The pursuit of de-carbonisation – proposed changes to the carbon tax regime announced in the 2021 National Budget

At a glance

- Proposed amendments to the Carbon Tax Act aim to clarify eligibility for the renewable energy premium tax deduction, specifying that only entities engaged in electricity generation activities and purchasing renewable energy under certain programs can claim the deduction.

- An alignment of fugitive emissions activities under the Carbon Tax Act is proposed to ensure consistency between different sections of the Act and cover emissions from energy production that were unintentionally excluded.

- Amendments are suggested to clarify the definition of carbon capture and sequestration, addressing concerns about double benefits and the eligibility of forestry plantation sequestered emissions for deductions. Additionally, progress is being made on including emission factors for waste tyres in the Act's schedule.

We briefly discuss these proposed amendments here:

Clarifying renewable energy premium beneficiaries

Concerns have been raised that the Carbon Tax Act is unclear as to who is eligible for the renewable energy premium tax deduction. To address this concern, it is proposed that section 6(2)(c) of the Carbon Tax Act is amended to clarify that only entities that conduct electricity generation activities and purchase additional renewable energy directly under the REIPPP programme or from private independent power producers with a power purchase agreement are eligible to claim the tax deduction for their renewable energy purchases. A formula for calculating the amount of the renewable energy premium, which will be deducted as follows:

Renewable energy deduction = quantity of renewable energy purchased (kilowatt hour) × rate (rand) for technology, as per the renewable energy notice gazetted in June 2020.

It is proposed that the amendment is effective from 1 January 2021. Carbon taxpayers should note that as the current carbon tax year runs from 1 January 2021 to 31 December 2021, they would be able to benefit from this amendment, if it is eventually passed and confirmed to apply retrospectively. Based on the wording used in the Budget, it is unclear whether only the purchaser of the renewable energy or both the purchaser and generator of the renewable energy will be able to claim the premium. Currently, section 6(2) states that the renewable energy premium is available to “a taxpayer in respect of the generation of electricity from fossil fuels in respect of a tax period.”

Aligning fugitive emissions activities under the Carbon Tax Act

The Carbon Tax Act defines the tax base in terms of:

- section 4(1), where companies use company specific emission methodologies to calculate their greenhouse gas emissions; and

- section 4(2), where country - specific emission factors or default emissions factors prescribed by the Intergovernmental Panel on Climate Change (IPCC) in its 2006 guidelines can be used to calculate emissions. Section 4(2) also sets out formulae for the calculation of, amongst others, carbon tax payable as a result of fugitive emissions.

When the Carbon Tax Act was amended in 2019, IPCC Activity code 1B3 for other emissions from energy production was unintentionally excluded from section 4(2) of the Carbon Tax Act. To ensure alignment between sections 4(1) and 4(2) of the Carbon Tax Act, it is proposed that an additional category be included under the Carbon Tax Act to cover the IPCC code 1B3 activities for other emissions from energy production.

Clarifying the definition of carbon capture and sequestration

The Carbon Tax Act allows taxpayers to deduct sequestered emissions as verified and certified by the Department of Environment, Forestry and Fisheries (DEFF) from their fuel combustion-related greenhouse gas emissions for a tax period. This covers carbon capture and storage in geological reservoirs and biological sequestration. Government has clarified that for combustion activities where carbon capture and storage technologies are used, the net greenhouse emissions should be reported to the DEFF. Amendments are proposed to:

- prevent double benefits for the same sequestered emissions, by amending the definition of greenhouse gas emissions sequestration to remove carbon capture and storage in geological reservoirs from the scope of the sequestered emissions deduction;

- to address concerns about the permanence of sequestered emissions in harvested wood products and the robustness of the available emissions calculation methodologies. To address this issue, it is proposed that only actual forestry plantation sequestered emissions should be eligible for the deduction under the Carbon Tax Act.

Progress on waste tyre greenhouse gas (GHG) emissions

Currently, schedule 1 of the Carbon Tax Act is aligned with the technical guidelines of the Department of Environment, Forestry and Fisheries (DEFF), which do not include emission factors for waste tyres. The DEFF will develop appropriate emission factors for waste tyres for possible inclusion in the 2022 Budget.

Clarifying the carbon budget allowance

Currently, section 12(1) of the Carbon Tax Act permits a taxpayer to claim a carbon budget allowance of 5% if they participate in the carbon budget system during or before the tax period. The DEFF has gazetted the extension of the voluntary carbon budget system, which became effective from 1 January 2021 and ends on 22 December 2022, and the piloting of new methodologies for determining company-level carbon budgets. To address any ambiguity due to the new voluntary carbon budget system, it is proposed that reference to “before the tax period” be replaced with the specific timeframe for the carbon budget (that is, 1 January 2021 to 31 December 2022), as determined by the department.

Aligning schedule 2 emissions activities and thresholds with the GHG regulations of the DEFF

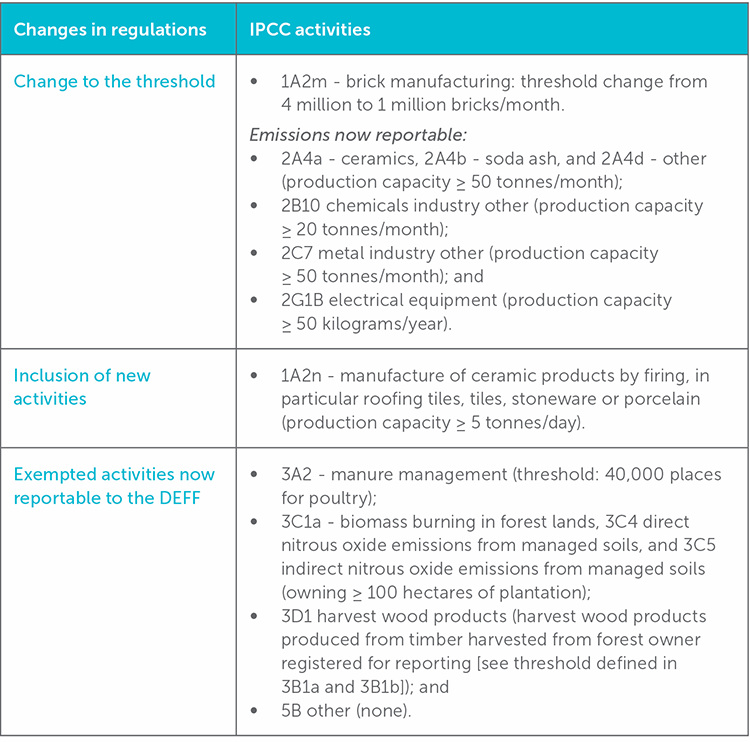

In September 2020, the DEFF gazetted the amended National Greenhouse Gas Emission Reporting Regulations, including new activities required to report emissions and changes to emissions reporting thresholds.

To ensure alignment between the activities covered under the Carbon Tax Act and the amended regulations, certain changes are proposed to schedule 2 of the Carbon Tax Act, with effect from 1 January 2021.

The proposed amendments will likely be included in the 2021 draft Taxation Laws Amendment Bill, which will likely be published in the second half of this year. Stakeholders and parties potentially affected by the amendments should keep an eye on the release of the draft legislation, as they will be given an opportunity to comment on the draft legislation and raise any concerns they may have.

(Note: A shorter version of this article was originally published in CDH’s 2021 Special Budget Speech Alert)

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe