Further ruling issued by SARS in respect of venture capital companies

The Ruling is important as it provides further direction in respect of the ongoing interpretation of the rules contained in s12J pertaining to VCCs as well as illustrating the practical implementation of some of the technical aspects of the rules to particular structures. This note does not discuss every nuance arising out of the Ruling, but merely highlights some of the major principles and aspects taken from it.

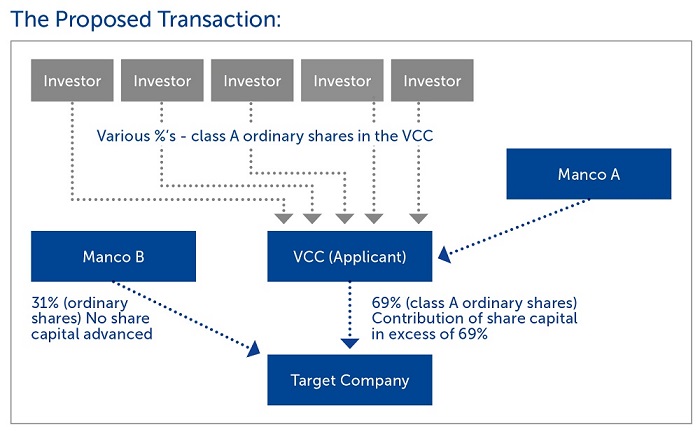

Background of proposed transaction

In essence, the applicant, a South African resident company approved as a VCC under s12J (Applicant) proposed raising funds by issuing shares to various persons (Investors), which funds were to be allocated specifically to a Target Company.

(Note: while the Ruling initially refers to a “Target Company B”, it thereafter merely refers to a “Target Company”. For purposes of this note, it is assumed that “Target Company B” and “Target Company” are the same.)

The proposed transaction steps were as follows:

Transaction step 1:

- The Applicant’s board of directors would classify and assign certain preferences, rights and limitations, and other terms to a class of its ordinary shares (class A ordinary shares) which would rank pari passu (ie equally) with all its other ordinary shares.

- The Investors who wished to specifically invest in the Target Company would subscribe for class A ordinary shares in the Applicant and a management company (Manco A) would co-invest in the Applicant.

Transaction step 2:

- The Applicant would use the subscription price received from the Investors to subscribe for class A ordinary shares in the Target Company.

- The Applicant would subscribe for no more than 69% of the total equity shares issued by the Target Company. The capital, which the Applicant would contribute to the Target Company would be disproportionately high, compared to the number of shares it would hold in the Target Company. Although the Applicant would subscribe for no more than 69% of the equity shares in the Target Company, it would contribute in excess of 69% of the Target Company’s capital.

- The total equity shares to be issued by the Target Company would comprise of ordinary shares and class A ordinary shares. Target Company’s class A ordinary shares would rank pari passu (ie equally) with all its other ordinary shares.

- The Target Company would issue the remaining 31% of its equity shares (ordinary shares) to a management company (Manco B).

- Manco B was not required to contribute any capital to the Target Company.

First issue – definition of “equity share” in respect of “venture capital shares”

The first issue which the parties wished to clarify was whether the relevant shares to be issued pursuant to the application would constitute “equity shares” as defined in s1(1) of the Act for purposes of the definition of “venture capital share” in s12J(1) of the Act. The main significance of this lies in the fact that as per s12J(2), a taxpayer is only allowed an income tax deduction (subject to certain qualifications) of expenditure actually incurred by that taxpayer in acquiring any “venture capital share” (ie an equity share) issued to that taxpayer by a venture capital company.

It is therefore important to consider the definition of “equity share” in s1 of the Act, which states as follows:

Any share in a company, excluding any share that, neither as respects dividends nor as respects returns of capital, carries any right to participate beyond a specified amount in a distribution.

In considering whether the relevant shares therefore constitute “equity shares” and thereby “venture capital shares” which would enable the Investors to claim the s12J(2) upfront income tax deduction on their subscription proceeds advanced to the Applicant, one must consider the specific rights, preferences, limitations and other terms of the various categories of shares issued by the VCC. The Ruling sets out the specific rights of the various shares as reflected below.

The Applicant’s ordinary shares entitled their holders to:

- vote on every matter to be decided by the shareholders of the company. A share would entitle the holder to one vote for each ordinary share; and

- share in the net assets of the Applicant upon its liquidation together with the Applicant’s class A ordinary shareholders.

The Applicant’s class A ordinary shares would entitle their holders to:

- share in distributions from only the Target Company. The class A ordinary shareholders would not be able to share in any distributions from any other target company in which the Applicant may invest;

- share in the net assets of the Applicant upon its liquidation together with the other ordinary shareholders of the Applicant;

- vote on every matter on which the shareholders are required to vote in relation to the Target Company’s class A ordinary shares and on any proposal to amend the preferences, rights, limitations and other terms associated with the Target Company’s class A ordinary shares in accordance with the relevant provisions of the Applicant’s memorandum of incorporation (MOI); and

- one vote on every matter on which that shareholder may vote, for each class A ordinary share held in the Applicant.

SARS Ruling

SARS ruled that for purposes of the definition of “venture capital share” in s12J(1), each of the Applicant’s ordinary shares and each of the Applicant’s class A ordinary shares would constitute an “equity share” as defined in s1(1). Building on developments in previous rulings issued by SARS in respect of the VCC regime, the Ruling demonstrates that there is a certain amount of flexibility in respect of how the VCC and its underlying investment can be set up and structured. Specifically, in this case, the Ruling illustrates that it is possible for the Investors to channel their funds to a specific investment by the VCC (ie the Target Company) and therefore ring fence their investment to a certain extent, without falling foul of the requirements

of s12J.

Second issue – definition of “equity share” in respect of “qualifying shares”

Section 12J(6A) of the Act provides certain requirements which VCCs must comply with by the end of each year of assessment after the expiry of 36 months from the first date of issue of venture capital shares. One such requirement is that a minimum of 80% of the expenditure incurred by a VCC to acquire assets must be for “qualifying shares”. Furthermore, the expenditure incurred by the VCC to acquire qualifying shares in any one qualifying company must not exceed 20% of any amounts received in respect of the issue of venture capital shares. In other words, 80% or more of the subscription proceeds advanced by various investors must be utilised by the VCC to subscribe for qualifying shares in underlying investee companies, and secondly the VCC cannot subscribe for shares in any underlying investee company which is in excess of 20% of the aggregate subscription proceeds received from its investors. In essence, the purpose of the latter requirement is to ensure that VCCs spread their wealth and investment so that the incentive achieves its objective of supporting many small, medium and micro-sized enterprises and not merely a chosen few.

A “qualifying share” is defined in s12J(1) as an equity share held by a VCC which is issued to that VCC by a qualifying company, and which does not include any “hybrid equity instrument” as defined in s8E(1) of the Act (but for the three year period requirement), nor a “third-party backed share” as defined in s8EA(1) of the Act. As per the definition of equity share referred to earlier, one must have regard to the rights and limitations attached to the shares in the Target Company in order to ascertain whether such shares constitute “equity shares” and thereby “qualifying shares” which is important when considering the various requirements of a VCC structure.

The Target Company’s ordinary shares would entitle their holders to:

- vote on every matter to be decided by the shareholders of the company. A share would entitle the holder to one vote for each ordinary share held in the Target Company; and

- share with the Target Company’s class A ordinary shareholders in the net assets of the company upon its liquidation.

The Target Company’s class A ordinary shares would entitle their holders to:

- vote on every matter to be decided by the shareholders of the company. A class A ordinary share would entitle its holder to one vote;

- be paid the full amount of each and every distribution in respect of the class A ordinary shares, in priority to the holders of the Target Company’s ordinary shares and/or the holders of any other class of shares in the company. This is subject to the relevant provisions of the Companies Act,

No 71 of 2008, the MOI of the Target Company and any other applicable laws; and - share with the Target Company’s ordinary shareholders in the net assets of the Target Company upon its liquidation. In respect of all other distributions, the full amount of each and every distribution must be made only to the holders of the Target Company class A ordinary shares.

SARS Ruling

In respect of this issue, SARS ruled that for purposes of the definition of “qualifying share” in s12J(1), each of the Target Company’s ordinary shares and each of the Target Company’s class A ordinary shares would constitute “equity shares” as defined in s1(1). The general principle taken from this is that, notwithstanding the fact that the class A ordinary shares in the Target Company had preferential rights to each and every distribution of the Target Company over the ordinary shareholders, such shares still constituted equity shares as defined and hence constituted qualifying shares in the Target Company, thereby complying with the relevant s12J requirements.

Third issue – “qualifying company”

Section 12J(1) of the Act defines a “qualifying company” as, among others, any company that is not a “controlled group company” in relation to a group of companies. A “controlled group company” is defined with reference to the definition of “group of companies” as two or more companies in which one company (controlling group company) directly or indirectly holds at least 70 percent of the equity shares in at least one other company (controlling group company), or by one or more other controlled group companies within the group or any combination thereof.

Therefore a VCC will be prohibited from investing in any potentially qualifying investee company which constitutes a controlled group company where it holds 70% or more of the equity shares in such underlying qualifying company directly. Alternatively, the prohibition would arise where any other shareholder (ie a third party) owns 70% or more of the equity shares in the qualifying company. In essence therefore a VCC will not be able to subscribe for shares in the underlying investee company in excess of 69.9%. In addition, no other investor company may hold 70% or more of the shares in the underlying investee company.

SARS Ruling

In respect of this issue, SARS ruled that, for purposes of the definition of “qualifying company” in s12J(1), the Target Company will not constitute a “controlled group company” as long as the number of equity shares to be held by the Applicant in the Target Company will constitute less than 70% of the total number of equity shares, despite the fact that the Applicant may invest more than 70% of the aggregate share capital in the Target Company in monetary terms.

It is therefore interesting to note that, despite the fact that the Applicant (ie the VCC) had an economic interest in the Target Company in excess of 70% (by virtue of contributing in excess of 70% of the share capital in Target Company), it would still not breach the threshold of 70% and hence the prohibition in respect of the underlying investee company not constituting a “controlling group company” was not applicable.

Summary and importance of the Ruling

One must always be cautious when relying on rulings issued by SARS as not all the facts and background are published in the sanitised rulings placed on SARS’s website. Notwithstanding this, they nevertheless provide valuable guidance in respect of the interpretation of various provisions within the Act. In respect of this specific Ruling, it shows that there is certainly some flexibility in respect of how VCC structures can be set up and implemented, which should be welcomed by potential investors and persons interested in this sector. This Ruling certainly builds on the previous rulings issued by SARS in respect of VCCs, nevertheless, one would be well advised to consult with a professional before embarking upon a structure of this nature and, if necessary, apply for a ruling in the event that the circumstances warrant it.

Announcements in the 2017 Budget

A final point to note is that the Minister of Finance recently announced in the 2017 Budget that further changes are being considered to the VCC regime to remove impediments to investment such as rules relating to investment returns as well as those relating to qualifying companies. One amendment which may be on the cards is the relaxing of the prohibition of underlying investee companies engaged in any trade carried on in respect of immovable property (except as a hotel keeper).

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe