Practical M&A: Locked box mechanism explained

How it works

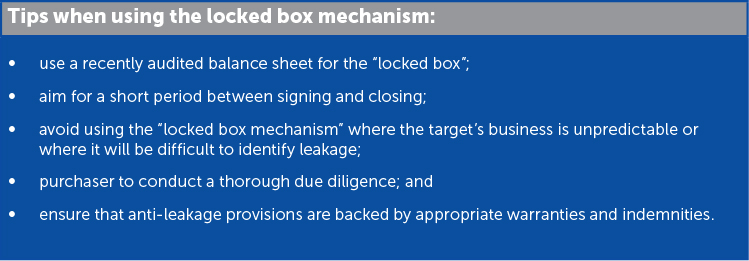

The locked box mechanism entails that the purchase price payable on the transaction’s closing date (Closing), is agreed and fixed at the date of signature of the transaction agreements (Signature Date). There is no price adjustment or true-up between the Signature Date and Closing. The purchase price is based on a balance sheet agreed between the parties and the date of this balance sheet constitutes the agreed date of the “locked box” (Locked Box Date). The parties forecast and agree fluctuating items such as actual cash, debt and working capital, and factor that into the price as there will be no adjustment for these items between the Signature Date and Closing. From the Locked Box Date the target is prohibited from taking value out of the business. This could for example be in the form of dividends, management fees and bonuses (Leakage). During such period only specifically agreed payments and payments made by the target in the ordinary course of business are allowed (Permitted Leakage). Permitted Leakage is also factored into the purchase price. The purchaser therefore acquires and pays for everything that is in the “locked box” at the Locked Box Date.

Time and cost considerations

The “locked box mechanism” is generally less complicated than the closing accounts mechanism, which requires lengthy negotiations and complicated drafting and calculations. Such complexities often give rise to costly disputes about the interpretation of the accounts and calculation of the purchase price adjustments.

As the “locked box mechanism” is quick, it is attractive to sellers wanting a quick exit. Since the price is known upfront and fixed it is also easier for the purchaser to do pre-acquisition planning, secure funding and obtain the necessary authorisations. On the downside, the purchaser will need to spend more time and money on a thorough due diligence of the target to get to know the target’s business at an early stage.

Because the purchaser will need to negotiate the purchase price based on forecasts and a balance sheet prepared solely by the seller, the purchaser will also have to spend time and money appointing auditors to test the balance sheet and provide an independent valuation forecast of the target or the target business based on the information gathered during its due diligence. Both parties need to carefully consider how they define Leakage and Permitted Leakage.

Risk and reward

With the “locked box mechanism” the risk and reward of ownership is pushed forward and passes to the purchaser with effect from the Locked Box Date. Where profits increase and the target business grows, these profits will be locked in the “locked box”. On the downside, the risk of unexpected deterioration of the target business also falls on the purchaser.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe