Commercial and industrial power purchase agreements: Potentially a risky business?

At a glance

- Loadshedding remains a major concern for businesses, leading them to seek cost-effective and long-term solutions such as renewable energy.

- The raising of the licensing threshold for embedded generation projects has unlocked a pipeline of private sector projects, and the government plans to completely remove the licensing threshold to encourage private investment in electricity generation.

- Power purchase agreements (PPAs) are the typical commercial arrangements between power sellers and buyers, and negotiating and allocating risks in these agreements is crucial for achieving a balanced agreement.

Many businesses have sought to mitigate the risk of blackouts through short-term solutions such as utilising diesel generators. The realisation that Eskom is nowhere near resolving its shortage of generation capacity, coupled with the rise in diesel costs, has led to many commercial and industrial businesses looking towards renewable energy developers for cost-effective and long-term solutions.

During his address on the national energy crisis on 25 July 2022, President Cyril Ramaphosa reported that the raising of the licensing threshold from 1 MW to 100 MW for new embedded generation projects which took place at the end of 2021 “unlocked a pipeline of more than 80 confirmed private sector projects with a combined capacity of over 6,000 MW”. In an effort to further increase private investment into electricity generation, the Presidency announced its intention to completely remove the licensing threshold for embedded generation, and draft regulations to this effect have been published. These steps are encouraging for consumers needing a secure supply of energy and serve as evidence of Government’s ongoing efforts to remove or speed up the regulatory hoops that need to be jumped through when developing embedded generation projects.

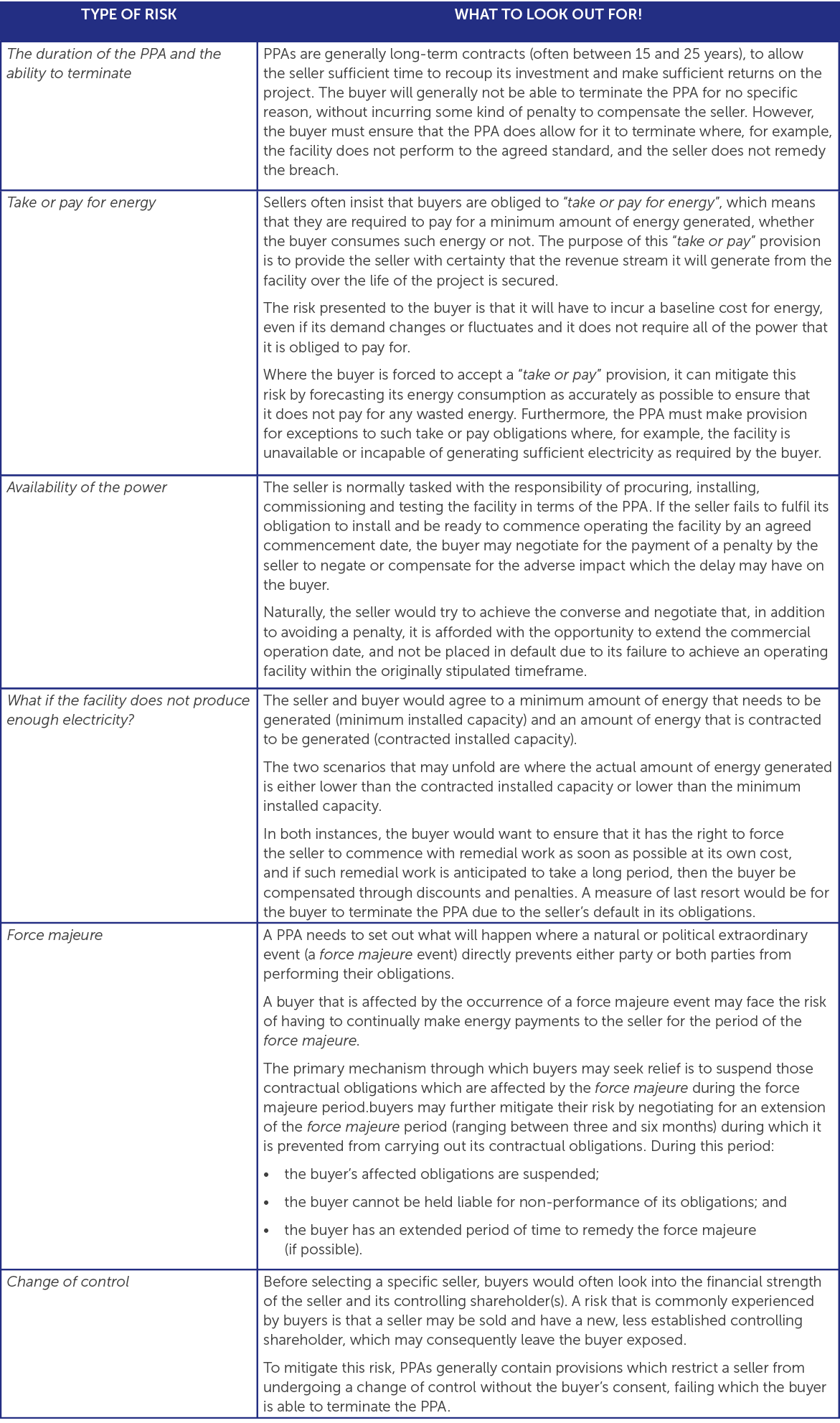

The commercial arrangement between the generator of the power (seller) and the consumer of power (buyer) is typically structured as the purchase of power in terms of a power purchase agreement (PPA). PPAs are complex agreements as parties to them need to negotiate and fairly allocate the risks associated with the project amongst themselves.

We have highlighted just a few of the risks that buyers should be aware of when entering into commercial and industrial PPAs. We have specially looked at the instance where the seller will install a rooftop or ground mounted solar PV system (facility) at the buyer’s premises to generate electricity that it will sell to the buyer.

At the outset, it is important to bear in mind that PPAs are subject to negotiation and each party will always try to put forward mechanisms that would advance their interest and mitigate their risks. Parties therefore need to remain conscious that a PPA, at its core, has to be a balanced agreement which is achieved through engaging in careful negotiations and allocating the risk to parties who are able to efficiently manage them in the best possible way.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe