2021 Draft Tax Laws Amendment Bill: Welcome relief for REITs?

At a glance

- The 2021 Budget Speech Review Documents outlined the government's plan to restructure the corporate tax regime by reducing the tax rate from 28% to 27% while broadening the tax base.

- The proposed changes include limitations on assessed losses and excessive interest deductions, as stated in the 2021 draft Taxation Laws Amendment Bill.

- The proposed changes aim to align South Africa's rules with international BEPS recommendations and expand the definition of interest, fix the percentage of adjusted taxable income at 30%, and apply section 23M to back-to-back loans and withholding tax on interest. REITs will also be affected, with a proposed change in the definition of "adjustable taxable income" to consider qualifying distributions. Public comments on the proposed legislation can be submitted until August 28, 2021.

Two of the tools which National Treasury and South African Revenue Service (SARS) wish to use to further this objective include the limitation of assessed losses and the limitation on the deduction of excessive interest. The 2021 draft Taxation Laws Amendment Bill (Draft TLAB) published on 28 July 2021 for public comment gives further insight in relation to these two proposed limitation rules. In this article, we discuss the latter proposal including specifically the impact of the proposed changes on real estate investment trusts (REITs).

Background: Section 23M of the Income Tax Act

Essentially, section 23M of the Income Tax Act 58 of 1962 (Act) furthers the aim of the Government to ensure that base erosion and profit shifting (BEPS) from South Africa does not occur. In particular, section 23M limits excessive interest deductions in respect of debts owed to persons not subject to tax in South Africa if the debtor and the creditor are in a controlling relationship (or a debt owed to a creditor where that creditor obtained funding for the debt from a person in a controlling relationship with the creditor). A controlling relationship basically encompasses the scenario where the creditor holds at least 50% of the equity shares or voting rights in the debtor. To the extent that section 23M applies, then the deduction of interest in the hands of the debtor is limited by way of a specific calculation.

The calculation is set out in section 23M(3) and has undergone one or two changes since it first came into effect, but essentially provides that interest deducted cannot exceed the sum of:

- the total interest received or accrued to the debtor;

- plus a percentage (linked to the repo rate) of “adjusted taxable income” of the debtor;

- less interest incurred in respect of debts owed (other than debts caught by section 23M).

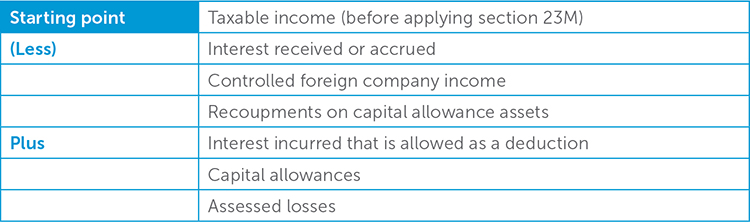

Importantly the limitation hinges on the definition of “adjusted taxable income” which is essentially the tax equivalent of earnings before interest, taxation, depreciation and amortisation (EBITDA). The definition of “adjusted taxable income” is currently calculated as follows:

Proposed changes: General

A review of the tax treatment of excessive debt financing has been in the making for the last couple of years in order to align South Africa’s rules more closely with the OECD/G20 BEPS Action 4 recommendation. As a result of the review, National Treasury has proposed making several changes as per the Draft TLAB including the following:

- an expansion of the definition of “interest” beyond the current definition contained in section 24J of the Act which shall also include foreign exchange gains and losses taken into account in determining taxable income in terms of section 24I(3) and 24I(10A);

- the percentage of “adjusted taxable income” to be fixed at 30% as opposed to being flexible and linked to the repo rate;

- broadening the scope of the application of section 23M to include back-to-back loans within a chain of companies that are in controlling relationships with each other; and

- where a resident debtor makes an interest payment and the payment attracts the withholding tax on interest at a rate higher than zero, a portion of the deduction of the interest expense will be subject to section 23M.

The proposed changes will thus broaden the scope of interest to which section 23M applies. According to the Explanatory Memorandum to the Draft TLAB (Memo), National Treasury is of the view that the current definition of “interest” is too narrow when compared to the OECD/G20 BEPS recommendations. In particular, it does not consider avoidance scenarios where interest can be labelled as other types of payments to circumvent the application of these rules. The proposal intends specifically including payments under interest rate swap agreements, any finance cost element included in finance lease payments and foreign exchange differences.

Furthermore, the limitation will be fixed to 30% of adjusted taxable income. In the Memo, National Treasury states that SARS data shows that applying a fixed ratio of 30% would be fair in that the majority of taxpayers will be able to deduct all their interest and equivalent payments without restriction. Over and above this, the Memo states that introducing a fixed ratio limitation of 30% based on adjusted taxable income does not result in much change given that the existing formula yields a 30% restriction in any event. This is driven by the current low repo rate, which is unlikely to continue indefinitely.

Proposed changes: REITs

Subject to various provisos, a REIT is not taxed on the income it derives due to a deduction for “qualifying distributions” made by it. In other words, REITs are treated as “flow-through vehicles” as per the special taxation regime afforded to REITs in section 25BB of the Act. However, in the Memo, National Treasury accepts that section 23M currently provides for no distinct treatment for REITs.

In certain instances, the deduction of a qualifying distribution may result in zero-taxable income for a REIT. National Treasury has identified that the deduction for qualifying distributions of REITs would distort their “tax EBITDA” and would result in them having a much lower “tax EBITDA” than other taxpayers. As a result of this, it is proposed (as per the Draft TLAB) that a change be made to the definition of “adjustable taxable income” in section 23M(1) to take into account a “qualifying distribution” of a REIT.

Discussion

In instances where a REIT is funded by a tax exempt entity (say a pension fund or non-resident) and that pension fund or non-resident is in a “controlling relationship” in relation to that REIT, then any debt advanced between these two entities may be caught within the provisions of section 23M. With the broadening of the scope of the definition of “interest” as well as the application of section 23M to back-to-back loans within a chain of companies in controlling relationships with one another, section 23M may apply to a broader set of circumstances from now on. This is in addition to the proposed amendments that are intended to ensure that interest subject to the withholding tax on interest does not altogether escape the application of section 23M.

As indicated in the Memo, under current legislation, a REIT’s “adjusted taxable income” may be zero as its starting point taxable income may be zero to the extent that it makes sufficient qualifying distributions in that relevant year of assessment to fully reduce its income. Under those circumstances, the REIT would in essence be limited in its deduction of interest to the extent that it receives interest. However, a REIT’s main forms of income are more likely to be dividends, qualifying distributions from subsidiaries and rental income. Hence under the current dispensation, a REIT would be discouraged from raising funding from a related party creditor that is not subject to tax given that it will only be allowed to deduct a portion of that interest that equals the interest it receives (if any).

Say, for example, where a REIT, that makes sufficient qualifying distributions and has an “adjusted taxable income” of nil, receives or accrues interest in an amount of R100 in a year of assessment and incurs interest of R200 to a creditor that is caught by section 23M, the REIT would only be able to deduct R100 of the R200 interest incurred. R100 of the section 23M interest will be subject to tax in the REIT’s hands and to the extent that that amount is distributed as a “qualifying distribution” it will be subject to further tax in the hands of the REIT shareholder.

The proposed amendment to the legislation now makes provision for the fact that a REIT makes qualifying distributions and this must be taken into account when calculating a REIT’s “adjusted taxable income” for section 23M purposes. In following the example above, if the REIT now has an adjusted taxable income of R500 given that the REIT’s qualifying distributions will be added back in full as per the amended section 23M formula, the REIT will be able to fully deduct the interest incurred in relation to the controlling creditor. In other words, in terms of the section 23M calculation, the REIT would theoretically be able to deduct up to R250 interest on the loan funding advanced by controlling creditors on the basis that it received R100 interest and 30% of R500 is R150.

The proposed legislation is still in draft form and it remains to be seen what the final legislation will look like, however, REITs would be well advised to consider the proposed legislation and its impact on their tax position and funding requirements. The closing date for the submission of public comments is 28 August 2021.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe