Alternative model to labour brokers in SA

The 2015 amendments to the Labour Relations Act, 66 of 1995 (LRA) have attracted significant attention and debate, particularly the additional protections afforded to Temporary Employment Services (TES) employees who are placed at the client of the TES for a period longer than 3 months.

Prior to the 2015 amendments, the joint and several liability of a TES and its client towards TES employees was limited to certain instances contemplated in s198(4) of the LRA. However, the 2015 amendments extended this liability significantly.

In terms of the amended section 198A(3)(b(i) of the LRA, a TES employee earning under the prescribed threshold placed at a client is also deemed to be the employee of the client if that employee has been working for the client for longer than 3 months and is not employed for any other reason outlined in section 198A(1). This places a duty on the client to, inter alia, remunerate these TES employees on the same or similar level as its own permanent staff who perform the same or similar work. This naturally attracts additional costs and potential equal pay/treatment disputes for the client.

Therefore, the three primary consequences of section 198A are –

1 The client is also the deemed employer for purposes of the LRA;

2 TES employees deemed to also be the employees of the client must be treated on the whole not less favourably than employees of the client performing the same or similar work, unless there is a justifiable reason for different treatment; and

3 Extended joint and several liability for clients over TES employees.

In addition to the high costs associated with the equal treatment provision, this did not come without concerns for clients utilising TES employees, such as the fact that the client often has little or no control over liability which may ensue regarding its TES employees. For example, the client has little or no control over the manner in which the TES treats its employees in terms of unfair dismissals or otherwise, yet the client carries the risk in this regard as a dual employer.

When considering alternative relationships to the traditional TES model, one must always start with the provisions of the amended LRA pertaining to TES employees, which specifically excludes the independent contractor relationship from being subjected to such extended liability.

In some European countries, there is a so called 'Management Service Provider' (MSP) model whereby the company contracts with an expert service provider who takes over the responsibility for all of the company's service delivery functions, which might include labour brokers, cleaning services and the like. The expert MSP then sub-contracts all of the required services to provide such range of services to the client.

What the MSP model provides is specialised outsourced services to an independent contractor which, inter alia, increases the productivity, sales and efficiency of the company in typical non-core activities.

Another benefit of the MSP model is that the expert MSP has the benefit of access to various different service providers at more competitive prices. The benefit of the MSP therefore accrues in the form of better price in acquiring service providers and increased productivity for the company.

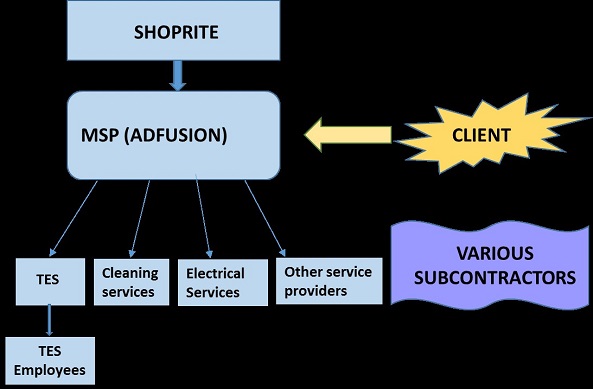

Hence, if the MSP model is utilised as a bona fide independent contractor relationship where the MSP outsources the requires non-core services, then the MSP must be the client of the TES with whom it contracts for purposes of section 198A, and not the company who independently contracts with the MSP. This was the precise determination that the CCMA was recently tasked with, i.e. whether the MSP is the client for purposes of equal treatment. This relationship is graphically demonstrated below –

In the arbitration of L Thabiso & 914 Others v Shoprite Checkers (Pty) Ltd, Adfusion Contract Management Services and Various TES', Shoprite had entered into a service level agreement to contract with Adfusion as the expert MSP to take complete control over the logistics and management of its distribution warehouse (DC). Adfusion, in turn, managed and sub-contracted all of the required services to various TES' and other service providers to perform these services at the DC and managed such services.

The goal of this relationship was to utilise Adfusion as the expert service provider and to increase the productivity and efficiency of Shoprite's DC, being a non-core service of Shoprite, such as, inter alia, security, plumbing, electrical work and logistics. This relationship also encompasses an outcomes-based billing mechanism, which shows the true nature of the independent contractor relationship.

The applicants in the matter, who were employees of the various TES' who were subcontracted to the MSP, however, claimed that they were the deemed employees of Shoprite and that Shoprite was the client for purposes of section 198A. They furthermore claimed that the service level agreement between Shoprite and Adfusion was a sham and was merely put in place to avoid Shoprite becoming the deemed employer of those employees.

The employees argued, inter alia, that it was Shoprite who exercised control over the employees, who could determine individual conditions of employment and who could discipline the employees. However, both Shoprite and Adfusion led evidence to refute this allegation and prove that the relationship between Shoprite and Adfusion was purely an independent contractor relationship based on the MSP model.

In considering the evidence, the commissioner found that the Agreement between Shoprite and Adfusion was concluded to achieve a legitimate objective, namely to increase the level of efficiency in the DC which was lacking before the introduction of Adfusion. Adfusion as the MSP possessed the requisite skill-set to achieve this goal and accordingly there was no evidence to show that the Agreement served to defeat or circumvent the provisions of the LRA.

It is important to note that, in terms of section 200B of the LRA, the MSP model can never be used to avoid and circumvent the application of the deeming provision in section 198A of the LRA. It is also important to note that in terms of this model, the potential exists for the labour broker to function as an independent contractor to the MSP, provided the relationship is a genuine independent contractor relationship.

This case signifies the acceptance of the MSP model in South African labour law which potentially provides an alternative solution for companies looking to maximise its efficiencies in terms of this model.

CDH represented Adfusion at the arbitration proceedings.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe