The draft Integrated Resource Plan 2018: The roadmap for future generation capacity

Why is the IRP important?

The integrated resource plan (IRP) is an electricity capacity plan which aims to provide an indication of the country’s electricity demand, how this demand will be supplied and what it will cost. On 6 May 2011, the Department of Energy (DoE) released the Integrated Resource Plan 2010-2030 (IRP 2010) in respect of South Africa’s forecast energy demand for the 20-year period from 2010 to 2030. The IRP 2010 was intended to be a ‘living plan’ that would be periodically revised by the DoE. The IRP 2010 stated that at the very least the IRP should be revised by the DoE every two years but this was never done.

In terms of the Electricity Regulation Act, No 4 of 2006 (ERA), the National Energy Regulator of South Africa (NERSA) is required to issue rules designed to implement the IRP. It is notable that NERSA has not issued any such rules since the IRP was first published. Instead, the DoE has to date implemented the IRP 2010 by issuing Ministerial Determinations in line with s34 of the ERA in order to give effect the procurement of new generation capacity.

What is the difference between the IRP and an IEP?

The National Energy Regulator Act, No 34 of 2008 places an obligation on the Minister of Energy to develop, and on an annual basis, review and publish the Integrated Energy Plan (IEP) in the Government Gazette. The IEP is meant to serve as the guide for energy infrastructure investments, take into account all viable energy supply options and guide the selection of the appropriate technology to meet energy demand. There has been no IEP published since the enactment of the National Energy Regulator Act, and the IRP Update gives no indication as to when such IEP will be published.

What assumptions have changed since the IRP 2010?

A number of assumptions utilised in the IRP 2010 have since changed which necessitated the review. The IRP Update states that the key input assumptions that have changed since the IRP 2010 was promulgated include, amongst others:

- electricity demand projection that did not increase as previously envisaged;

- existing Eskom plant performance that is significantly below the assumed 86% availability factor;

- additional capacity committed to and commissioned; and

- technology costs that have declined significantly relative to the assumed values in the IRP 2010.

“Least-cost plan” up to 2030

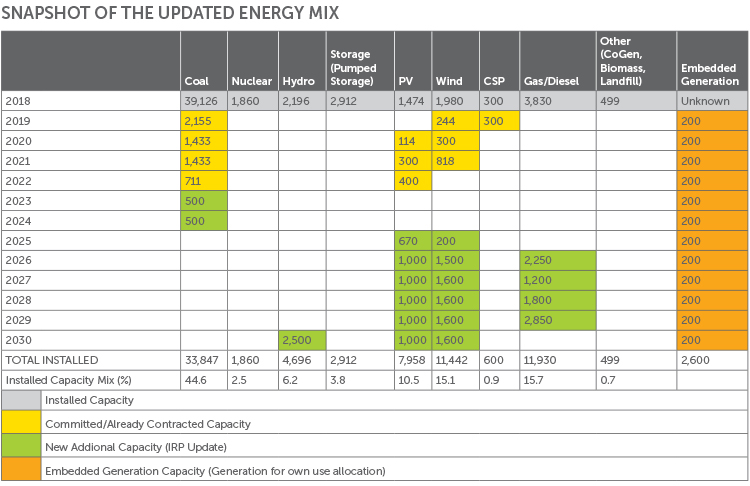

The IRP Update “least-cost plan” up to 2030 contains only a capacity allocation for solar photovoltaic (PV), onshore wind, embedded generation and gas and notably excludes nuclear, solar CSP and any new coal generation capacity.

Interestingly, the IRP Update results of the demand-growth scenario analysis reveals that the installed capacity and energy mix for the period up to 2030 between the different scenarios tested during the IRP Update process do not differ materially, notwithstanding the reduction in demand for this period. This is due mainly to the decommissioning of approximately 12 GW of Eskom coal plants in this period.

The findings of the scenario analysis are also that the committed Renewable Energy Independent Power Producers Programme (RE IPP Programme), including the recent 27 signed projects, and the Eskom capacity rollout ending in 2022 with the last unit of Kusile, will provide more than sufficient capacity to cover the projected demand and decommissioning of plants up to approximately 2025.

The projected unit cost of electricity by 2030 was also found to be similar except for market-linked gas prices.

The following new additional capacity by 2030 is included:

1,000 MW of coal,

2,500 MW of hydro,

5,670 MW of solar PV,

8,100 MW of wind, and

8,100 MW of gas/diesel.

Coal

Up to the end of 2030, the new capacity demand is primarily driven by the decommissioning of the existing coal-fired plants and the IRP Update contains a detailed decommissioning plan.

For the period post-2030, the decommissioning of coal plants (total 28 GW by 2040 and 35 GW by 2050), together with emission constraints imposed, imply that coal will contribute less than 30% of the energy supplied by 2040 and less than 20% by 2050.

Under the Eskom build programme, the coal capacity already commissioned is 2 172 MW from Medupi (out of the 4 800 MW planned) and 800 MW from Kusile (out of the 4 800 MW planned).

The IRP Update includes 1 000 MW of coal to power in 2023-2024 based on the already procured and announced two projects under the Coal Baseload IPP Programme.

Renewable Energy

The IRP 2010 contained capacity allocations for electricity generated from renewable technologies, and it is in line with these allocations that the Minister of Energy has made Ministerial Determinations for renewable energy, which included the technologies of solar PV, wind, solar CSP, landfill gas, biomass, biogas and shall hydro.

To date, four bidding rounds have been completed for renewable energy projects under the RE IPP Programme, and on 1 June 2018 the Minister of Energy announced that a new Bid Window 5 for the RE IPP Programme will be launched in November 2018 and is estimated to procure a capacity of 1 800MW.

The publication of the IRP Update, however, casts doubt on the scale and pace of any further bid windows under the RE IPP Programme, specifically as no provision is made for the commissioning of additional wind capacity during 2022 to 2024, or for solar PV in 2023 and 2024.

The study undertaken to compile the IRP Update states that it considered comments from stakeholders such as the CSIR on least cost scenarios, adjusted learning rates for PV and wind technology to reflect the steep decline in prices and took into account the transmission infrastructure costs incurred through solar PV and wind energy generation.

The IRP Update reaches the following important conclusions with regard to renewable energy after an analysis of the potential scenarios:

- Ministerial Determinations for capacity beyond Bid Window 4 issued under the IRP 2010 must be reviewed and revised in line with the projected system requirements;

- the least-cost electricity path to 2050 is the scenario without a renewable energy annual build limit; and

- unless in the case of policy intervention, all technologies included in the IRP 2010 where prices have not declined cease to be deployed.

The IRP Update concludes by outlining the following recommended plan for renewable energy:

- a detailed analysis of the appropriate level of penetration of renewable energy in the South African national grid needs to be undertaken to better understand the technical risks and mitigations required to ensure security of supply is maintained during the transition to a low-carbon future;

- a least-cost plan with the retention of annual build limits (1 000 MW for solar PV and 1 600 MW for wind) for the period up to 2030 which will provide for a smooth roll out of renewable energy and help sustain the industry;

- renewable energy technologies identified and endorsed for localisation and promotion will be enabled through Ministerial Determinations. Technologies reflected in the IRP Update are a proxy for technologies that provide similar technical characteristics at similar or less cost to the system; and

- the timing of new capacity indicated in the IRP Update can be adjusted depending what occurs with projected electricity demand or Eskom’s existing plant performance.

Gas

With gas projected to comprise 15.7% of the installed capacity mix by 2030, it is clear from the IRP Update that it is envisaged that gas will be a significant part of the energy mix in the future.

There is currently 3830 MW of installed capacity generated from gas while a further 8100 MW of new additional capacity is projected to be procured and generated from gas which will eventually contribute to a total of 11 930 MW by 2030. Gas is included in the plan from 2026.

The projected unit cost of electricity by 2030 was found to be similar for all scenarios analysed except for the scenario in which a market-linked increase in gas prices was assumed instead of an inflation-based increase. The analysis revealed that the risk associated with increasing gas volumes to support generation from renewable energy is real unless gas becomes available locally. It was therefore recommended that the impact of the importation of gas and the exposure of electricity prices to currency fluctuations must be assessed prior to any commitment.

The IRP Update further recommends that a detailed analysis of the gas supply options should be undertaken in order to better understand the technical and financial risks and required mitigations for an electricity generation mix that is dominated by gas and renewable energy post-2030.

Embedded Generation

The IRP Update allocates 200MW per annum for embedded generation-for-own-use of between 1MW to 10MW, starting in 2018. The activities that constitute embedded generation for own use are set out in Appendix E to the IRP Update and relate to the operation of a generation facility with an installed capacity between 1MW and 10MW, whether connected to the national grid or not, that is operated solely to supply electricity to a single customer or related customer (which includes different legal entities within the same group of companies). The allocation is not technology specific. In order to undertake the activities listed, an IPP will have to apply for and hold a generation licence administered by NERSA.

It is surprising that there is no MW allocation made available for embedded generation for-own-use below 1MW.

Hydro

The IRP Update includes 2500MW of hydro power in 2030 to facilitate the RSA-DRC treaty on the Inga Hydro Power Project, in line with South Africa’s commitments contained in the National Development Plan to partner with regional neighbours. The project is stated to have the potential to energise and unlock regional industrialisation.

The main risks associated with import hydro options, as noted in the IRP Update, relate to delays in the construction of both the necessary grid extension and the power plants themselves. There is also a cost risk in that the assumptions used in the IRP Update are based on a ‘desktop study’ and do not reflect any commitment on the part of potential developers.

Nuclear

New additional capacity arising from nuclear capacity has not been included in the period up to 2030.

It is also expected that the 1800 MW of nuclear power generation from the Eskom Koeberg plant will reach end of life between 2045 and 2047.

The road ahead…

It would appear that despite the IRP Update study period being extended to the year 2050, the IRP Update only provides a firm plan for the period up to 2030. The IRP Update specifically recommends that the post-2030 path not be confirmed and that detailed studies be undertaken to inform the future update of the IRP.

The IRP Update acknowledges that the significant change in the energy mix post-2030 is highly impacted by the assumptions used and that a slight change concerning the assumptions can alter the path chosen. It is therefore critical that the IRP Update, when finalised, is approached as it was intended to be, as a living document that is regularly reviewed and updated.

The IRP Update states that the review and outcome implies that the pace and scale of new capacity developments needed up to 2030 must be curtailed compared with that in the IRP 2010. Effectively this means that the following IPP programmes will likely not continue: the Coal Baseload IPP programme (beyond the current two projects being procured), the Co-Generation IPP Programme and the Small Renewable Energy IPP Programme.

Importantly the IRP Update states that the Ministerial Determinations for capacity beyond Bid Window 4 issued under the IRP 2010 must be reviewed and revised. Ministerial Determinations are issued in terms of s34 of the ERA and require consultation with NERSA. Decisions of NERSA are regulated by the National Energy Regulator Act and require a public participation process. This will certainly impact the timing of the anticipated Bid Window 5 under the RE IPP Programme.

The introduction of a MW allocation for embedded generation in the IRP Update is a welcome development as it will facilitate the process of applying for and obtaining a generation licence and presumably stimulate market growth. It is, however, unclear at this stage as to how NERSA intends to deal with the current backlog of generation licence applications that have been made over the past year(s) and whether this will be dealt with on a ‘first come first serve’ basis or another method of adjudication.

The IRP Update unlocks momentum for energy generation and holds promise for the road ahead.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe