Part 3 |What are the factors African states must take into account when developing the right policy and regulatory framework for a clean hydrogen economy?

At a glance

- The right policy and regulatory framework for attracting investors and unlocking a country's hydrogen economy includes directives, mandates, robust carbon pricing, and targeted support for initial investments in large-scale hydrogen infrastructure.

- African countries need to shift their mindset and develop policies that incentivize investment in hydrogen projects, understanding that clean hydrogen production is a conversion process rather than an extractive business like oil and gas. They should also consider the long-term risks associated with hydrogen.

- African countries can be categorized as self-sufficient, exporters, or importers in the global hydrogen economy. Developing regional policies and fostering cooperation between countries is crucial for economic integration and maximizing the benefits of the hydrogen economy.

What countries in Africa must also fundamentally understand is that there will be a need for a mind shift in the development of policies that incentivise investment in hydrogen projects. One of the biggest differences is that the production and supply of clean hydrogen is a conversion (manufacturing) process, not an extractive business like oil and gas, and as such has the potential to be produced competitively in many places around the globe. This limits the possibilities of capturing economic rents akin to those generated by fossil fuels. Further, as the costs of green hydrogen fall over time, new and diverse participants will enter the market, making hydrogen even more competitive. So, as a starting point, African states will have to be cognisant of this distinction and appreciate the long-term risk associated with hydrogen.

Another important consideration for Africa governments planning to make hydrogen an economic catalyst is the grouping within which each country may fall. The Hydrogen Council has classified three country groups in the global hydrogen economy. These are:

- Self-sufficient countries: These are countries that aim to produce and consume hydrogen within their respective jurisdictions. These states would need to create the entire value chain from upstream supply, midstream transmission and storage, distribution, and downstream demand.

- Exporters: These countries would need to focus on the development of export infrastructure and ensure that project locations are optimised to create export hubs in a manner that contributes to the development of the local (and regional) hydrogen economy.

- Importers: These countries would need to focus on developing import infrastructure, working with exporters to ensure they get access to affordable clean hydrogen, and developing downstream applications to ensure they have control over where hydrogen is used.

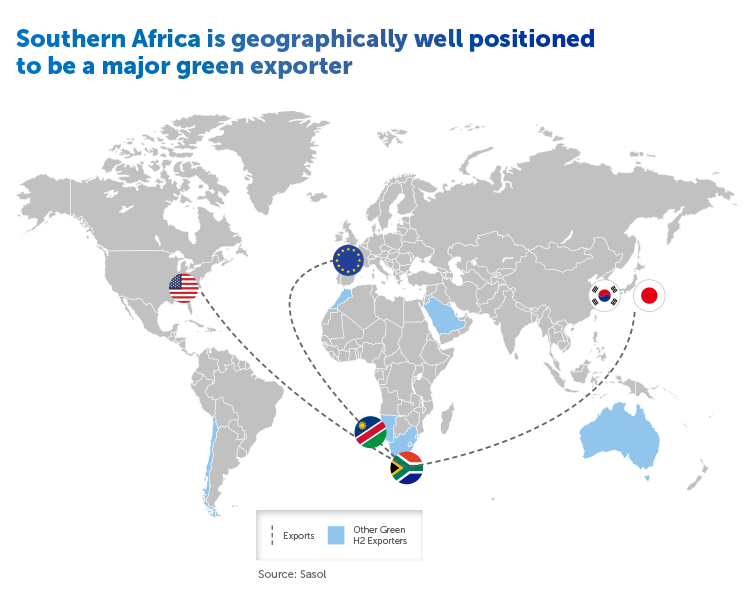

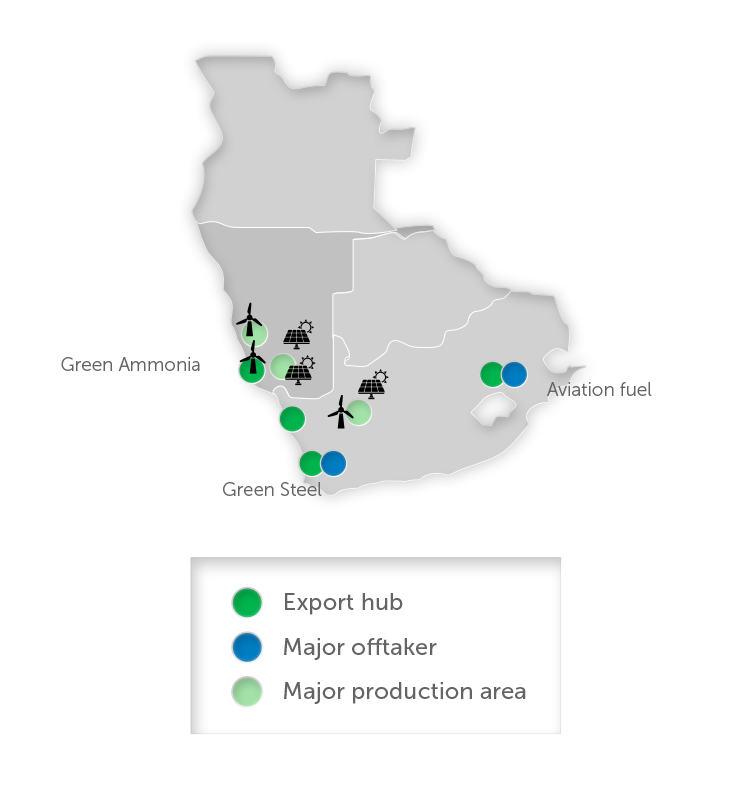

A few countries in North Africa, notably Morocco, and in Southern Africa, notably Namibia and South Africa, would need to follow and adopt policy approaches as exporters of green hydrogen. For South Africa this would need to be a fine balance between local industry demands and the export market, but ultimately, it should aim to be a net exporter of cost-competitive green hydrogen. Southern African can develop both as an export hub and supply green hydrogen to the heavy industries situated in South Africa.

While only a few countries in Africa have the potential to become competitive hydrogen exporters, several others may develop into net importers of hydrogen (i.e. producing green hydrogen locally and importing additional green hydrogen to meet domestic demand).

In order to plan for the various scenarios and created a harmonised approach to the development of the hydrogen economy in Africa, it is essential to have a hydrogen roadmap for Africa that will ensure economic and infrastructure integration. For African countries that are part of the AfCFTA, developing national industrial policies in isolation without regard for regional and continental integration of industries will negate the benefits of the AfCFTA for deeper economic growth. As such, uniform regional policies will need to be developed that address how the barriers to a hydrogen economy will be dealt with on a regional level. As South Africa and Namibia are both considered markets that have significant prospects of becoming export hubs of green hydrogen, deeper co-operation between these two countries is important. Regional co-operation in the development of sound legal principles, the nature and type of incentives, infrastructure, and industry standards and certification should inform regional policies and filter into domestic laws. This is imperative for continental economic integration and for private sector parties to be in a position to take full advantage of the benefits under the AfCFTA’s the protocols on goods and services. Regional value chains supported by robust and integrated regional policies that nurture emerging industries are imperative for Africa to realise the economic growth required to achieve Agenda 2063. As one of its action items under “Hydrogen Export” the HSRM does emphasise that regional co-operation/partnership on green hydrogen must be expanded. It is encouraging to see that the HSRM recognises the value of regional co-operation, as the economic potential for a regional and continental approach to the hydrogen economy will have a profound impact on the economic development of the continent.

Having said that, what is the right policy and regulatory framework to attract investors and unlock a country’s hydrogen economy? The Hydrogen Council has identified six pillars for efficient policy design for clean hydrogen:

- Make use of local strengths and benefit from cross-border co-operation: Leveraging local strengths is an important starting point in policy design and should be complemented by cross-border co-operation and trade to unlock efficiency gains. In cases like Namibia and South Africa, which can be anchors for regional and continental development, it is imperative that uniform policy and regulatory frameworks be developed.

- Create certainty through targets and commitment: To drive down costs and attract investment, governments can help create certainty by developing legislation that reduces policy risks and market uncertainty. In establishing robust policies there must be learnings from other sectors to avoid future disputes with investors.

- Provide hydrogen-specific support across the value chain: To catalyse and grow new markets, hydrogen-specific support is required in production, midstream infrastructure, and end-use sectors like industry and transport.

- Support robust carbon pricing: Robust regional carbon pricing mechanisms should be built up from existing schemes, and work together with hydrogen-specific support, to drive efficient and effective uptake in the longer term, while mitigating carbon leakage.

- Adopt harmonised certification schemes: International standards and robust certification systems play a crucial role in the development of the hydrogen economy, enabling cross-border trade in hydrogen.

- Factor in societal value and values: Societal value and values can be factored into policy decisions. Well-designed hydrogen policies can make a positive contribution to several UN Sustainability Development Goals. As such, ESG standards are imperative. We consider this in more detail under the South African segment.

In framing and developing national policies and the necessary regulatory framework to attract investments, it will be important to put in place the six pillars identified by the Hydrogen Council. However, in doing so, it is also important for governments to be cognisant of the legal consequences that certain commitments or guarantees could have as a result of future economic, social or political changes in their countries. As such, the investment agreement concluded with investors must be carefully negotiated to mitigate against unforeseen risk. The investment frameworks of the country should also take into account existing (and future) investment commitments under bilateral or multilateral agreements that deal with issues such as:

- who qualifies to be an investor;

- what constitute an investment;

- expropriation, in particular the extent of the guarantees be provided (i.e. does it extent to indirect expropriation);

- whether fair and equitable treatment guarantees should be provided and, if so, the extent thereof (having regard to states’ differing positions on fair and equitable treatment guarantees as provided for under the Draft Pan African Investment Code, which is understood to serve as a guide for the negotiation of the AfCFTA Investment Protocol);

- the extent of the most favoured nation guarantee to be provided, including issues around national treatment and full protection and security;

- investor obligations in relation the issues such ESG; and

- the legal recourse the state will provide in the event of a dispute, in particular access to investor state dispute settlement mechanisms in the form of consent to arbitration under the auspices of the International Centre for the Settlement of Investment Disputes.

There are sound lessons to be learnt from the investor-state disputes in the extractive and energy sectors. If incorporated and properly balanced, these learnings would mitigate against the risk associated with large-scale capital investments. To attract capital investment for large-scale hydrogen infrastructure projects will require states to compromise as they are competing with other states, but this should not be a reason to not incorporate sound legal principles that, amongst other things, guarantee regulatory freedom for the state and balance the rights and obligations of the investor and state.

There is thus a delicate balance required in the policies, regulatory framework, investment guarantees and commitment a state provides to attract investments in hydrogen projects. In doing that, states must be cognisant that green hydrogen production and supply will become more competitive and be less lucrative than hydrocarbon (coal, oil and gas) production and supply in future, as it can be produced in any part of the world. For Africa, hydrogen could be a game changer if approached regionally, as it has the potential to materially impact Africa’s industrialisation, allowing for investment in heavy industries such as the automotive industry, steelmaking, ammonia production and other complimentary downstream industries at net zero. With hydrogen, Africa could industrialise at net zero without compromising the climate and achieving sustainable development, thereby contributing to the realisation of Agenda 2063.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe