Curbing climate change: Proposed amendments to the Carbon Tax Act in the Draft TLAB

At a glance

- The draft 2021 Taxation Laws Amendment Bill proposes amendments to the Carbon Tax Act, including clarifying beneficiaries of the renewable energy premium deduction and aligning emissions activities and thresholds with greenhouse gas emission reporting regulations.

- The proposed amendment clarifies that only entities liable for carbon tax and engaged in electricity generation activities, purchasing additional primary renewable energy under the Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) or privately, are eligible for the renewable energy premium deduction.

- The proposed amendment also aims to align Schedule 2 of the Carbon Tax Act with the amended greenhouse gas emission reporting regulations, including changes to thresholds for certain activities and the inclusion of new activities. Public comments on these proposed amendments can be submitted until August 28, 2021.

In light of the recent gazetting of the rules that will allow private entities to generate up to 100MW of distributed or self-generated electricity without a licence and the Intergovernmental Panel on Climate Change’s (IPCC) Sixth Assessment Report, it is appropriate to discuss some of the Draft TLAB’s proposed changes to the Carbon Tax Act 15 of 2019 (Carbon Tax Act).

Clarifying renewable energy premium beneficiaries

The Draft Explanatory Memorandum on the Taxation Laws Amendment Bill, 2021 (Memo) explains that section 6(2)(c) of the Carbon Tax Act, provides for electricity generators liable for the carbon tax to offset the cost of their additional renewable energy purchases against their carbon tax liability. The purpose of the provision was to address stakeholders’ concerns about possible double taxation due to the introduction of the carbon tax in addition to the “Renewable Independent Power Producers tariff” already applied under the Renewable Energy Independent Power Producers Procurement Programme (REIPPPP). During the Annexure C stakeholder consultations, taxpayers were of the view that the Carbon Tax Act was ambiguous on the intended beneficiaries of this concession and requested clarity on whether renewable-based self-generation with electricity wheeling arrangements through Eskom would also be eligible to claim the renewable energy premium deduction.

The Memo explains that historically, the renewable energy premium deduction in section 6(2)(c) was initially limited to Eskom and its purchases under the REIPPPP. However, after stakeholder consultations, it was expanded to include other electricity generators for purchases of renewable based electricity under either the REIPPPP or privately. To address this concern, National Treasury proposes that only entities that are liable for the carbon tax, conduct electricity generation activities and purchase additional primary renewable energy directly either under the REIPPPP or from private independent power producers would be eligible to claim the renewable energy premium deduction. For purchases under the REIPPPP or privately, this would apply where a power purchase agreement exists. To give effect to this proposal, the Memo states that section 6(2)(c) will be amended to clarify that the renewable energy premium to be deducted for purchases of additional renewable electricity is calculated using the following formula:

Deduction (B) = quantity of renewables purchased (kWh) x rate (rand) per technology as per the Renewable Energy Notice gazetted by the Minister of Finance.

It is proposed that the amendment apply with effect from 1 January 2021.

Aligning Schedule 2 Emissions Activities and thresholds with the greenhouse gas emission reporting regulations of the DFFE

The Memo explains that the tax base for the carbon tax is the stationary greenhouse gas emissions (GHG) that are reported annually by taxpayers to the Department of Forestry, Fisheries and the Environment (DFFE) as required under the National Greenhouse Gas Emission Reporting Regulations (GHG Regulations). Schedule 2 of the Carbon Tax Act outlines the activities that are subject to the carbon tax and is based on Annexure 1 of the GHG Regulations as reported emissions are subject to carbon tax. The Memo further states that on 11 September 2020, the DFFE published the amended GHG Regulations. Annexure 1 of the GHG Regulations was amended to include changes to the activities required to report emissions and thresholds, and the inclusion of new activities now reportable to the DFFE. Amendments to Schedule 2 of the Carbon Tax Act are required to ensure alignment with the amended GHG Regulations.

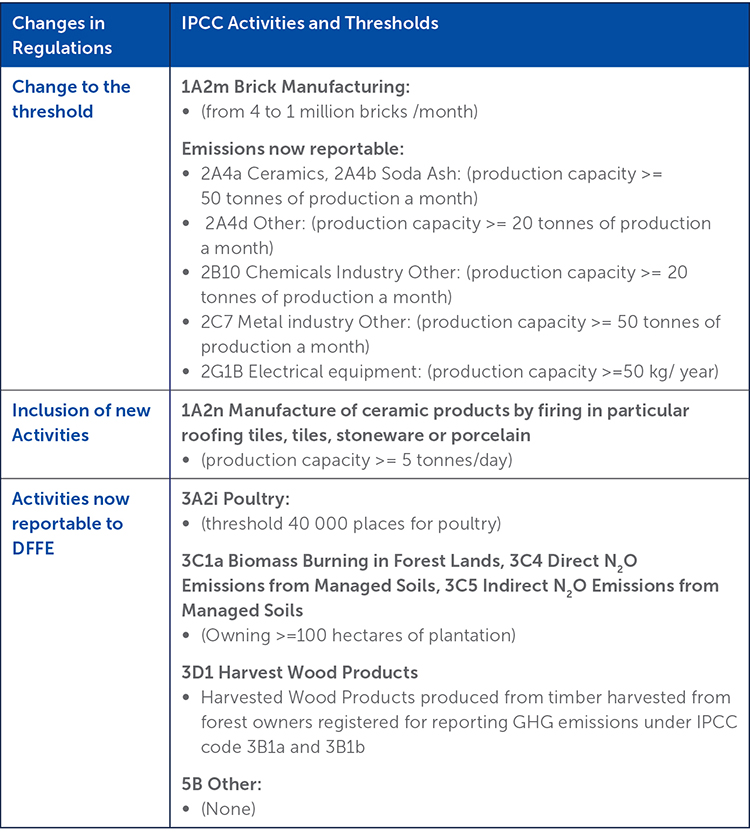

In light of this, it is proposed that Schedule 2 of the Carbon Tax Act be amended to reflect the changes set out in the amended GHG Regulations. This includes changes to the thresholds for certain activities and the inclusion of a new activity in the emissions reporting regulations. In terms of the Memo, the following changes are proposed:

It is proposed that these amendments will be deemed to have come into operation on 11 September 2020.

Comment

Taxpayers that intend to procure electricity privately or that intend to generate their own electricity through renewable energy, pursuant to the new 100 MW licensing requirement, should consider the effect of the proposed amendment regarding the renewable energy premium.

The amendments pertaining to the alignment of Annexure 1 of the GHG Regulations and Schedule 2 of the Carbon Tax Act, should serve as a reminder to taxpayers - if a taxpayer conducts a listed activity that exceeds the specified threshold, it has a reporting obligation under both the GHG Regulations and the Carbon Tax Act.

As noted in our previous alerts, the public has until 28 August 2021 to submit comments regarding these proposed amendments.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe