Our team acts for a leading SA based enterprise and supplier development advisory and project management firm

- Home

- Home

- Our team acts for a leading SA based enterprise and supplier development advisory and project management firm

Our team acts for a leading SA based enterprise and supplier development advisory and project management firm

Our team acts for a leading South Africa-based enterprise and supplier development advisory and project management firm against a US-based company concerning the responsibility of the US Company for massive remediation activities at its cost in respect of a property sold to our client.

You might also be interested in

9 May 2025

by Timothy Smit

The Consumer Code

Earlier today, the Department of Trade, Industry and Competition published the draft Consumer Goods and Services Industry Code of Conduct (" the Draft Code ") for public comment and simultaneously issued an invitation for the public to comment on the Draft Code in terms of the Consumer Protection Act.

Consumer Goods, Services & Retail

1 min read

8 Apr 2025

by Ismail Makda

Secondment to Investec: A Junior Lawyer’s Perspective

Over a three-month period starting in December 2024, Ismail had the privilege of being seconded to Investec. Initially brought in to assist on a major group transaction, his role quickly expanded to include a variety of matters, offering him a comprehensive in-house experience.

2 min read

1 Aug 2025

by Lebohang Mabidikane

Know what to disclose and disclose it

Lebohang Mabidikane, Director in the Competition Law practice, was recently featured in the Sunday Times Supplement, where she discussed 'Know what to disclose and disclose it.'

Competition Law

1 min read

16 Apr 2025

by Yaniv Kleitman and Roxanne Bain

Staying ahead of governance trends: Key changes in the draft King V Code

South Africa’s influential King Codes on corporate governance continue to evolve, responding to changes in the business, regulatory and social landscape. The recently published draft King V Code introduces updates intended to improve clarity, usability and relevance in governance practices. Businesses of all sizes and sectors should understand these changes, given their importance in demonstrating sound governance, maintaining credibility and creating long-term value.

Corporate & Commercial Law

4 min read

21 Feb 2025

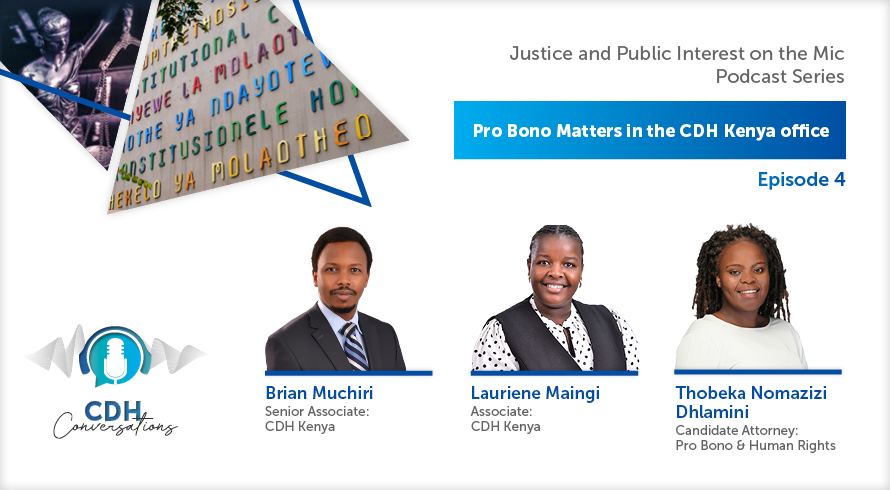

by Brian Muchiri, Lauriene Maingi and Thobeka Dhlamini

Justice and Public Interest on the Mic - Pro Bono Matters in the CDH Kenya office

Since 2013, CDH's Pro Bono & Human Rights practice (Pro Bono practice) has been at the heart of our firm's commitment to making a real difference. Over the past decade, our Pro Bono practice has passionately championed the cause of public interest, providing pro bono legal support to clients in need. The decision to establish a dedicated practice was motivated by our belief in giving back to the communities in which we operate and in the power of the legal profession to spark positive change.

Pro Bono & Human Rights

11:25 Minutes

8 May 2025

by Jackwell Feris

Webinar Recording | CDH and Ciarb - The Dispute Resolution Marketplace

Hosted by CDH in collaboration with Ciarb, this engaging event unpacked the shifting dynamics of dispute resolution.

Dispute Resolution

2:18:55 Minutes