What do we mean by Investment Protection?

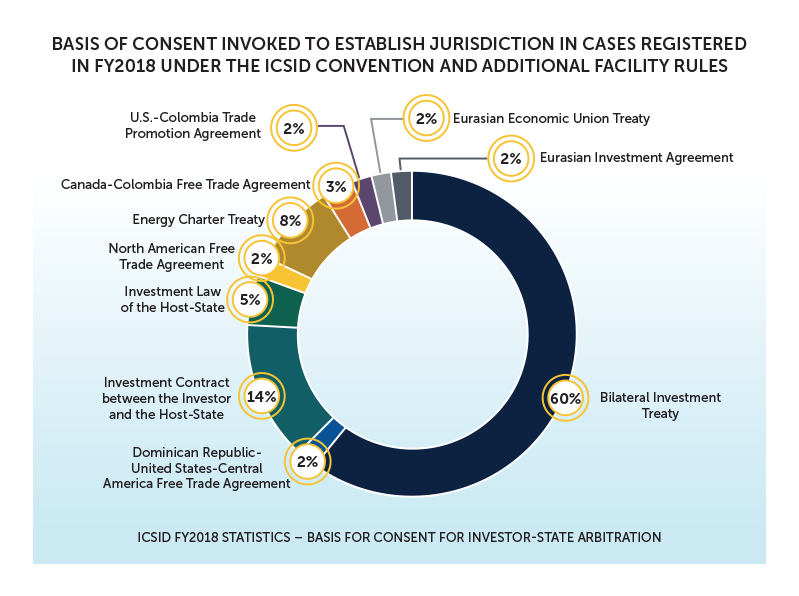

Generally speaking, with reference to the publicly available statistics contained in the 2018 annual report of the Centre for the Settlement of Investment Disputes (ICSID), it demonstrates that investors primarily rely on bilateral or multilateral investment treaties to enforce investment protection, with a further 14% relying on investment contracts between the investor and the host government and an additional 5% relying on investment laws of the host-state.

The ICSID 2018 statistics do not consider non-ICSID investor-state disputes flowing from treaties, investment agreements or domestic legislation usually conducted under the auspices of institutions such as the Permanent Court of Arbitration, the Arbitration Institute of the Stockholm Chamber of Commerce, the Singapore International Arbitration Centre. However, it is estimated that ICSID administers most of all investor-state arbitrations and its statistics is seen as a good yardstick to determine the nature and extent of the utilisation of the international investment protection regimes by foreign investors globally.

The scope of this video insert is limited and does not cover the various nuances flowing from the investment treaties or domestic legislation which provide for investment protection. It merely provides a high-level insight into what is meant by international investment protection.

For more information, contact Jackwell Feris Jackwell.Feris@cdhlegal.com or +27 (0)11 562 1825

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe