Key changes to preferential procurement law: Part 3

Remedial powers of organs of state

Previously, an organ of state was empowered to act directly against a fraudulent tenderer to, among other things, disqualify the tenderer or terminate the contract; claim damages; prevent the tenderer from obtaining business from any organ of state for a maximum period of 10 years; and refer the matter for criminal prosecution.

Now, in terms of the Revised Regulations, when an organ of state identifies a fraudulent tenderer they must first inform the tenderer accordingly; give the tenderer an opportunity to make representations within 14 days; and, finally, after considering the representations made, disqualify the tenderer or terminate the contract and, if applicable, claim damages.

These remedial powers of organs of state are further restricted as they can no longer refer the matter for criminal prosecution but, rather, only penalise a tenderer who failed to disclose a sub-contracting arrangement for a maximum of 10% of the value of the contract. An organ of state is obliged to inform National Treasury, in writing, of any action taken in this regard, whereafter National Treasury is empowered, after submissions have been made by both the fraudulent tenderer and relevant organ of state, to prevent a tenderer from doing business with any organ of state for a maximum period of 10 years and to add the tenderer to National Treasury’s list of restricted suppliers.

Conditional preference point system

Previously, an organ of state had to cancel a tender invitation where the only bids received fell outside the stipulated preference point system (in terms of the price for the contract) and then re-invite tenders under the revised, correct preference point system. To illustrate, if a tender invitation applying the 80/20 preference point system only received tenders that in quoted price exceeded the estimated rand value of R1 million (now R50 million under the Revised Regulations), the tender had to be cancelled and tenderers had to be re-invited to tender under the 90/10 preference point system.

Now, according to the Revised Regulations, the initial tender invitation may stipulate that either the 80/20 or 90/10 preference point system will apply, and that the lowest acceptable tender will determine the applicable preference point system.

Removal of the proper planning, tax clearance and declaratory provisions

The Revised Regulations repealed the requirement for an organ of state, prior to making an invitation to tender, to properly plan for and, as far as possible, accurately estimate the costs of the tender. Significantly, even though this is no longer explicitly required, the Implementation Guide published by National Treasury still requires proper planning and accurate cost estimations. This is necessary to determine the appropriate preference point system to be utilised in the evaluation and adjudication of bids, and to ensure that the cost of the services, works and goods is market related. The removal of this provision seems rather curious, but organs of state would be well advised to follow the Implementation Guide.

Previously, tenderers were required to declare that the information provided in their bids is true and correct, the signatory is duly authorised and the tenderer will submit documentary proof when required to do so to the satisfaction of the organ of state. This is no longer required although, in practice, should a tenderer wilfully misrepresent information in its bid, an organ of state will be able to exercise its remedial powers against fraudulent tenderers (as mentioned above).

Finally, tenderers were also previously required to have their tax matters declared to be in order by the South African Revenue Service before being awarded a tender. This requirement has also been removed but is still required according to the Implementation Guide. In the case of Afriline Civils (Pty) Ltd v Minister of Rural Development & Land Reform and Another; Asla Construction (Pty) Ltd v Head of the Department of Rural Development and Reform and Another [2016] 3 All SA 686 (WCC), the High Court considered whether the applicants’ tenders were fairly rejected as non-responsive for, among other things, failing to comply with the mandatory requirement relating to the furnishing of a tax clearance certificate. The court found that the requirement relating to tax clearance certificates, as provided in the tender documents, was mandatory and therefore, due to non-compliance therewith, the tenders were rendered invalid.

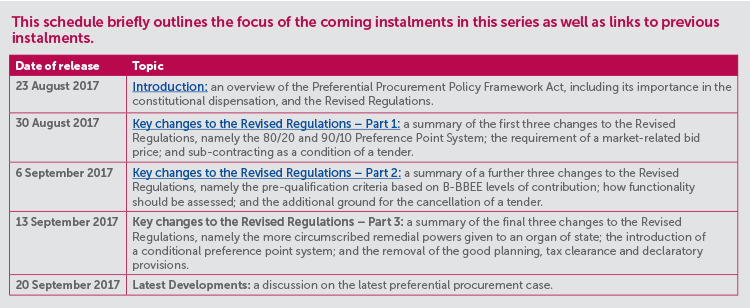

In the next and final alert in this series, we will highlight the most recent developments in preferential procurement in case law.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe