Kenya Budget FY 2025/26 highlights: What’s new, what’s next?

At a glance

- In this alert, we highlight the key proposals, sectoral allocations and policy measures shaping Kenya’s development agenda in FY 2025/26.

- The FY 2025/26 Budget signals a shift in Kenya’s fiscal policy toward sustainability, efficiency and targeted investment, prioritising economic recovery without imposing new tax burdens.

- Key reforms such as zero-based budgeting, enhanced tax administration and rationalised spending reflect the Government’s intent to improve efficiency and accountability across the public sector.

This FY 2025/26 Budget (Budget) comes at a pivotal time, as the Government navigates a complex economic landscape shaped by external shocks, a constrained fiscal space and public demand for equity, transparency and impact.

In this alert, we highlight the key proposals, sectoral allocations and policy measures shaping Kenya’s development agenda in FY 2025/26.

Economic outlook

Kenya’s 2025/26 Budget was tabled against a complex backdrop of global financial uncertainty, domestic recovery needs and civic demands for accountability. Last year’s proposed tax hikes triggered widespread protests and required painful rollback; this year, the Government is taking a more nuanced approach, balancing investor confidence with public stability.

The Government projects GDP growth at a steady 5.3% in both 2025 and 2026, supported by stabilised inflation and cautious monetary easing. This optimism, however, is tempered with fiscal realism.

Total revenue is projected at KES 3.3 trillion, while spending is set at KES 4.239 trillion, leaving a KES 923 billion deficit to be financed through KES 592 billion in domestic borrowing, KES 284 billion in external debt, and KES 46.9 billion in grants. The Budget features a KES 5 billion contingency reserve, signalling anticipation of possible shocks.

The Government opted to avoid aggressive taxation while maintaining a development-oriented agenda that positions the economy to recover without political backlash. However, execution remains the Achilles’ heel. Unresolved pending bills from previous years and a mounting debt burden threaten to stretch the fiscal envelope, making robust institutional discipline essential for effective delivery.

With public debt hovering at a worrying 66% of GDP, well above the sustainable 55% threshold, the new Budget aims to reduce this burden while steering clear of politically charged tax increases.

National Treasury’s emphasis on zero-based budgeting and harmonisation of public wages illustrates a deeper strategy to instil efficiency and performance discipline in public financial management.

Inflation is currently contained within the preferred range, creating room for the Central Bank of Kenya to maintain an accommodative stance. This comes alongside a notable appreciation of the Kenyan shilling, which has strengthened by approximately 20% against the US dollar since early 2024. At the same time, the decision to lean on domestic borrowing (KES 592 billion) could pose crowding-out risks if not well-managed, especially for the private sector.

Budget overview

The Budget continues the BETA with an emphasis on job creation, fiscal consolidation and restoring economic resilience.

Compared to FY 2024/25, the FY 2025/26 Budget includes more conservative revenue targets, slightly reduced development spending and heavier reliance on domestic borrowing to finance the significantly larger fiscal deficit.

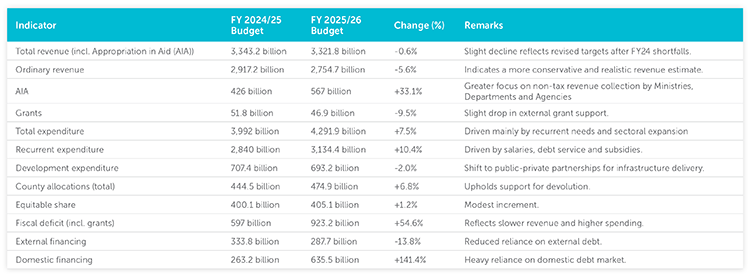

Comparative analysis: FY 2025/26 v FY 2024/25 Budget

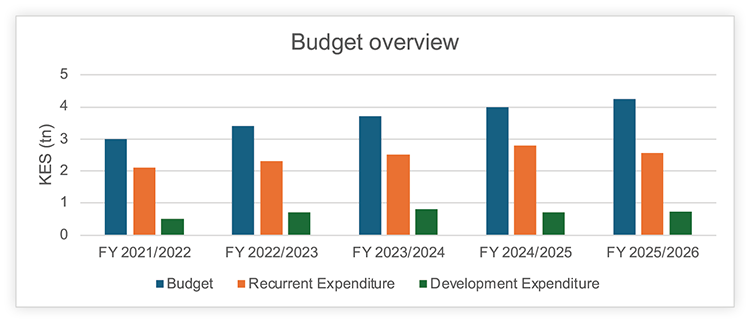

The chart below presents a five-year trend in Kenya’s national budget, comparing total expenditure with recurrent and development spending across fiscal years.

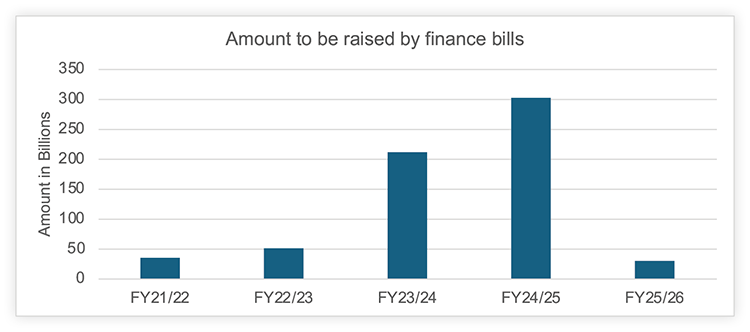

Additional tax revenue arising from Finance Bill, 2025 measures

The Finance Bill, 2025 targets additional tax revenue collection of KES 30 billion in the coming fiscal year. The measures being proposed are different from those in the previous bills as they seek to enhance tax administration, as opposed to introducing new taxes.

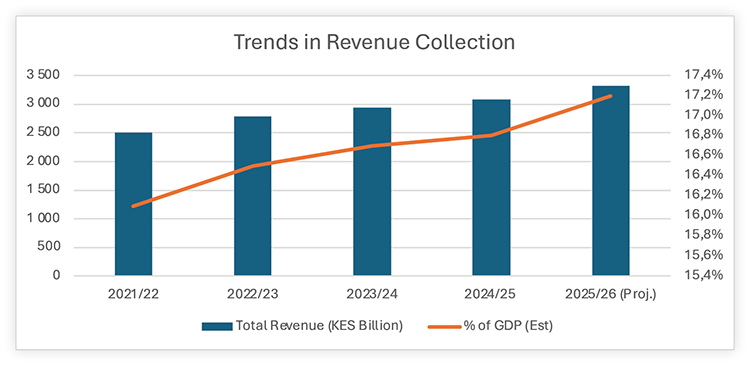

Trends in revenue collection

The total revenue for FY 2025/26 is projected at KES 3.32 trillion, equivalent to 17.2% of GDP, compared to an estimated KES 3.08 trillion (16.8% of GDP) in FY 2024/25.

This includes:

- Ordinary revenue: KES 2.75 trillion (14.3% of GDP)

- Ministerial AIA: KES 567 billion

- Grants: KES 46.9 billion (0.2% of GDP)

The following graph illustrates the trend in total revenue, highlighting projected collections for FY 2025/26 in comparison to last five fiscal years.

To support these revenue targets, the Government has outlined a series of policy and administrative measures aimed at enhancing domestic resource mobilisation.

These include:

- Continued implementation of the Medium-Term Revenue Strategy and National Tax Policy aimed at improving predictability and consistency in tax administration.

- Enhanced use of digital platforms like GAVA Connect, electronic Tax Invoice Management System (eTIMS) integration, simplified Pay-As- You-Earn and value-added tax returns, and electronic rental income tax system to expand compliance.

- Focused efforts to broaden the tax base and reduce compliance costs, especially in the digital economy, agribusiness, and micro, small and medium enterprise (MSME) segments.

- Reduction in tax expenditure, currently standing at 3.38% of GDP, to unlock additional fiscal space.

- Strengthened enforcement through Kenya Revenue Authority modernisation and automation initiatives, with emphasis on real-time data analytics and risk profiling.

Key sectoral allocations

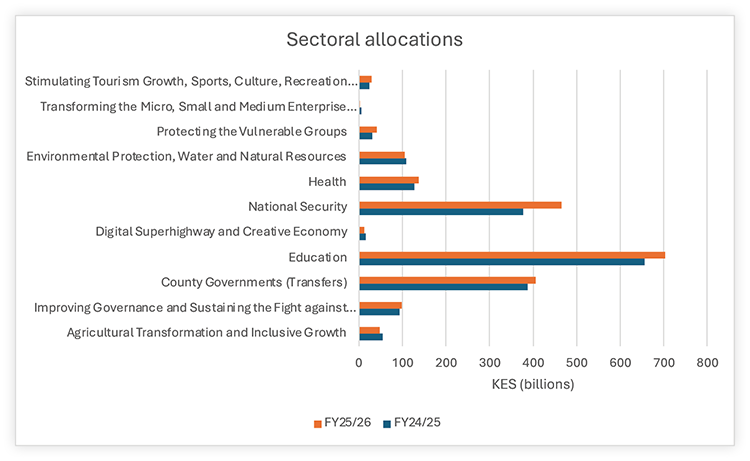

The chart below compares sectoral budget allocations for FY 2025/26 against FY 2024/25, highlighting shifts in government spending priorities across key areas such as education, health, national security, agriculture and county transfers.

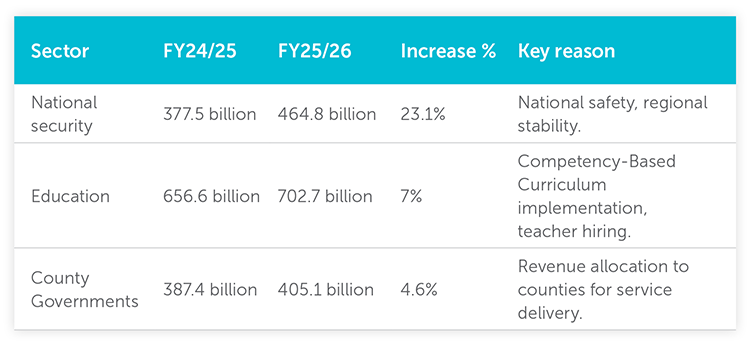

Top sectoral increases

The FY 2025/26 Budget reflects notable increases in allocations to sectors aligned with national security, education and devolved governance. The largest winners are outlined below.

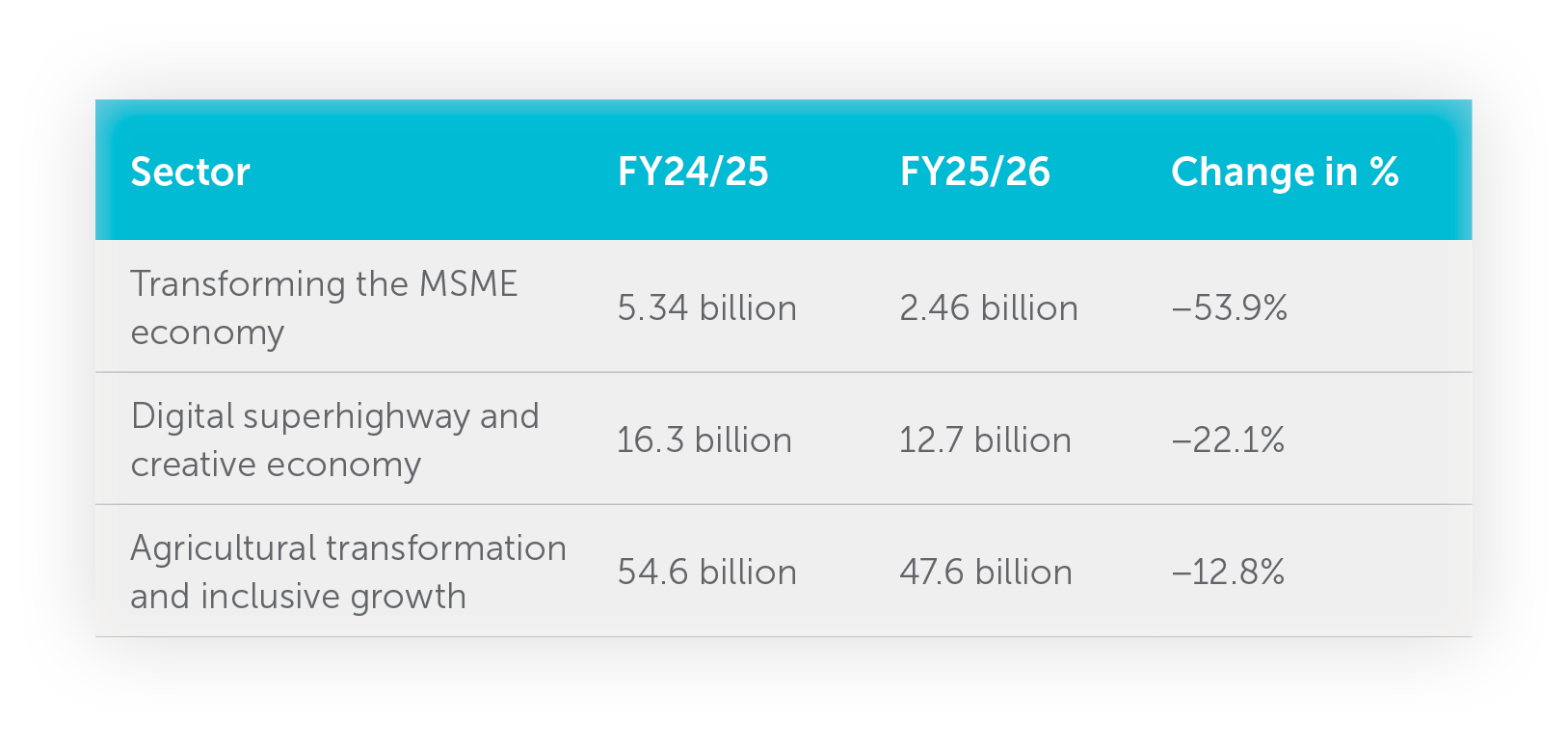

Top sectoral reductions

Conversely, several sectors experienced significant reductions in funding, reflecting a shift in fiscal prioritisation.

Proposed tax measures: Comparing the FY 2025/26 Budget to the Finance Bill, 2025

Ahead of the FY 2025/26 Budget, the Departmental Committee on Finance and National Planning (Committee) tabled its report on the Finance Bill, 2025, providing early insights into the proposed legislative framework. We will provide a detailed update on the Committee’s final recommendations.

The Budget reaffirmed the Government’s commitment to a tax policy approach anchored on no new taxes or rate increases, with a clear emphasis on administrative reform, and simplification in the tax system.

A comparative review of the Budget and the Finance Bill, 2025 reveals broad alignment, reflecting a co-ordinated fiscal policy stance. However, a few notable additions and clarifications emerged in the Budget.

Excise licensing timelines

In the Finance Bill, 2025 the proposal is that the General Commissioner is required to provide feedback within 14 days while the Budget offers a clearer timeline by referring to 14 working days.

Customs measures

The Budget introduced several new customs measures that are not ordinarily part of finance bills, but which reflect regional agreements by the East Africa Community (EAC) Customs Union.

Key highlights include:

- Tea packaging materials: Kenya was granted a preferential import duty rate of 10% for tea packaging materials.

- Wheat imports: A 10% duty remission was approved for wheat imports, down from the Common External Tariff (CET) rate of 35%.

- Rice imports: Kenya secured an extension to apply a lower duty of 35% or USD 200 per metric tonne (whichever is higher) for imported rice, as opposed to the standard CET rate of 75% or USD 345 per metric tonne.

- Animal feed inputs: Kenya obtained approval to continue duty-free importation of raw materials used in the manufacture of animal feeds, supporting price stability in the agriculture sector under the EAC duty remission scheme

- Telecommunication equipment: An extension of duty remission on inputs for the local assembly of devices such as mobile phones, laptops, and tablets was approved.

- Leather and leather products: Kenya will continue applying a 35% import duty on leather products and will benefit from duty remission on leather processing chemicals.

- Transformer assembly: A tariff split was approved to distinguish between fully built and unassembled transformers, which is expected to incentivise local assembly in the energy sector.

- Cranes: Inputs used for local assembly of cranes will continue to enjoy duty-free access under the EAC Duty Remission Scheme.

- Paper packaging inputs: Kenya declined to extend last year’s stay of application on higher CET rates for certain paper types. However, local packaging manufacturers will continue accessing raw materials under remission, ensuring they remain competitive.

Our detailed analysis of the proposed tax measures in Finance Bill, 2025 is available here.

Conclusion

The FY 2025/26 Budget signals a shift in Kenya’s fiscal policy toward sustainability, efficiency and targeted investment, prioritising economic recovery without imposing new tax burdens. The Budget aims to stimulate growth while maintaining macroeconomic stability.

Key reforms such as zero-based budgeting, enhanced tax administration and rationalised spending reflect the Government’s intent to improve efficiency and accountability across the public sector.

However, the success of these measures will depend heavily on disciplined execution and institutional capacity. Persistent challenges – including a high public debt burden and limited absorption of development funds – pose significant risks.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe