Welcome relief for individual taxpayers

The upward adjustment of personal income tax brackets has avoided a phenomenon known as “bracket creep”. This occurs where not adjusting the income tax brackets leads to higher tax collected due to inflationary increases in people’s income, as people either move into higher brackets or earn more above the taxing threshold in their current bracket.

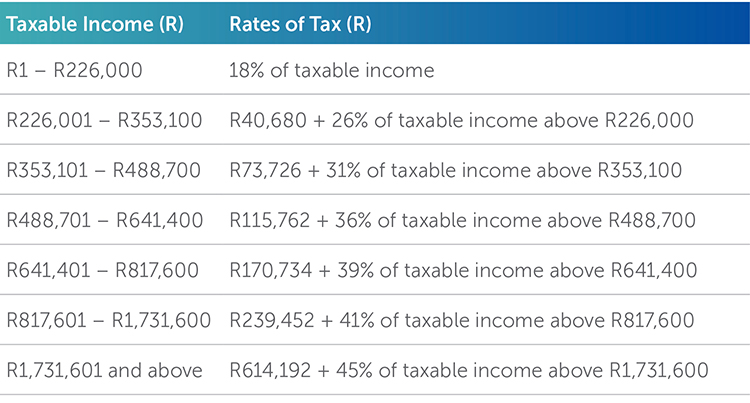

The personal income brackets for the 2022/23 tax year are as follows:

The income tax rebates have been increased to the following amounts:

- Primary: R16,425

- Secondary: R9,000

- Tertiary: R2,997

The income tax thresholds are as follows:

- Below age 65: R91,250

- Age 65 to 75: R141,250

- Age 75 and over: R157,900

Added disposable income in the hands of South African consumers is essential for economic growth, especially following the income constraints faced from the COVID-19 pandemic. The tax relief provided in the 2022 Budget Speech is therefore a welcome decrease in the burden South African individual taxpayers must bear.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe