Community Schemes Ombud Service Act: A year on

The Act was drafted with a three-fold purpose, namely:

- to provide a dispute resolution mechanism in respect of “community schemes” – that is, housing schemes where the use of and responsibility for land and buildings is shared;

- to promote good governance of community schemes and monitoring that governance; and

- to provide education, information, documentation and services to raise awareness of persons who have rights and obligations in community schemes.

Typical examples of community schemes include sectional title development schemes, share block companies, home or property owners’ associations and life right development schemes for retired persons. Shared responsibility for land and buildings can sometimes be fraught with conflict, and the Community Schemes Ombud Service (CSOS) aims to resolve disputes efficiently and cost-effectively.

Under the framework of the Act, new community schemes are required to formally register with the CSOS within 30 days of the date the date on which they are incorporated. Pre-existing schemes were required to have registered by 7 November 2016.

Payment of Monthly Levies

A number of questions have arisen since the promulgation of the Act. The most common questions relate to the payment of monthly levies, out of which the CSOS is funded.

In terms of s29(1)(b) of the Act, certain levies are payable by schemes to the CSOS. Regulation 2(1) provides that schemes must collect the prescribed monthly levy from every unit within a community scheme and pay these levies to the CSOS on a quarterly basis. Although not defined, a sensible interpretation of the Act is that units include, amongst others, a section in a sectional title scheme, a house in a housing development or a unit in a life right scheme.

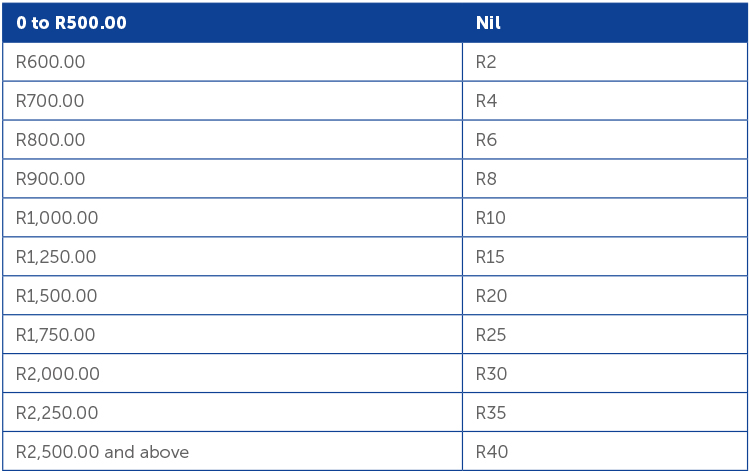

The Regulations set out a table and methodology (based on the levies charged by the relevant schemes) for the calculation of monthly CSOS levies, as follows:

So, for example, if a monthly levy between R0 and R500 is payable in respect of a unit in a scheme, then no monthly CSOS levy is payable. If a monthly levy of R2,500 and above is payable, a monthly CSOS levy of R40 is payable. There is, therefore, a prescribed minimum of R0 and a maximum of R40 per unit, per month, with amounts ranging in between.

Although these amounts are collected monthly from each unit by the scheme, they are payable quarterly by the scheme to the CSOS at the end of March, June, September and December each year. The CSOS Practice Directive: No 1 of 2017 which the CSOS issued on 24 March 2017 provides guidance as to the nature of the existing monthly levy on which the monthly CSOS levy is based, namely, the amounts paid towards the administrative fund. The administrative fund is made up of the monies budgeted for by the scheme for that specific financial year for the maintenance of the common property, sewer and effluent, insurance, the salaries of the scheme’s employees, security and other conceivable expenses related to the running and management of the scheme. Any special levies and payments related to the maintenance of the exclusive use areas are excluded from the calculation of the CSOS levy. It, therefore, appears that any amounts payable in respect of meals (if applicable) and other monthly items are excluded.

The Regulations do, however, provide for certain discounts and waivers:

- As stated, individual units within a scheme for which the monthly levies do not exceed R500 are effectively granted a 100% waiver of the CSOS levies.

- Any person whose monthly net household (gross income less PAYE) income is below R5,500 is entitled to a 100% waiver of application and adjudication fees in respect of any dispute before the CSOS.

- Any person who may not qualify in terms of the above criteria may lodge an application for discount and/or waiver for consideration by the Chief Ombud.

Offences and Penalties

Non-compliance with the provisions of the Act bears the risk of incurring significant penalties. Non-payment of levies on the due date will attract interest at a rate of 2% per month. In terms of s34 of the Act, any person who fails to comply with the Act is liable, on conviction, to a fine or imprisonment for a period not exceeding 5 years or to both a fine and such imprisonment. Where a person is convicted for a second or subsequent conviction for an offence, he or she is liable to a fine or imprisonment for a period not exceeding 10 years or to both a fine and such imprisonment. Schemes will use normal debt collection mechanisms to collect outstanding levies from owners.

Conclusion

As the Act is a relatively new piece of legislation, it has not had the benefit of legal interpretation by either the CSOS or the courts. It is therefore likely that issues will arise in relation to the nature and extent of a scheme’s obligation to collect and pay CSOS levies and we will continue to monitor developments in that regard.

It will also be interesting to see whether the documents required for transfer of ownership of units in schemes change to require written proof from the CSOS that the levies are fully paid and up-to-date (similar to a tax clearance certificate). This may be the only means to ensure that schemes formally register and pay their quarterly levies.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe