Claiming “COVID-19 made me do it” simply isn’t good enough when deciding to defer or cancel the declaration or payment of a dividend

During the weeks preceding the date of this article, a number of JSE-listed companies published announcements purporting to defer the payment of declared dividends, whereas others have purported to cancel/withdraw declared dividends outright. Common amongst these announcements is the explanation that the decision has been taken primarily due to the uncertainty introduced by the COVID-19 pandemic.

On 30 March 2020, the JSE issued a letter to sponsors and designated advisors in terms of which it confirmed that it had been approached by a number of issuers with requests to cancel payment, postpone payment or adjust the quantum of dividends which have been previously declared but not yet paid.

The upshot of the JSE’s advisory letter is twofold:

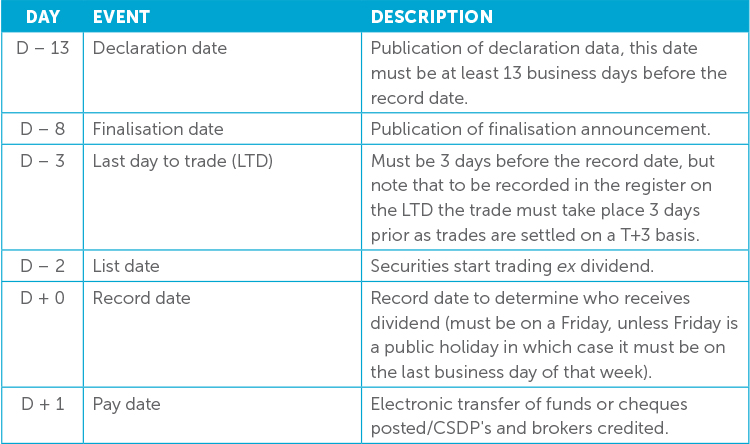

- subsequent to the occurrence of the “finalisation date” (as contemplated in the JSE Corporate Action Timetable, a paraphrased version of the corporation action timetable applicable to cash dividends is displayed at the end of this article) in relation to a declared dividend, the declaration and/or payment of such dividend cannot be cancelled by the issuer; and

- should an issuer, subsequent to the finalisation date but prior to the LTD (last day to trade) in relation to a declared dividend, amend any of the pertinent details of such dividend this would cause the JSE-approved corporate action timetable to be terminated, and the issuer would be required to start afresh and obtain JSE approval for a new corporate action timetable in relation to the dividend.

While the JSE’s letter is instructive in ensuring issuer compliance with the JSE’s timetable for corporate actions, it by no means tells the whole story in relation to an issuer’s legal ability to cancel, postpone or adjust dividends having been or to be declared. Nor was the letter intended to do so, it appears, as the JSE issued a letter of clarification on 2 April 2020, in which it stated that communications by the JSE are always issued subject to the provisions of applicable legislation.

In particular the JSE cites, in its follow-up letter, the need to comply with the Companies Act 71 of 2008 (Companies Act), and states that any cancelations and changes to declared dividends can only be implemented if such actions comply in all aspects with the provisions of the Companies Act.

When deciding if, or how, to withdraw a declared dividend or postpone the payment of it, the following considerations should be considered by all JSE-listed issuers that are subject to South African company law (noting that issuers with inward listings on the JSE should have regard to the company law dispensation in their jurisdiction of incorporation).

When does an issuer incur the obligation to pay a dividend?

The event that causes the issuer to incur the obligation to pay a dividend is the declaration of the dividend.

For JSE-listed companies, a dividend declaration usually comprises two (possibly amongst other) steps having been taken:

- the board has applied the “solvency and liquidity test” (S&L Test), confirmed it is reasonably satisfied that the issuer will satisfy the S&L Test immediately after payment of the dividend and has resolved to declare the dividend (section 46(1)(c) Companies Act) (Declaration Resolution); and

- the issuer announced the declaration of the dividend via SENS.

Once these steps have been taken, the dividend has been declared and the issuer has incurred a legally binding obligation to settle (i.e. pay) the dividend.

In our view, the date on which an issuer declares a dividend may not, in all instances, also be the “declaration date” (per the JSE Corporate Action Timetable). The declaration date is the date that effectively kicks off the JSE Corporate Action Timetable in respect of the payment of a dividend. Where an issuer announces the declaration of a dividend but does not include in that announcement the “declaration data”, then in our view:

the dividend has been declared and the issuer has incurred a legally binding obligation to settle payment of the dividend; but

the clock has not started ticking on the JSE Corporate Action Timetable.

Once declared, when must payment of the dividend be settled to shareholders?

At common law, the default position is that a dividend is payable immediately after it is declared (however, this position can be altered or modified by the terms of the declaration, as discussed below).

The Companies Act prescribes that once the board has adopted a Declaration Resolution, the relevant distribution must, subject to section 46(3) of the Companies Act, be carried out (section 46(2) Companies Act). But the Companies Act does not prescribe a time period within which the declared dividend must be paid.

Given that the Companies Act does not prescribe when a declared dividend must be paid, the common law position, that a dividend is payable immediately after it is declared, applies.

Are there circumstances in which an issuer is precluded from making payment of a declared dividend?

The Companies Act provides that if a declared dividend is not paid within 120 business days after the board passed the Declaration Resolution, then the issuer is precluded from paying the dividend until the board has re-applied the S&L Test and, then being reasonably satisfied that the issuer will satisfy the S&L Test after payment of the dividend, passes the Declaration Resolution afresh (section 46(3) Companies Act).

Where, prior to the expiry of the 120-business day period, there is a change in the financial position or outlook of the issuer, there is in our view no reason why the board should be precluded from re-applying the S&L Test voluntarily. If the board, on a re-application of the S&L Test, is unable to reasonably conclude that the issuer will satisfy the S&L Test after payment of the declared dividend, then the issuer is in our view prohibited from paying that dividend. The reason for this is that an issuer is precluded from making a distribution where it does not reasonably appear that the issuer will satisfy the S&L Test immediately after completing the distribution (section 46(1)(b) Companies Act).

This payment prohibition is equally applicable after the “finalisation date” in respect of a declared dividend in terms of the JSE Corporate Action Timetable, meaning that notwithstanding the issuer’s obligations under the JSE Listings Requirements, the issuer must not in any circumstances make payment of a dividend where it does not reasonably appear that the issuer will satisfy the S&L Test immediately thereafter. Accordingly, there appears to be some tension between the company law position and the JSE Listings Requirements; non-payment at this juncture would seemingly cause the issuer to breach the JSE Listings Requirements, thereby exposing the issuer (and, possibly, its directors) to the risk of, amongst other things, censure and/or the imposition of a fine by the JSE.

In addition, by the finalisation date the issuer’s board would have determined and announced the “record date” for participation in the dividend, leading investors to trade in the issuer’s securities on a cum dividend basis. There is a risk that shareholders recorded in the register on the record date could, where payment is deferred or the dividend is withdrawn altogether, lodge a claim for payment of the dividend together with a possible damages claim. Whether any such claims will ultimately succeed is a different matter.

In these circumstances, the board is between the proverbial rock and hard place, where non-payment exposes the issuer (and possibly its directors) to the risk of punitive measures by the JSE and possible litigation by investors, but payment would cause the directors to act in contravention of the provisions of the Companies Act.

How can the payment of a dividend be validly deferred?

While the inability to satisfy the S&L Test prohibits an issuer from making payment of a declared dividend, the board itself is (in principle) capable, when declaring a dividend, of modifying when and how the dividend will become due and payable.

When declaring a dividend, the board is capable of determining the terms on which such dividend is declared. It appears to be perfectly competent for a dividend to be declared such that the payment obligation is deferred to a later time or that such obligation is subject to fulfilment of certain conditions, thereby effectively modifying the default position under the common law that declared dividends become due and payable immediately.

When determining whether an issuer has scope to defer the payment of a declared dividend, regard should be had to:

- the authority conferred on the board in the company’s constitution in relation to the manner in which dividends are to be declared and paid;

- and the terms on which the dividend was declared.

Where the terms on which the dividend was declared do not leave scope for the deferral of the payment obligation, then, in the absence of the payment being prohibited by virtue of section 46(1)(b) of the Companies Act, it would be unlawful for the issuer to defer payment of the dividend. In such circumstances the deferral could provide grounds on which claims could be brought against the issuer by investors.

Once declared, is it competent for an issuer to unilaterally withdraw/cancel the dividend?

Upon declaration of a dividend, the issuer incurs an obligation to settle the dividend. Conversely, the shareholders become legally entitled to enforce the distribution (i.e. it becomes a debt owing to them).

There is no case-law under section 46 of the Companies Act that has held that a unilateral withdrawal of a declared dividend by the issuer is competent.

An analogous legal position may be found in the law of contract (to the extent that the debtor/creditor relationship created between an issuer and its shareholders upon declaration of a dividend justifies such analogy).

Where a contractual obligation becomes impossible to perform due to a supervening impossibility, this constitutes grounds for (i) the suspension of the obligation to perform until performance becomes possible or (ii) the termination of the contract. Whether a contract may be terminated by virtue of a supervening impossibility of performance, turns on whether the impossibility is temporary in nature or causes performance under the contract to be absolutely and inevitably impossible. Where the impossibility of performance is temporary in nature, it provides a ground only for the suspension of the requirement to perform and not for the termination of the contract (see World Leisure Holidays (Pty) Ltd v Georges 2002 (5) SA 531 (W)).

A board being unable to reasonably conclude that the issuer will satisfy the S&L Test immediately after the payment of a dividend would, all else being equal, constitute a temporary supervening impossibly of performance and would therefore not justify the cancellation/withdrawal of the dividend.

In our view, therefore, unless the terms on which the dividend was declared entitle the issuer to unilaterally withdraw or cancel the dividend, it is not competent for an issuer to do so. In such circumstances, the unilateral withdrawal or retraction of a declared dividend by an issuer would be unlawful.

Do REITs remain obligated to declare and pay dividends in order to retain their reit status?

The obligation to declare and pay dividends is particularly important where the issuer is a “REIT” (as such term is defined in the Income Tax Act 58 of 1962).

In order for a REIT to enjoy the benefit of the tax dispensation applicable to REITs, it must (amongst other things) maintain its REIT-status in terms of the rules of the securities exchange on which its shares are listed as shares in a REIT.

For JSE-listed REITs, one such requirement is that a REIT must comply with the applicable distribution provisions of the JSE Listings Requirements (paragraph 13.49 JSE Listings Requirements).

In terms of paragraph 13.47(a) of the JSE Listings Requirements, a REIT must distribute at least 75% of its total distributable profits as a distribution to the holders of its listed securities by no later than 4 months after its financial year end. A failure to comply with this distribution requirement would eventually result in the issuer’s REIT status being revoked by the JSE (paragraphs 13.49 and 13.50 JSE Listings Requirements).

However, the obligation to make the distribution in terms of paragraph 13.47(a) of the JSE Listings Requirements is not absolute, but rather is expressly subject to the REIT satisfying the S&L Test.

Accordingly, where the REIT (i) fails to make the distribution within 4 months of its financial year end and (ii) such failure is a result of the issuer failing to satisfy the S&L Test in relation to that distribution, then the failure to have made such distribution should not result in it losing its REIT status.

Miscellaneous matters for consideration

Many other interesting questions have arisen in this context:

Share repurchases and redemptions

The term “distribution” is defined in the Companies Act to include, amongst other things, the repurchase and/or redemption of shares. To the extent that an issuer implements any of the measures discussed above (i.e. the withdrawal of a dividend or deferral of payment of it) on the basis that it does not reasonably appear that the issuer will satisfy the S&L Test immediately after completing the distribution, the issuer should be cognisant that any share repurchases or redemptions are subject to the same requirement and should likewise be refrained from.

Capitalisation issues

Capitalisation issues, being the issuance of shares to shareholders pro rata to their shareholding, do not constitute a “distribution” and therefore the ability of a board to undertake and implement a capitalisation issue is not subject to the S&L Test. However, where shareholders are offered cash as payment in lieu of the issue of capitalisation shares, this would constitute a “distribution” and would be subject to the same dispensation as dividends.

Setting the record date for participation in a dividend

From a Companies Act perspective, the record date for participation in a dividend must not be more than 10 business days prior to the date on which payment of the dividend is scheduled to occur (section 59(2)(a)(ii) Companies Act). The JSE Corporate Action Timetable prescribes that the record date must be the business day immediately prior to the payment date.

For this reason it would generally not be possible to “freeze the register” of the issuer for purposes of the distribution and for the shares then to trade ex dividend for an extended period.

Will declared but unpaid dividends be seen as debt for purposes of funding and other covenants?

If a board intends to declare a dividend on the basis that it will become payable at a specified date or a date to be determined, the issuer should consider whether such declared but unpaid dividend would constitute “financial indebtedness” or “debt” and, if so, whether this would have any ramifications under its funding agreements and/or funding covenants.

Will interest accrue on deferred dividends?

Interest would typically not be payable on deferred dividends unless the company’s constitutional documents provided otherwise. However, to the extent that pursuant to the matter being litigated on, a Court were to find that a deferral of payment of a dividend constituted non-payment of a debt which became due and payable, a Court may also grant successful claimants default interest for the period between the due date and the actual payment date.

Miscellaneous matters for consideration

For more information on our Listed Companies service offerings, please click here.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe