Transfer duty implications arising from the 2016 Budget Speech

Although the calculation of transfer duty in respect of transactions with a property value under R10 million has not been affected, a further tax bracket has been implemented in respect of the transfer duty rate on the portion of the property value above R10 million, which will increase from 11% to 13%.

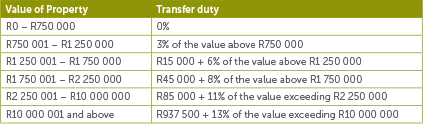

With effect from 1 March 2016, transfer duty will therefore be payable at the following rates on transactions which are not subject to VAT:

Transfer duty payable in respect of property transactions where the underlying agreements were concluded on or after 1 March 2016 will therefore be subject to the new transfer duty provisions and will be calculated as per the above table.

Agreements concluded prior to 1 March 2016 will therefore still be subject to the calculation of transfer duty based on the previous tax dispensation, notwithstanding that the date of fulfilment of suspensive conditions in terms of such agreements, or the registration of the transfers of the properties under those agreements may occur after 1 March 2016.

The Minister stated that higher capital gains inclusion rates and measures to strengthen the estate duty and donations tax are also proposed.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe