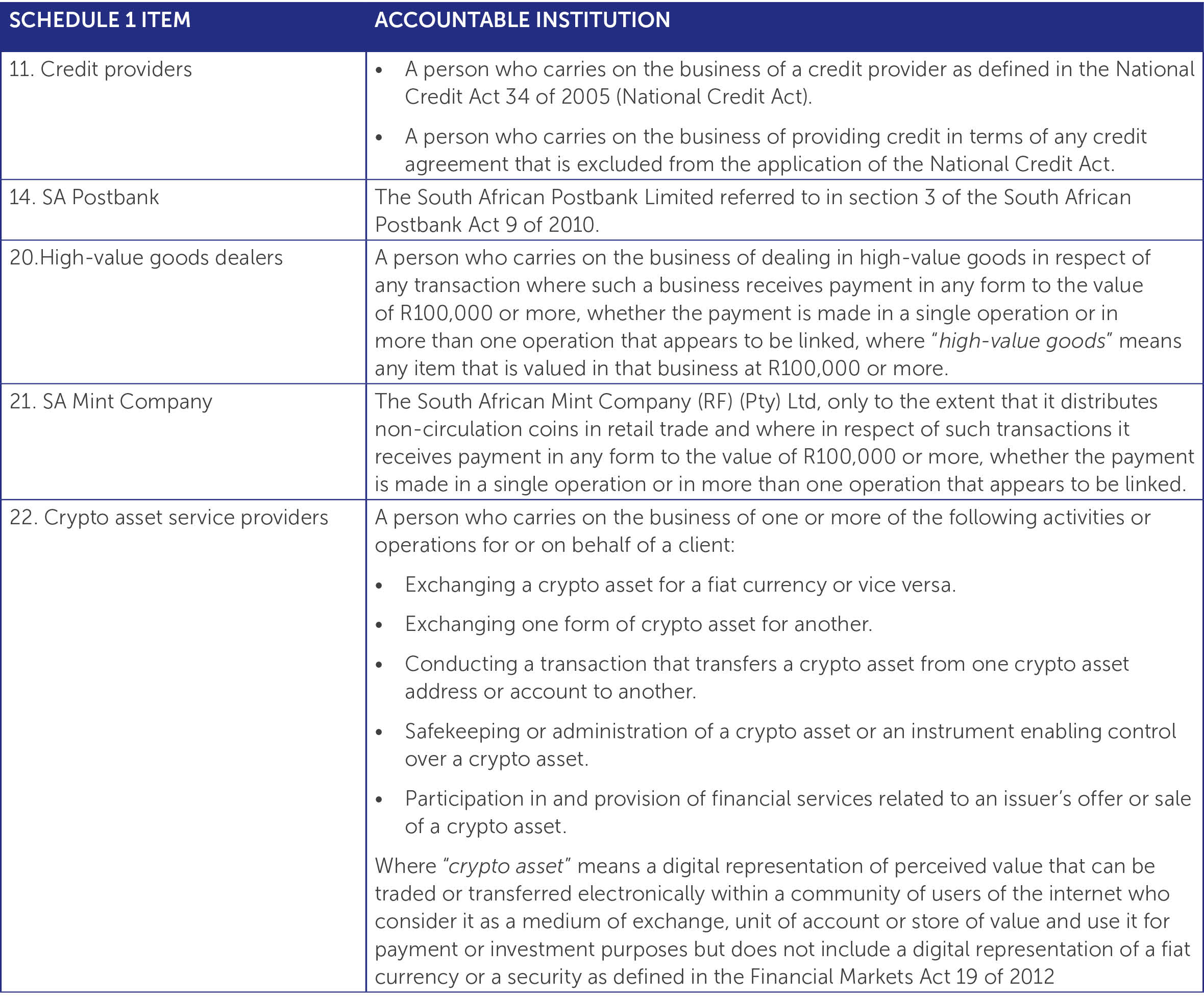

Accountable institutions listed in schedule 1 of the FIC Act as items 11, 14, 20, 21 and 22 must complete the return, covering the reporting period from 1 January 2023 to 30 June 2023, both dates inclusive. The below table sets out the categories of business that fall under these items:

These accountable institutions must submit the return, which will comprise information regarding the accountable institution’s understanding of money laundering (ML), terrorist financing (TF) and proliferation financing (PF) risks and their assessment of compliance with obligations in terms of the FIC Act.

The questions on the return run the gamut of FIC Act compliance, with questions on different types of risk including client, transaction, distribution channel, product, geographic and ML/TF/PF risks. The return also asks general FIC Act compliance questions on registration, risk management and compliance programmes, customer due diligence, employee training, record keeping and reporting to the FIC, including questions on the three major categories of reports – cash threshold reports, terrorist property and financial sanctions reports, and suspicious and unusual transactions reports.

As stated above, the return must be submitted to the FIC no later than 17h00 on Monday, 31 July 2023. Return submission is automated and accountable institutions are required to populate the information on the return directly via the following link made available by the FIC: Risk and Compliance Return.

The information obtained from the return will assist the FIC in forming an understanding of the levels of risk awareness and compliance of the responding accountable institution with the FIC Act and in identifying the ML, TF and PF risks facing different accountable institutions.

Non-submission of the return will be considered non-compliance with Directive 7 and may result in an administrative sanction, including financial penalties of up to R50 million. However, in a media release, the FIC has stated that in the first 18 months from the date of commencement of the amendments it will focus on entrenching the FIC Act risk and compliance provisions and implementation them among the new sectors in Schedule 1 to the FIC Act. In respect of the new sectors, the FIC does not envisage issuing financial penalties for non-compliance with the FIC Act during the transitional 18-month period.

CDH’s FICA Queries team is available to assist clients with legal advice and training on FICA compliance.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe