Newsflash: Proposed changes to merger thresholds

At a glance

- The Minister of Trade, Industry and Competition recently published proposed amendments to the merger thresholds and filing fees under the Competition Act 89 of 1998 for public comment.

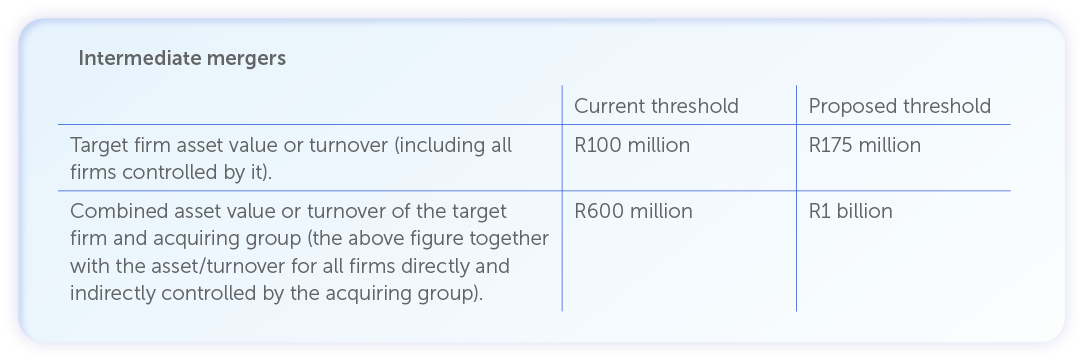

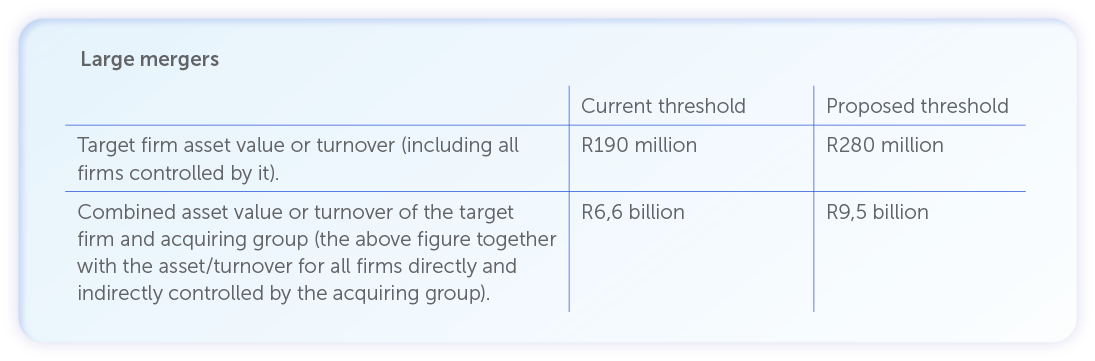

- The proposed target threshold for intermediate mergers has increased to R175million, while the combined threshold increased to R1billion. In the case of large mergers, the proposed thresholds have increased to R280million for the target and the combined thresholds have increased to R9.5billion.

- The proposed merger filings fees are R220,000 for intermediate mergers and R735,000 for larger mergers.

- Members of the public are invited to submit comments to the Department of Trade, Industry and Competition by 10 March 2026.

In terms of the Competition Act, a transaction that results in the acquisition or establishment of control over the business of another firm which meets certain financial thresholds (so-called “intermediate” and “large” mergers) cannot be implemented without obtaining the approval of the competition authorities. In order for a transaction to be classified as an intermediate or large merger, both a target and a combined financial threshold, i.e. the target considered together with the acquiring group of firms, needs to be met.

The regulatory requirement to obtain prior approval for mergers can attract significant costs and result in delays in closing merger transactions. The Minister’s proposal to increase the merger thresholds, once effective, will have the effect of reducing the number of mergers which are likely to be subject to mandatory regulatory oversight from the competition authorities of South Africa. This is particularly significant given the number of transactions which have attracted public interest conditions of late that result in additional deal costs and further complicate transaction implementation.

Proposed merger thresholds

In terms of the proposed amendments, the Minister proposes increasing the thresholds as set out below:

It is noteworthy that the proposed increases to the merger thresholds are significant. The proposed target threshold for intermediate mergers has increased by 75%, while the combined threshold has increased by approximately 66%. In the case of large mergers, the proposed thresholds have increased by approximately 50% for both the target and combined thresholds.

While the proposed thresholds may result in smaller, but significant, transactions now escaping the burden of obtaining prior approval before implementation, large corporate transactions will continue to be caught by the thresholds. Overall, this easing of the regulatory burden on smaller deal activity should be a welcomed as a positive step in creating an active South African mergers and acquisitions environment.

Proposed filing fees

The Minister has also proposed amending the merger filing fees from R165,000 to R220,000 for intermediate mergers and R550,000 to R735,000 for large mergers, adding to the costs of notifiable merger transactions in South Africa.

Are the proposed amendments in force?

The proposed amendments to the merger thresholds and merger filing fees are both in draft format and therefore not in force. It is uncertain when the final amendments will be published by the Minister.

Members of the public are invited to submit comments to the Department of Trade, Industry and Competition by 10 March 2026.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe