Customs & Excise Highlights

New authority / case law (certain sections quoted from the judgment):

- Glencore Operations SA (Pty) Limited v The Commissioner for the South African Revenue Service, case number 11696/18 in the High Court of South Africa, Gauteng Division, Pretoria:

The judgment, delivered on 24 October 2019, has regard to eligibility of refund claims in relation to diesel used for primary production activities, specifically in mining, in terms of rebate item 670.04 in Schedule 6 to the Act. It states (inter alia) as follows:

“… the crux of the dispute relates to whether the applicant used the diesel fuel in the manner intended in note 6(f) of Schedule 6 …

…….

… the activities in note 6(f)(iii) are non-exhaustive activities forming part of, i.e. included in, ‘own primary production activities in mining’. It further follows that where activities conducted by the applicant do not fit exactly within any of the activities referred to in note 6(f)(iii) of the Schedule, but are in reality part and parcel of the kind of operations which the legislature intended to include in the concept of primary activities in mining, the non-exhaustiveness of list in note 6(f)(iii) of the Schedule permits that such activities are also subject to the concession relating to rebates of distillate diesel fuel. Thus, those activities qualify as primary production activities in mining as defined in note 6(f)(iii) of Schedule 6 part 3 of the Act”.

The Court interpreted note 6(f) to have a wider meaning and it is hoped that activities traditionally not accepted by SARS as eligible, will now be eligible allowing diesel refunds for such activities to be claimable.

At the time of drafting this newsflash, it was uncertain whether the judgment will be appealed by SARS.

Amendments to Schedules to the Customs & Excise Act 91 of 1964 (Act) (certain sections quoted from the

SARS website):

- Schedule 1 Part 1:

1.1 The substitution of tariff subheadings 1701.12, 1701.13, 1701.14, 1701.91, and 1701.99, to increase the rate of customs duty on sugar from 401.79c/kg to 476.61c/kg in terms of the existing variable tariff formula; and

1.2 The substitution of tariff subheadings 1001.91 and 1001.99 as well as 1101.00.10, 1101.00.20, 1101.00.30 and 1101.00.90 to increase the rate of customs duty on wheat and wheaten flour from 66.47c/kg and 99.71c/kg to 100.86c/kg and 151.29c/kg respectively, in terms of the existing variable tariff formula.

- Schedule 4:

2.1 The insertion of rebate items 460.05/2712.10.20/01.08, 460.07/3916.90.90/01.08, 460.15/72.17/01.04, 460.16/8544.70/01.06 and 460.18/9001.10/01.06 in order to provide for a rebate on certain input material used in the manufacture of optical fibre cables and optical ground wire cables.

Notices issued by the International Trade Administration Commission (ITAC)

- ITAC has received the following applications concerning the Customs Tariff:

1.1 Review of rebate item 316.01/8415.90/02.06 dated 18 October 2019:

Air conditioning machines, having a rated cooling capacity exceeding 3 kW, incomplete or unassembled, for the manufacture of air conditioning machines identifiable for use in heavy vehicles as defined in Note 1 to rebate item 317.07.

Enquiries: ITAC Ref: 16/2019. Ms. Lufuno Maliaga. Tel: 012 394 3835 or

email:lmaliaga@itac.org.za.

Representations should be made within four (4) weeks of the date of the notice.

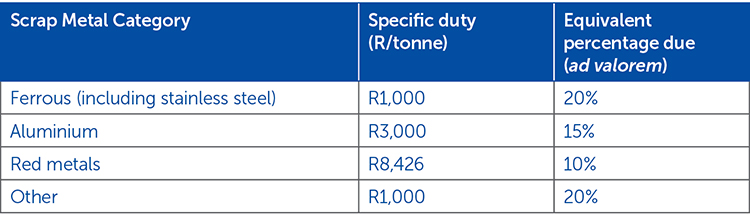

- ITAC proposed an export duty on ferrous and non-ferrous waste and scrap on 18 October 2019:

The duty is aimed to provide more effective support to foundries and mini-mills engaged in the processing of Scrap Metal. The imposition of export duties on Scrap Metal is being considered to replace the existing price preference system.

The specific export duties being considered on certain categories of Scrap Metal are as follows:

Interested parties are invited to submit written comments to the following officials:

Mr Dumisani Mbambo, e-mail: dmbambo@itac.org.za, Tel: (012) 394 3743; Ms Lufuno Maliaga, email: lmaliaga@itac.org.za, Tel: (012) 394 3835; Mr Njabulo Mahlalela,

e-mail nmahlalela@itac.org.za, Tel: (012) 394 3784; Mr Pfarelo Phaswana,

e-mail: pphaswana@itac.org.za, Tel: (012) 394 3628; and Mr Tshepiso Sejamoholo, e-mail: tsejamoholo@itac.org.za, Tel: (012) 394 1605.

Written submissions must be received within four weeks of the date of the notice,

which is on or before 15 November 2019.

SARS notices

- SARS gave notice in terms of Rule 276(1)(b) of the Rules of the National Assembly that the Minister of Finance intends to introduce the Tax Administration Laws Amendment Bill, 2019, in the National Assembly. The explanatory summary of the Bill was published in accordance with Rule 276(1)(c) of the Rules of the National Assembly on 28 October 2019.

The Bill provides for the amendment of, inter alia, the Act so as to:

1.1 Make technical corrections;

1.2 Insert definitions;

1.3 Extend a provision providing for information sharing and exclude certain information from the application of the prohibition on disclosure of information;

1.4 Clarify that an invoice may be amended by the issuing of an amended invoice or by the issuing of a credit or debit note in circumstances where the amount reflected on the invoice is amended;

1.5 Clarify that tariff determinations, amendments to tariff determinations or new tariff determinations apply to all identical goods entered by the same person, whether the goods were entered before or after the date on which the determination is issued;

1.6 Exclude bulk removals between excise manufacturing warehouses of alcoholic beverages classified under any subheading of heading 22.04 or 22.05 of Part 1 of Schedule 1 from compulsory tariff determinations;

1.7 Clarify that value determinations, amendments to value determinations or new value determinations apply to goods mentioned therein entered by the same person before or after the date on which the determination

is issued;

1.8 Limit the circumstances in relation to which applications for general refunds will be considered; and

1.9 Extend the general rule-enabling provision to include matters relating to the making of advance payments in relation to the importation of goods.

Please advise if additional information is required.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe