Unpacking the Kenya Finance Bill 2025: What's changing?

Kenya’s Finance Bill, 2025 (Bill) came out on Wednesday 30 April 2025. The Bill proposes a raft of amendments to the below tax laws:

- Income Tax Act, Cap 470 (ITA);

- Value Added Tax Act Cap, 476 (VATA);

- Excise Duty Act, Cap 472 (EDA);

- Tax Procedures Act Cap, 469B (TPA); and

- Miscellaneous Fees and Levies Act, Cap 469C

- Stamp Duty Act, Cap 480 (SDA)

The proposed amendments aim to redefine key areas like income tax, value-added tax (VAT), and excise duty. They also introduce new rules to streamline tax compliance and administration. All the proposed amendments are to take effect from 1 July 2025, save for the amendments relating to advance pricing agreements and the power of the Commissioner of the Kenya Revenue Authority (KRA) (Commissioner) to waive penalties and interests that accrue due to no fault of the taxpayer. These two amendments take effect from 1 January 2026.

This alert breaks down what these proposed changes mean for you and explores how they might impact taxpayers and Kenya’s broader economic future.

Summary of key highlights for the Finance Bill, 2025

We provide our detailed analysis of the contents of the Bill below.

Income Tax Act (ITA)

Definition of royalty payments

The Bill seeks to introduce an expanded definition of the term “royalty”. The Bill defines it to now include payments received as consideration for the distribution of software where regular payments are made for the use of the software through the distributor.

Previously, certain software-related payments, such as license payments made to software providers through distribution and end-user licence agreements, were not subject to withholding tax (WHT) in Kenya on the principle that they did not confer any intellectual property (IP) rights in the software to the payers. This practice, though contested by the KRA, is in line with the High Court’s recent judgment in Seven Seas Technologies Limited v Commissioner of Domestic Taxes, Income Tax Appeal 8 of 2017, as well as international best practices.

This is a shift from international best practice in the taxation of software payments, as captured under Article 12 of the Organisation for Economic Co-operation and Development’s (OECD) Model Tax Convention, which generally requires that such payments should only be subject to WHT if they are made as consideration for rights to the software’s underlying IP rights.

We note that the proposal would also go against common practice in the region, with both Uganda and Tanzania not including software in their respective tax laws’ definitions of “royalty”.

Single definition of related person

The Bill proposes a new definition of 'related person' to be –

in the case of two persons, either of the persons who participate directly or indirectly in the management, control or capital of the business of the other person; and in the case of more than the two persons;

a) any other person who participates directly or indirectly in the management, control or capital of the business of the two persons; or

b) an individual who:

i. participates directly or indirectly in the management, control or capital of the business of the two persons;

ii. is associated with the two persons by marriage, consanguinity or affinity; or

iii. the two persons participate in the management, control or capital of the business of the individual.

The Bill further proposes deleting multiple definitions of related person as used throughout the ITA, which has caused inconsistencies in interpretation and disputes during audits.

Increase in tax free limit of per diem allowance

The Bill proposes amending section 5 of the ITA by increasing the deductible per diem for employees from KES 2,000 to KES 10,000 per day. The KES 2,000 cap has long been outdated, especially in light of inflation and rising travel/accommodation costs, and increasing the limit to KES 10,000 aligns the law with economic reality.

Taxation of pension funds and benefits

Prior to the Tax Laws (Amendment) Act, 2024, the ITA only provided exemption for a monthly pension granted to a person who is 65 or older. The Tax Laws (Amendment) Act, 2024 extended the exemption to cover payment of pension benefits from a registered pension fund, registered provident fund, registered individual retirement fund, public pension scheme or the National Social Security Fund (NSSF), upon attainment of the retirement age determined in accordance with the rules of the fund or the scheme, as opposed to the mandatory age of 65.

The exemption was also extended to payment of gratuity or other allowances paid under a public pension scheme, payment of a retirement annuity or withdrawals from the fund prior to attaining the retirement age due to ill health; or withdrawals from the fund after 20 years from the date of registration as a member of the fund.

The result was that long-term savings were encouraged while employees were still left with disposable income, and ensured financial security in retirement.

However, the Bill proposes to amend section 8 of the ITA by deleting subsections 4, 5, 6, 7, 9 and 9A. These provisions provide tax relief and exemptions on certain income and withdrawals from pension funds. By deleting them, the Bill aims to remove or limit existing tax exemptions and reliefs related to pensions, retirement benefits and home ownership saving schemes. These subsections currently shield certain amounts and circumstances from being taxed, thereby reducing the tax burden on retirees, beneficiaries and savers.

The impact of the amendment includes:

On retirees and pensioners

- Loss of exemptions (e.g. KES 300,000 on pension income under subsection 4 and KES 600,000 on lump sum payments under subsection 5 would mean higher tax liability for retirees, reducing their disposable retirement income).

- Smaller retirement payouts, especially affecting low- to middle-income earners.

- It may also discourage the saving culture that the Government was seen as promoting in the Tax Laws (Amendment) Act, 2024.

On beneficiaries after death

- Without subsections 6 and 7, beneficiaries (spouses, children) may face full taxation on lump sum payments or pension balances that were previously exempt.

- Estate planning becomes costlier and less tax efficient.

On home ownership savings plans

- Deleting subsection 9A means tax will apply on withdrawals from deregistered home ownership savings plans, unless moved swiftly. This discourages long-term saving for home ownership.

On compliance and administration

- Increased complexity for individuals and trustees in determining tax obligations, especially in the absence of transitional provisions.

- May result in legal disputes or tax litigation over whether accumulated benefits from earlier years (under exempt rules) are now retroactively taxable.

Payments for the sale of scrap and supply of goods to a public entity by a resident person subject to withholding tax

The Bill proposes amending section 10 by adding “supply of goods to a public entity” and “sale of scrap” as payments subject to income tax. The Bill seeks to align with the introduction of withholding tax rates for such supplies to non-residents and residents as provided for under section 35(1) and 35(3) of the ITA. The alignment is meant to provide clarity that the income from such supplies is subject to tax.

New definition of significance economic presence tax

The Bill proposes broadening the definition of significant economic presence tax (SEPT) by making it also applicable to non-resident persons who earn income in Kenya by providing services through the internet or an electronic network and not just over the digital marketplace. Kenya recently introduced SEPT in December 2024 through the Tax Laws (Amendment) Act, 2024.

Removal of the KES 5 million threshold for SEPT

The Bill seeks to remove the exemption on non-resident entities with annual turnovers below KES 5 million from the obligation to pay SEPT. This change is intended to boost tax revenue by widening the scope of foreign companies that will pay tax on their taxable profits linked to Kenya.

Since the introduction of SEPT by the Tax Laws (Amendment) Act on 27 December 2024, there has been ambiguity regarding the threshold for determining a significant economic presence in Kenya. In the absence of a defined user threshold, it has generally been interpreted that the ITA sets the threshold based on turnover.

Reduction in the rate of digital asset tax

The Bill proposes reducing the tax rate for digital asset tax (DAT) from 3% to 1.5% of the transfer or exchange value of the digital asset. This will bring a sigh of relief as the 3% of the value of the digital asset has been viewed as a hard blow for those disposing of their digital assets, since it was on the value and not the gain.

Due date for minimum top-up tax

The Bill introduces a requirement that the minimum top-up tax be payable by the end of the fourth month after company’s year-end. This amendment sets a clear timeline for compliance, which was previously absent from the provision.

The minimum top-up tax, as introduced by the Tax Laws (Amendment) 2024 Act, applies to covered persons (these are resident person(s) or non-resident persons with a permanent establishment in Kenya who are members of a multinational group with a consolidated annual turnover of EUR 750 million at the parent entity level).

Introduction of advance pricing agreements

The Bill seeks to introduce a new provision permitting non-resident entities engaged in business with related resident parties or through a permanent establishment in Kenya – as well as resident entities transacting with related parties in preferential tax regimes – to enter into advance pricing agreements (APAs) with the Commissioner.

APAs allow taxpayers to enter into binding agreements with the revenue authority on the determination of transfer prices for future intercompany transactions. The Finance Bill of 2024 had proposed introducing APAs. The proposal did not go through following the withdrawal of the Bill. Currently, there are no APAs in Kenya and this is a welcome move for taxpayers who ordinarily seek a private ruling with respect to transactions needing clarification

The Bill proposes that the agreements will remain effective for a maximum duration of five consecutive years. Some jurisdictions allow roll-back of the agreed method to previous years. This helps clear uncertainties about the transfer pricing method to be used, and Parliament should consider including this provision.

It is expected that in the coming days the Cabinet Secretary will issue regulations/guidelines on the practical aspects of implementation of the APA provisions or amend the existing Transfer Pricing Rules to accommodate APAs.

100% Deduction for implements, utensils and similar articles employed in the production

The Bill proposes amending section 15 of the ITA to allow 100% deduction for the diminution in value of utensils and implements used in business, excluding plant and machinery. The amendment also seeks to take away the Commissioner’s discretion to consider a just and reasonable amount as being an allowable deduction.

This aims to reduce administrative tasks for the Commissioner and to improve compliance by taxpayers, as well as to promote certainty.

Improved oversight in accounting period year-end change applications

The Bill proposes introducing an obligation on the Commissioner to respond to an application for change in accounting periods for a company within six months, failure by the Commissioner to respond within the timelines the application stands granted by law.

The amendment introduces a statutory consequence for inaction by the Commissioner and incentivises timely decision-making and prevents administrative delays from unfairly penalising taxpayers.

Income by non-resident ship owners and charterers subject to WHT

The Bill proposes to subject profits and gains by non-resident ship owners and charterers to WHT. If passed into law, the taxation could lead to increased revenue for Kenya as it targets income that might otherwise escape taxation due to the mobile nature of the international shipping industry.

The corresponding high cost of doing business for non-resident ship owners could lead to potential reduction of shipping activity including rerouting.

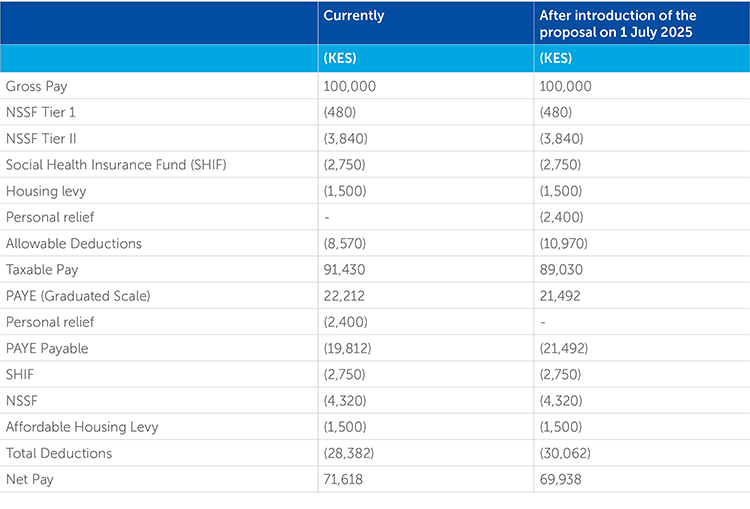

Employee reliefs and deductions

The Bill seeks to introduce the provision that “an employer shall, before computing the tax deductible under subsection (1), grant an employee all applicable deductions, reliefs and exemptions provided under this Act.”

Whereas the Government’s intention is to ease the tax burden by applying all eligible deductions, exemptions, and reliefs before computation of Pay-As-You-Earn (PAYE), our comparative analysis below on the impact of these changes on a payslip before and after the introduction of these changes raises questions about the real impact on take-home pay.

Repealing of notification requirements

The Bill proposes repealing the requirement for businesses to notify the Commissioner within 30 days of changes to key information, such as:

- Business location, trading name, or contact details

- Shareholding (for incorporated entities)

- Beneficial ownership (for nominee arrangements)

- Trustees, settlors, or beneficiaries (for trusts) or partners (for partnerships)

- Business cessation or sale (including liquidation or new ownership)

The proposed amendment seeks to do away with these reporting requirements as they are already captured under other laws or administrative mechanisms, such as section 9 of the TPA.

Penalty for understatement of Instalment tax removed

The Bills seeks to repeal section 72C, which imposes a 20% penalty on the difference between the instalment tax that should have been paid and the amount actually paid, multiplied by 110%.

This is a positive change because the current rule unfairly penalises taxpayers who use the previous year’s income to calculate their taxes, especially when their income hasn’t increased from the prior year.

Offences for non-compliance with certain statutory obligations

The proposed amendment aims to delete the offences for non-compliance with certain statutory obligations, such as failure to furnish returns or certificates, failure to furnish a full and true return in response to a notice served under the act, or failure to notify the Commissioner as required by section 52(3) (i.e. to file a return upon cessation of income or business).

This change reflects a broader shift in tax administration – both globally and in Kenya under the TPA – from criminal prosecution toward administrative measures such as penalties and interest. The focus is now on encouraging compliance and efficient tax collection rather than pursuing criminal charges for filing failures.

Extension of timeline for processing income exemption

The Bill proposes extending the timeframe for the processing of exemption certificates application from 60 days to 90 days by Paragraph 10 entities (trusts and institutions established to alleviate poverty or for educational or religious purposes). This comes against the backdrop of a backlog of exemption applications awaiting processing by the Commissioner. Parliament should also include a provision for administrative accountability where such application is deemed allowed if not processed within the stipulated timelines.

Exemption of contributions and payments made to SHIF

The Bill proposes to amend Paragraph 45A of the First Schedule of the ITA to update it by replacing the National Insurance Fund with the SHIF, ensuring contributions made to the fund and payments out of the fund are exempt.

Compensating tax for manufacturers of human vaccines

The Bill proposes deleting the exemption under the First Schedule that currently excludes compensating tax accruing to a company undertaking the manufacture of human vaccines from taxation.

The deletion signals a policy shift toward limiting sector-specific tax exemptions, possibly to broaden the tax base and improve revenue mobilisation. As such, companies engaged in the manufacture of human vaccines will no longer be exempt from compensating tax when distributing dividends from profits that were not subject to corporate income tax.

Clarification on Exemption of Special Economic Zone entities from capital gains tax

The Bill proposes to clarify that only gains on transfer of property within a Special Economic Zone (SEZ) by a licensed SEZ developer, operator or enterprise qualify for exemption from capital gains tax.

Currently, any transfer of property that relates to an SEZ is exempt, regardless of whether the transferor (seller) is a licensed SEZ developer, operator or enterprise. This amendment is aimed at sealing the tax loophole in the SEZ regime by ensuring that only registered SEZ entities benefit from the exemption.

This change may discourage some non-licensed investors who have been relying on the broad exemption, potentially affecting the flow of private investment into SEZs. On the other hand, stricter criteria could enhance the attractiveness of SEZs to legitimate, licensed investors, as it removes the possibility of non-registered entities benefiting from the tax break. This could ultimately lead to a more focused and streamlined SEZ environment, potentially improving long-term investor confidence in the integrity of the SEZ regime.

Exemption of dividends paid by a company certified by the Nairobi International Financial Centre Authority

The Bill also proposes to exempt dividends paid by Nairobi International Financial Centre Authority (NIFCA) certified companies where the company reinvests at least KES 250 million shillings in Kenya, in that year of income.

The proposed amendment aligns with the NIFCA’s goal of positioning Kenya as a leading financial hub, by offering a competitive tax environment for global and regional investors. This will promote local reinvestment by encouraging companies to plough back significant capital into the Kenyan economy.

Relief for start-ups certified by NIFCA

The Bill proposes an amendment to lower the corporate income tax rate for start-ups certified by NIFCA to be 15% for the first three years and 20% for the succeeding four years.

The amendment, if passed into law, could create a more attractive environment for local and foreign investors looking to fund or launch innovative ventures, enhance the competitiveness of the Nairobi International Financial Centre and support business sustainability in the early stages.

Relief for companies certified by NIFCA

The Bill proposes preferential tax rates for companies certified by NIFCA, including a 15% corporate income tax rate for the first 10 years of its operations and 20% for the subsequent 10 years of its operations where:

the company invests at least KES 3 billion in Kenya in its first three years of operation;

the company is a holding company and at least 70% of its employees in senior management are citizens of Kenya; or

the regional headquarters of the company are in Kenya, and at least 60% of its employees in senior management are Kenyans.

The Bill equally puts a strong incentive for large-scale investment which may attract multinationals, especially in financial services and technology, seeking regional hubs with stable, favourable tax regimes. This would also come with a boost in job creation and local talent development as well as cementing Kenya’s position as a regional hub.

Removal of 100 investment allowance

The Bill proposes removing the tax incentive that provided for 100 investment deductions on hotel buildings, manufacturing sites and equipment for companies that:

- invested KES 250 million or more in a year, outside Nairobi or Mombasa counties;

- made cumulative investments of at least KES 1 billion in the preceding three years; or

- invested in SEZs.

The effect of this proposal is that capital allowances on capital expenditure for hotel buildings, manufacturing buildings, and machinery used in manufacturing will be claimed at 50% in the first year of use, with the remaining balance claimed in equal annual instalments of 25%. This is a move toward reducing the rate of taking the incentive in favour of spreading it over time. While it will likely boost short-term revenue, it may dampen long-term investment in underserved regions and SEZs unless alternative support mechanisms are introduced.

Removal of preferential rate for construction of up to 400 residential units

The ITA currently provides a reduced corporate tax rate of 15% for a company that constructs at least 400 residential units annually, subject to approval by the Cabinet Secretary responsible for housing.

The Bill now proposes scrapping the 15% preferential rate for such companies. The preferential tax treatment was meant to encourage large-scale investment in residential housing, particularly the Government’s affordable housing agenda, and this move could undermine it.

Removal of preferential rate for local motor vehicle assemblers

The ITA currently provides a reduced corporate income tax rate of 15% for companies engaged in the local assembling of motor vehicles, applicable for the first five years from the commencement of operations and which can be extended for another five years.

The removal of this incentive could discourage investment in Kenya’s automotive assembly industry, which has been a focus area for manufacturing sector growth and local job creation. While this proposal reflects the broader government effort to rationalise tax incentives, it could risk stalling progress in priority manufacturing sectors without alternative support mechanisms.

Taxation of fringe benefits

The Bill proposes taxing fringe benefits at the corporate tax rate for the year of income. Currently the corporate income tax rate is 30%. The fringe benefit tax relates to loans to employees, directors and relatives of employees and directors where interest charged is below the Commissioner’s prescribed rate, and the difference is taxed at 30%. If the amendment is passed into law, the current fringe benefit tax rate of 30% may change whenever the rate of corporate tax changes, to match the rate of corporate tax.

Relief on taxation of dividends

The Bill seeks to amend the ITA to classify the 5% withholding tax on qualifying dividends as a final tax. A “qualifying dividend” refers to the portion of total dividends that is taxable and is not exempt under any other provision of the act, excluding dividends paid by designated co-operative societies. By treating the withholding tax as final, the Bill intends to prevent any additional taxation on these dividends.

Interest on loan used for home construction allowable deduction

The Bill proposes an amendment to section 15 that deals with allowable deductions. The Bill aims to amend section 15(3)(b) to include interest of up to KES 360,000 being allowed if the taxpayer borrows money from prescribed financial institutions to construct a residential house.

Currently, the ITA only provides the same benefit for loans used for the purchasing or improvement of residential houses occupied by the taxpayer during the year of income.

The amendment seeks to promote home ownership by allowing interest deductions on loans used to construct residential houses.

Re-introduction of the limit of carrying forward of tax losses

The Bill amends section 15(3)(b) that allows taxpayers to carry forward their tax losses. The Bill proposes an amendment to restrict the carrying forward of tax losses to five years. The ITA currently allows tax losses to be carried forward indefinitely.

The move may reduce taxpayers’ ability to fully utilise losses from prior periods, especially in capital intensive industries where recovery spans longer periods.

Additionally, the removal of the provision allowing capital losses to be offset against future capital gains could result in taxpayers being taxed on gains despite having incurred previous losses, potentially leading to a higher overall tax burden and reduced relief in economically challenging periods.

Value Added Tax (VAT)

New definition of tax invoice

The Bill proposes introducing a definition of “tax invoice” that includes an electronic tax invoice issued in accordance with section 23A of the TPA. This amendment seeks to align the definition with the Electronic Tax Invoice Regulations, 2024.

It also tightens the compliance requirements for invoices to be issued through the electronic tax invoice management system (eTIMS). It is not clear whether entities exempted from eTIMS will validly issue a tax invoice if the proposal is adopted.

Removal of offset option for withheld VAT

The Bill proposes deleting section 17(5)(c) of the VAT Act, which allows taxpayers to offset any excess input VAT resulting from tax withheld by appointed VAT withholding agents or a refund pursuant to section 47(4) of the TPA. The proposed deletion effectively removes the option for taxpayers to apply excess input VAT against other tax liabilities, with the available recourse now being a refund under section 17(5)(b).

This move narrows the relief options for excess input VAT arising from withholding, making the system less flexible for businesses and increasing reliance on a refund process that is already under strain. Refunds under subsection (b) will still be allowed, but offsets will no longer be permitted, potentially increasing cash flow pressure and reliance on the KRA refund mechanism.

VAT refunds to be made with 12 months.

The Bill also proposes to amend subsection 17(5)(d) to reduce the time limit for lodging VAT refund claims from 24 months to 12 months from the date the tax becomes due and payable.

This change seeks to align the refund timelines with the provision of section 47(1) of the TPA as amended by the Tax Procedures (Amendment) Act, which provides that applications for tax refunds resulting from all other taxes should be made within 12 months.

Reduction of the time frame for classifying supply as bad debt

The Bill proposes significant changes to section 31 of the VAT Act, which governs VAT refunds on bad debts.

The Bill proposes reducing the waiting period from the current three years to two years. Taxpayers will apply for a VAT refund on a bad debt after two years from the date of supply. This provides for earlier access to refunds, which may improve cash flow for businesses that suffer bad debts.

Tax invoices to all supplies

The Bill proposes removing the word “taxable” from section 42(1) of the VAT Act, which provides that registered person making taxable supply shall issue tax invoices to purchasers of the supplies.

This proposed amendment will now require a tax invoice for all supplies, not just taxable ones, if made by a registered person. This brings exempt supplies within the scope of mandatory invoicing for VAT purposes.

Liability to pay VAT on abuse of exempt and zero-rates supplies/VAT claw back

The Bill proposes a provision to impose VAT where goods or services initially acquired as exempt or zero rated are later used or disposed of inconsistently with their intended purpose.

The measure is aimed at curbing misuse of exemptions and zero rating, particularly in sectors such as education and healthcare, and donor-funded projects, where VAT relief is often granted conditionally. It emphasises that VAT exemptions are not absolute but depend on continued compliance with the intended purpose.

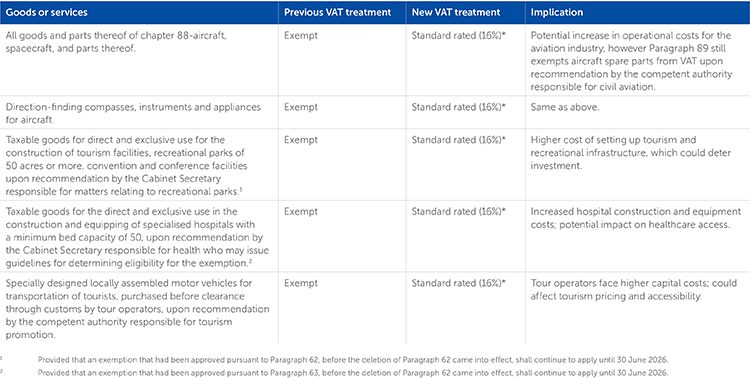

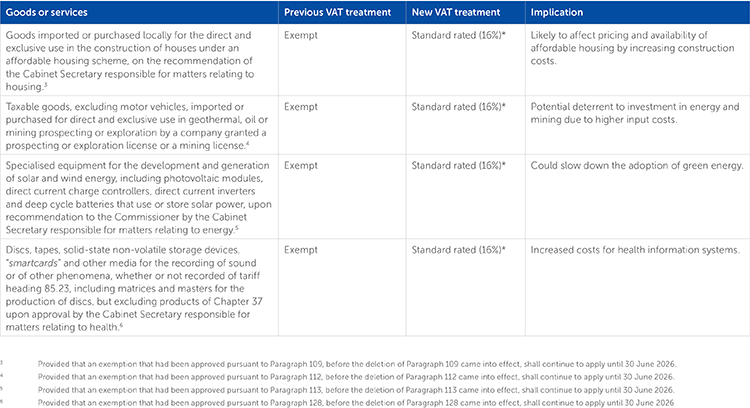

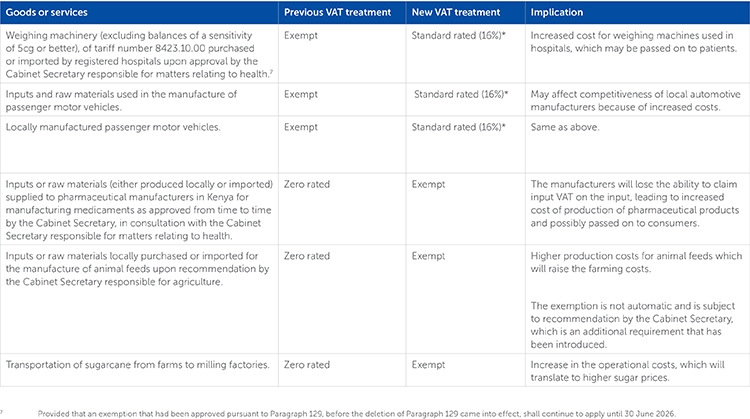

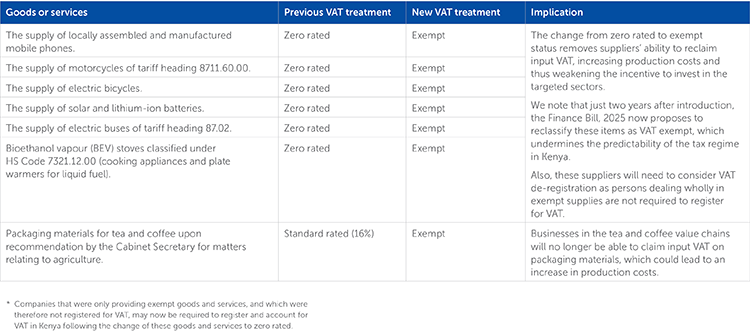

Change in VAT status for certain goods and services

The Bill has reclassified certain goods and services under the taxable, exempt, or zero-rated categories, as seen in the table below.

Excise Duty Act

Definition of digital lender expounded

The Bill proposes to amend the definition of “digital lender” and replace it with definition that covers a broader scope to mean:

“A person extending credit through an electronic medium but does not include a bank licensed under the Banking Act, a Sacco society registered under the Co-operative Societies Act, or a microfinance institution licensed under the Microfinance Act.”

The new definition removes the licensing requirement under the Central Bank of Kenya (CBK), signalling the Government’s intent to bring more unregulated or non-traditional lenders within the tax framework, particularly for excise duty purposes on loan fees and interest.

Introduction of “digital marketplace” definition

The Bill seeks to introduce the definition of a digital marketplace to include an online platform that enables users to sell goods or provide services to other users. This aligns with the definition provided for in the VAT Act and reinforces the Government’s broader strategy to tax the digital and platform economy consistently across tax statutes.

Classification of goods by EAC tariff code

The Bill proposes introducing a provision that goods shall be classified by reference to the tariff codes set out in Annex 1 to the Protocol on the Establishment of the East African Community (EAC) Customs Union, and in interpreting that annex, the general rules of interpretation set out in the annex shall apply.

This proposed amendment, introduces a statutory link between Kenya’s excise duty classification and the EAC Common External Tariff (CET) framework, thus ensuring that the same product classification rules used for customs and import duties apply to excise taxation, promoting consistency and clarity.

Imposition of excise duty on services provided by non-residents

The Bill proposes amending the provision brought in by the Tax Laws (Amendment) Act, 2024 that introduced excise duty on services offered by non-residents through digital platforms. The Bill proposes expanding the scope of the services that are excisable to include services offered by non-residents over the internet, an electronic network or through a digital marketplace. For purposes of this provision, a non-resident person means a person outside Kenya.

Place of supply of excisable services

The Bill seeks to clarify that if the place of business of the supplier is outside Kenya, the supply of services shall be deemed to be made in Kenya if the services are consumed by a person in Kenya through the internet, an electronic network or a digital marketplace.

This proposed amendment aligns with destination-based taxation for such digital services, in the sense that excise duty is triggered based on where the service is consumed, not where it is supplied.

Timelines for issuance of licences

The Bill proposes introducing a statutory 14-day timeline for the Commissioner to consider an excise licence application. This proposed amendment seeks to establish a clear timeline for the issuance (or refusal) of excise licences, which previously had no specified timeframe.

This is a welcome move as it helps avoid administrative delays and supports ease of doing business for local manufacturers and importers.

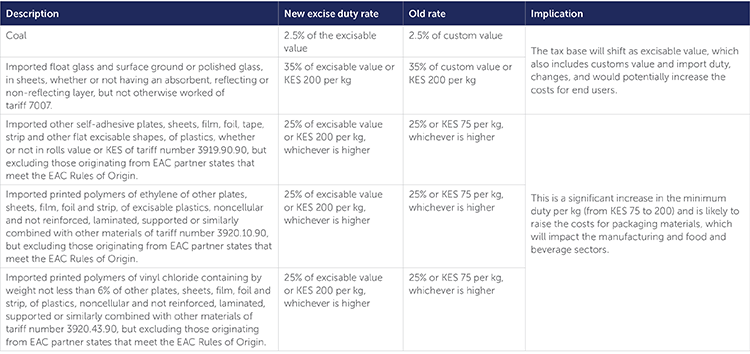

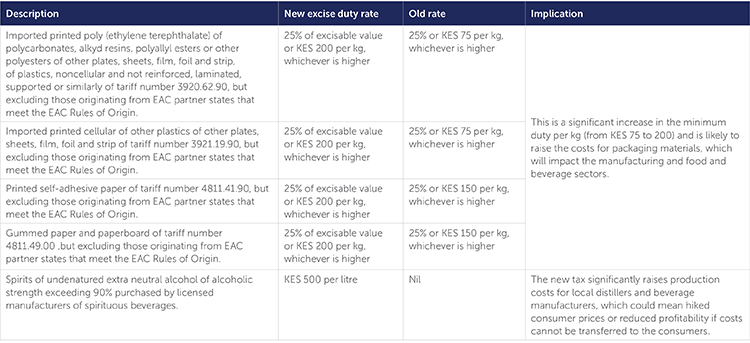

Changes in excise duty rates

Tax Procedures Act

Refined scope of exemptions from electronic tax invoice requirements

The Bill proposes amending section 23A (4) of the TPA by refining the categories of transactions that may be excluded from the requirement to issue electronic tax invoices. It is notable that only payments subject to withholding tax that is a final tax can be excluded.

Requirement to provide reasons for amended tax assessments

The Bill proposes introducing an additional requirement in section 31 of the TPA for the Commissioner to include the reasons for making an amended assessment when notifying a taxpayer. Under the current law, the Commissioner is required to issue a written notice when amending an assessment, such as the tax assessed, any penalties or interest, the relevant reporting period, the due date for payment, and the process for lodging an objection.

The proposed change of providing reasons for an amendment assessment aims to compel the Commissioner to disclose the rationale for the amendment, thereby promoting accountability, enabling taxpayers to better understand their tax obligations, and facilitating more informed and effective objections or appeals.

Relief from WHT liability where recipient has paid it

The Bill proposes introducing a provision that a person (withholding agent) who does not deduct, withhold or remit tax on a payment shall not be required to pay the principal tax where the recipient of the payment has paid and accounted for the full principal tax.

This is a welcome move for taxpayers since under the current provisions the Commissioner can pursue both the payer and the recipient for the same principal tax, even if it has already been paid by one party. This proposed amendment focuses on actual revenue collection rather than penalising technical non-compliance where there is no revenue loss to the Government. The person who fails to withhold still remains responsible for penalties and interest.

Stamp Duty exemption for KRA to register security over property or transfer property

The Bill proposes enhancing the provisions governing the registration of security over property for unpaid taxes under section 40. The proposed provision seeks to exempt the Commissioner’s notification from stamp duty at the point of its registration and also grants stamp duty exemption on the transfer of the property where it is disposed of by the Commissioner following their failure to pay the tax liability.

In its current form, the law allows the Commissioner to dispose of property under restraint if tax remains unpaid within two months and permits a payment plan, but it does not provide for stamp duty exemption for the Commissioner on the property transfer.

Inclusion of non-resident persons in enforcement provisions

The Bill proposes granting the Commissioner powers to collect tax from a non-resident person who is subject to tax in Kenya. Currently, section 42 applies only to taxpayers, which has generally been understood to mean resident persons. As a result, enforcement actions under this section – such as the issuance of agency notices – is not explicitly applicable to non-residents.

The proposed change ensures that non-resident persons who are liable for tax in Kenya are also subject to the same enforcement mechanisms as resident taxpayers. The current enforcement mechanisms include:

Issuance of agency notice

The proposed amendment allows the Commissioner to use agency notices in respect of non-resident persons, expanding the reach of tax recovery tools. The proposed amendment includes all other obligations in relation to agency notices which will apply to non-resident persons, such as conditions for notifying the non-resident person of the agency notice and payment timelines by the agent.

Deductions from income

The Bill proposes allowing the Commissioner to recover taxes owed by a non-resident person from their salary, wages, or other periodic remuneration.

Joint account recovery

The Bill proposes allowing the Commissioner to recover funds from joint accounts (other than a partnership account) operated by non-resident persons in Kenya.

Return of monies held by third parties

The Bill proposes allowing the Commissioner to require third parties to declare any funds held on behalf of a liable person, including non-resident persons. The amendment strengthens the Commissioner’s ability to trace assets of non-resident persons subject to tax in Kenya.

Agents liable for non-compliance with agency notices

The Bill proposes imposing liability for non-compliance with agency notices to agents or the non-resident person who is subject to tax in Kenya

Premature enforcement through agency notices despite pending appeal

The Bill proposes granting the Commissioner powers to issue agency notices even when the taxpayer has appealed against an assessment specified in a decision of the Tax Appeals Tribunal (TAT) or the higher courts.

This removal effectively grants the Commissioner unrestricted discretion to enforce collection through agency notices at any stage, including when a taxpayer has lodged a valid appeal. We have already seen instances where the Commissioner issues agency notices to banks or other third parties even before the exhaustion of appeal mechanisms, despite the presence of the restriction against doing so. The complete removal of the restriction exposes taxpayers to the risk of aggressive or premature enforcement actions even as the taxpayer proceeds to appeal an assessment.

Removal of criminal penalty for failure to withhold or remit VAT

The Bill proposes removing the requirement for conviction before imposition of a penalty for failure to withhold or remit withholding VAT as required under section 42A. The amendment is intended to make it easier for the KRA to enforce the 10% penalty by removing the procedural hurdle of obtaining a conviction. It therefore strengthens the KRA’s ability to take swift enforcement action once non-compliance is established.

Repeal of power to appoint agents for digital service tax collection

The Bill proposes repealing the Commissioner’s powers to appoint agents for the collection and remittance of digital service tax as introduced by the Finance Act, 2020. This change aligns with the broader policy shift abolishing the digital service tax. Since the tax is no longer in force, the legislative basis for appointing collection agents is redundant and has therefore been removed.

Tax refund/offset processing timelines extension

The Bill proposes extending the period within which the Commissioner must determine an application for offset or refund of overpaid tax from 90 days to 120 days. By increasing this period, the amendment grants the Commissioner more time to assess applications, which may ease administrative burdens but could also delay resolution for taxpayers.

Refund audits timelines extension

In cases where a tax refund application is subjected to an audit, the Bill proposes extending the timeline for determining the application from 120 days to 180 days. Overall, these amendments favour administrative efficiency for the Commissioner but may result in slower turnaround times and increased uncertainty for taxpayers seeking timely refunds or offsets.

Clarification on commencement of objection decision timeline for late objections

The Bill proposes introducing a new provision to clarify that where an application for late objection is allowed and the objection is validly lodged, the statutory period (60 days) within which the Commissioner must issue an objection decision will begin to run from the date the objection is actually lodged, rather than from any earlier point such as the original deadline or the date of the tax decision.

This amendment seeks to remove ambiguity and ensure that both taxpayers and the Commissioner have a clear and consistent understanding of when the 60-day period for making an objection decision commences, thereby reinforcing procedural fairness and predictability in objection handling.

Removal of restriction on data sharing relating to trade secrets and customer information

The Bill proposes removing the current limitation on the Commissioner from requiring a person to integrate or share data relating to trade secrets and private or personal data held on behalf of customers or collected in the course of business. This limitation had been introduced earlier by the Tax Procedures (Amendment) Act, 2024. This proposed amendment raises concerns around personal data protection and protection of business trade secrets. The same concerns were raised in the withdrawn Finance Bill, 2024. Parliament ought to reject it.

Inclusion of weekends and public holidays in objection and appeal timelines

The Bill proposes reversing the provision recently introduced by the Tax Procedures (Amendment) Act, 2024 by including Saturdays, Sundays and public holidays in the computation of the period for lodging an objection, appeal to the TAT, or appeals to higher courts.

This change would reduce the number of days for a taxpayer to lodge an objection against an assessment or appeal an objection decision. However, it also makes it simpler to calculate the time limit for lodging an objection or appeal, thereby enhancing taxpayer compliance and administration by the KRA, TAT and courts.

Discretion to waive penalty or interest due to system-related errors

The Bill proposes granting the Cabinet Secretary for Finance powers to waive a penalty or interest on the recommendation of the Commissioner, where the taxpayer’s liability arose from: system-generated errors, delays in system updates, duplicated penalties due to malfunctions of the system, or incorrect registration of tax obligations.

This is a welcome move which aims to ensure that taxpayers are not unfairly penalised for system-related issues beyond their control.

The Miscellaneous Fees and Levies Act (Cap. 496C)

Limitation of import declaration fee and railway development levy exemptions for aviation industry imports

The Bill proposes introducing a more limited exemption that applies only to parts of Chapter 88 (aircraft, spacecraft and parts thereof) and goods falling under tariff heading 8802.30.00 and 8802.40.00, which are aeroplanes and other aircraft of an unladen weight exceeding 2,000kg and 15,000kg respectively.

Further, for aircraft spare parts to be exempted from the import declaration fee and railway development levy, the recommendation of the Kenya Civil Aviation Authority was required, but this will be removed if the Bill is adopted as is.

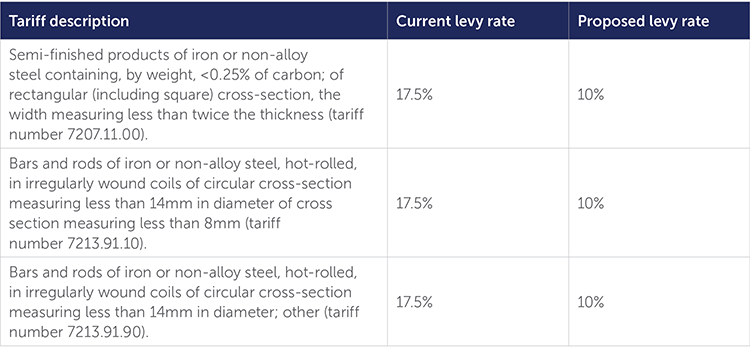

Reduction in export and investment promotion levy for specific steel products (iron and steel tariff adjustments)

The Bill proposes reducing the export and investment promotion levy rates for specific iron and steel products as follows:

These amendments aim to make the importation of semi-finished steel products more affordable, potentially benefiting manufacturers and industries that rely on these materials. This reduction may encourage domestic production, stimulate investments in the steel sector, and enhance the competitiveness of businesses using these materials in their manufacturing processes.

Stamp Duty Act, Cap 480

Exemption on the transfer of property by a company to its shareholders

The Bill proposes to amend the SDA by introducing the exemption on the transfer of property by a company to its shareholders as part of internal restructuring provided it has met the below conditions.

- the property is transferred to the shareholders in proportion to their shareholding in the company immediately before the transfer; and

- where the property consists of shares, such shares should be in a subsidiary of the company undertaking the transfer.

The proposed amendment introduces a distinct and much-needed exemption category under Kenya’s Stamp Duty Act by addressing internal reorganizations involving transfers of property from a company to its shareholders. Unlike sections 95 and 96, which require a 90% ownership threshold for exemption, the proposed amendment removes this rigid requirement and instead applies a proportionality test based on shareholding. This change recognises that in many legitimate corporate restructurings—such as spin-offs, or capital reductions—assets may be distributed to shareholders without triggering a complete 90% shareholding shift.

Conclusion

The Finance Bill, 2025 introduces a range of significant tax policy and administrative changes that aim to enhance revenue mobilisation, close existing loopholes, and align with broader economic goals. While some proposals offer targeted incentives to support investment and innovation, others may increase compliance costs or reduce certain long-standing reliefs, potentially impacting business planning and investment decisions.

The Bill notably fails to extend the tax amnesty programme, which had been introduced by the Finance Act, 2023 and later extended by the Tax Procedures (Amendment) Act, 2024. Under the amnesty programme the Commissioner is empowered to waive penalties and interest on tax liabilities, provided that taxpayers pay all principal tax due for periods up to 31 December 2023 by 30 June 2025. Based on media statements by the KRA, many businesses and individuals successfully applied for the amnesty.

The absence of a further extension in the Bill could be seen as a missed opportunity to encourage broader voluntary compliance. It may discourage taxpayers who are still struggling financially from coming forward, potentially limiting the programme’s revenue recovery impact. This could also signal a shift in policy away from amnesty-based compliance incentives and toward stricter enforcement, which may increase disputes and strain taxpayer relationships with the revenue authority.

The Bill also aligns with the National Tax Policy in terms of reducing VAT incentives. We have noted the proposed standard rating of several supplies that were previously exempt from VAT, including supply of:

- Goods used in the construction of houses under approved affordable housing schemes.

- Specialised hospital construction and equipment inputs, which were previously exempt upon Cabinet Secretary approval.

- Inputs used in geothermal, oil and mining exploration.

- Inputs and raw materials used in the manufacture of passenger motor vehicles.

- Specialised equipment for solar and wind energy generation.

Next Steps

This analysis is based on the draft version of the Finance Bill, 2025 currently in circulation, pending publication of the official version (green copy) in the Kenya Gazette. Once published, the Bill will undergo public participation as required under Article 118 of the Constitution of Kenya. The Departmental Committee on Finance and National Planning will lead this process by calling for both written and oral submissions from the public and relevant stakeholders – a crucial opportunity for engagement, feedback and dialogue. After this, the committee will compile a report with its recommendations for debate in the National Assembly, where Members of Parliament may propose further amendments. If approved, the Bill will be submitted to the President for assent. Upon receiving presidential assent, it will become law and take effect on 1 July 2025, with a few provisions taking effect on 1 January 2026.

We urge all stakeholders – individuals, businesses, and professional bodies – to take an active role in the consultation process to ensure that the final legislation is balanced, inclusive and aligned with Kenya’s economic priorities.

As the Bill progresses to the next stages that could possibly see it come to life, it would be prudent for the Government to consider the following actions to ensure a smooth process:

- Estimates: It would be useful to know how much the Government intends to collect, save or forfeit for each suggested change.

- Civic education: We should have many forums for the Government to explain the contents of the Bill and the rationale. It should drive the process.

- Public participation: We should be open to changes not necessarily touching on whatever is already in the Bill.

- Transparency: We should have an idea of what the changes introduced in the recent past have achieved e.g. Finance Act, 2023, Tax Laws (Amendment) Act, 2024, Tax Procedures (Amendment) Act, 2024, etc.

- Certainty/predictability: We should consider whether we really need a Finance Bill in 2025 considering we recently had changes through the amendment acts that took effect in December 2024. Could we achieve the same objective through amendment acts, say in 2026?

- Disposable income versus economy: We should model a decrease in the top rate for PAYE (down to 25%) and an increase in VAT (say 18%). In this we give a relief to the overburdened small percentage of employed individual taxpayers (about 3 million against a population of over 50 million) and still target everybody through indirect tax such as VAT.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe