New limits for credit life insurance premiums

Up until now, credit life insurance has been largely unregulated by the National Credit Act, No 34 of 2005 (NCA) and this has resulted in many credit providers charging customers high insurance premiums. This is all due to change with a new set of Regulations to be welcomed by consumers of retail credit.

These Regulations will protect consumers from abusive practices that have developed over time such as selling consumers unnecessary and inappropriate insurance products, and levying excessive insurance premiums without performing an accurate risk assessment of each customer.

The Regulations will come into effect from 10 August 2017 (Commencement Date) and will affect all credit agreements concluded on or after the Commencement Date under the NCA.

A credit provider is entitled to require a consumer to maintain credit life insurance during the term of the credit agreement to ensure that any outstanding loan amount will be settled should something happen to the consumer.

Credit insurance refers to an insurance policy (such as a life insurance policy, disability and dread disease policy, retrenchment policy, salary protection policy etc). Such insurance is taken out by a consumer to compensate a credit provider in the event that the consumer is unable to repay a loan advanced to them due to, among other reasons, death, disability, unemployment or retrenchment.

According to the Regulations, a credit life insurance policy must cover at least death, permanent disability, temporary disability and in certain circumstances, unemployment (i.e. being unable to earn an income for a certain period for reasons other than temporary or permanent disability) (so called minimum benefits).

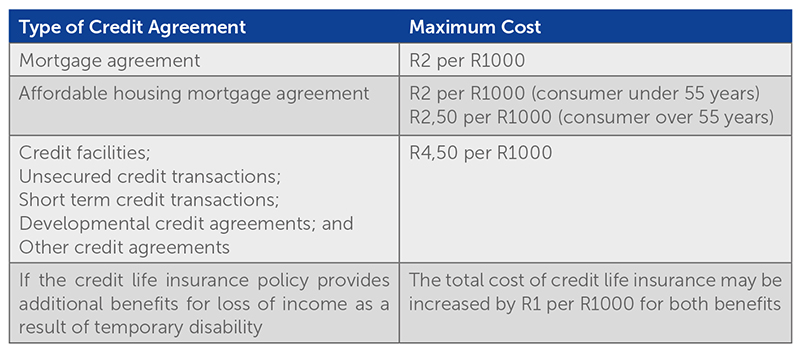

From the Commencement Date, the maximum prescribed costs for credit life insurance will now be calculated on the deferred amount under a consumer’s credit agreement:

Further, the Regulations will bring about the following changes:

- a credit provider cannot compel a consumer to take out insurance cover for loss of income as a result of temporary disability;

- where a consumer is unemployed on the date that the credit life insurance policy is concluded, a cost relating to the risk of the consumer becoming unemployed cannot be included in the total cost of credit life insurance in order to prevent credit providers from offering consumers inappropriate and unnecessary insurance cover. Where a consumer is a pensioner on the date that the credit life insurance policy is concluded, costs relating to the occupational disability of the consumer cannot be included in the total cost of the credit life insurance.

- where a consumer is self-employed or employed in the informal sector, a cost relating to the consumer’s inability to earn an income, for reasons other than retrenchment or occupational disability, may be included in the total cost of credit life insurance;

- a credit provider is now obliged to do a proper risk assessment for each consumer and cannot use a one-shoe fits all approach in determining the cost of credit life insurance;

- if death, permanent disability or unemployment occur as a result of one of the limitations listed in Regulation 4, the insurance company is not obliged to pay out a claim (e.g. if death or disability results from abuse of alcohol, drugs or narcotics then the credit provider will not be obliged to pay out a claim). However, credit providers have an obligation to explain all limitations and exclusions contained in Regulation 4 to every consumer;

- in the case of disability benefits only, a credit provider can stipulate a waiting period of up to three months provided that the term of the credit agreement is at least six months;

- no waiting period can be stipulated for any benefits under a credit life insurance policy in respect of a short term credit transaction with a term of one month or less; and

- a consumer may substitute a credit life insurance policy offered by a credit provider with any other credit life insurance policy provided that the new policy provides for the Minimum Benefits in Regulation 3(2).

The good news for credit providers is that all credit agreements concluded prior to the Commencement Date will not be affected by these Regulations as the Regulations are not retrospective. However, credit providers should ensure that their documents, practices and procedures comply with these Regulations by the Commencement Date to avoid having their future credit agreements being declared unlawful and void.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe