B-BBEE Ownership Points under Statement 102 (Sale of Assets, Equity Instruments and Other Businesses)

However, the Codes of Good Practice on Broad-Based Black Economic Empowerment, 2013 (Generic Codes) provide an alternative form of ownership recognition in Statement 102 which relates to the sale of assets, equity instruments and other businesses. There are other forms of ownership recognition, but these have not been addressed in this Alert and accordingly, the content is limited to the provisions of Statement 102.

The general principle of Statement 102 is that a measured entity (termed a seller) who has concluded a transaction involving a sale of asset, equity instrument or business of a separately identifiable relating business, may claim the benefits provided for in this statement in its ownership scorecard.

Where a seller has claimed benefits in terms of Statement 102 under its ownership scorecard it may not claim under the enterprise and supplier development element. This confirms the principle that you may not double count.

Which transactions qualify for recognition under Statement 102?

Statement 102 provides that it will find application in respect of a “qualifying transaction”. A “qualifying transaction” is indicated as a transaction which may involve the sale of (a) an asset (which is not defined), (b) a business (which term has also not been defined), or (c) Equity Instruments in an entity. The term “Equity Instrument” is defined in the Generic Codes as “the instrument by which a Participant holds rights of ownership in an Entity”. We are of the view that this would include an ordinary share in a company or members interest in a close corporation.

For ownership points to be recognised, the transaction:

- must result in the creation of viable and sustainable businesses or business opportunities in the hands

of Black people; and - result in the transfer of critical and specialised skills, managerial skills, and productive capacity to Black people.

Moreover, a sale of asset, Equity Instrument and/or business must involve a separately identifiable related business which has:

- no unreasonable limitations or conditions with regards to its clients or customers;

- clients, customers or suppliers other than the seller; and

- B-BBEE shareholders, or their successors if the B-BBEE shareholding is the same or improved, holding the asset for a minimum of three years.

What is meant by a “separately identifiable related business”? Under Statement 102, that term is defined as a “business that is related to the Seller by virtue of being a Subsidiary, Joint Venture, Associate, Business Division, Business Unit, or any other similar related arrangements within the Ownership structure of the Seller”.

In addition to the above qualification criteria, Statement 102 provides that:

- any operational outsourcing arrangements between the seller and the separately identifiable related Business must be negotiated at arms-length on a fair and reasonable basis; and

- the transaction should be subject to an independent verification value by an independent expert.

It should be noted that the Generic Codes provide that the following transactions do not constitute “qualifying transactions” and accordingly, the provisions of Statement 102 cannot be used.

These transactions include:

- transfers of business rights by way of license, lease or other similar legal arrangements not conferring unrestricted ownership; and

- sales of franchises by franchisors to franchisees (but a “qualifying transaction” will include sales of franchises from franchisees to other franchisees or to new franchisees do not qualify for recognition).

Thus, if a franchisor assists a Black participant to invest in a franchise, this would not be considered a sale of assets or business, but rather as Enterprise Development.

Another crucial point to note is that the Generic Codes provide that, “No Qualifying Transaction could be claimed as B-BBEE ownership if a repurchase transaction is entered into within a three period after transaction implementation, even if [the repurchase] transaction implementation is deferred post year 3. A seller cannot have any right to enforce such a repurchase.”

How are ownership points measured?

In respect of the Net Value points on the ownership scorecard, the calculation of these points under Statement 102 must be based on (i) the total value of the transaction; (ii) the value of Equity Instruments held by Black people in the separately identifiable related business; and (ii) the carrying value of the Acquisition Debt of Black people in the separate identifiable related business. The measured entity must use the Standard Valuation method when calculating the aforesaid values.

Acquisition Debt is defined in the Generic Codes as “the debts of (a) Black participants incurred in financing their purchase of their equity instruments in the Measured Entity; and (b) Juristic persons or trust found in the chain of ownership between the eventual Black Participants and the Measured Entity for the same purpose as those in (a).”

The seller, when applying Statement 102, will need to comply with the sub-minimum requirement for ownership, being 40% of the Net Value points only to the extent of the transaction involving the separately identifiable related business and will only have to comply with all other priority elements as required by the Generic Codes.

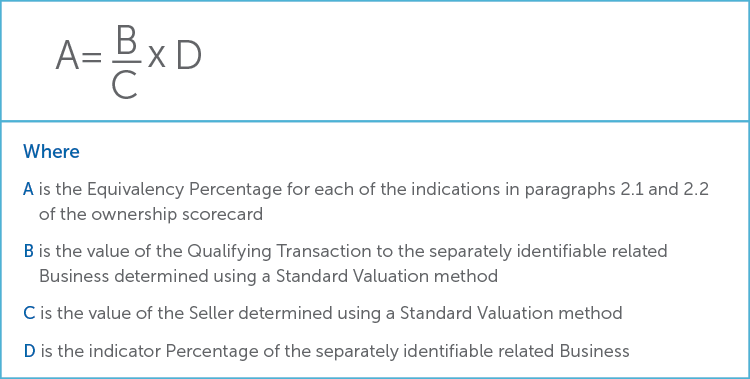

In respect of Voting Rights and Economic Interest (being the indicators, respectively, in paragraphs 2.1 and 2.2 of the ownership scorecard), the seller must include the equivalency percentages in its ownership scorecard as if those percentages arose from a sale of Equity Instruments in the seller to Black people. This is calculated in accordance with the formula set out in Annexe 102(A) and which is depicted below.

Where calculating the ownership score, recognition of the value of the sale transaction occurs on the basis that:

- The separately identifiable related business must form part of the same chain of ownership and be owned by the seller.

- The recognisable Economic Interest will be the percentage of the value of the separately identifiable related business to the total value of the seller.

- The percentage of Exercisable Voting Rights held by the new owners of the separately identifiable related business represents the recognisable right to Exercisable Voting Rights held by Black people.

- The rights of ownership granted to Black people in the separately identifiable related business are comparable to rights that would have accrued had the sale/transaction taken place at seller level.

How is the sale of asset, equity instrument and business recognised?

For the first three years after the transaction, the seller will recognise the ownership points on the date of measurement in accordance with the (i) value of the seller and (ii) the value of the separately identifiable related business. Such recognition is in respect of each year of the 3-year period. On each measurement date after the third year, the seller will recognise ownership points based on the ownership indicator percentages achieved in the third year after the transaction. It is not clear whether this is intended to be for an indefinite period as the Generic Codes do not provide an end date for such recognition.

The transaction value is required to be reviewed by an independent expert, who is required to provide an opinion on the fairness of the transaction value. Continued recognition is subject to the opinion of the independent expert supporting the transaction value.

Example of Annexe 102(A) Calculation:

The following is an example of how the sale of assets/business might be calculated:

Company X (the measured entity) sells a division of its business (ie a separately identifiable related business) to Company Y.

- Company X: The total value of Company X is R100 million. The value of the business to be sold to Company Y is

R25 million (ie 25% of the total value). - Company Y: The total rights of ownership (voting rights and economic interest) in Company Y in the hands of Black people is 80%.

After the sale of the business, Company X would be entitled to an Equity Equivalency percentage calculated according to the following formula:

A = B/C*D

A = R25m/R100m*80%

A = 20%

Therefore, in Year one Company X would be deemed to have 20% notional Black shareholding (for the purposes of the indicators on the ownership scorecard), even if it has no Black shareholders.

The above calculation is repeated in Year two and Year three after the transaction. After this, the score attained in Year three will then be applied as the ownership score.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe