Analysis of the Court of Appeal’s ruling on implementation of the Social Health Insurance Act, 2023

At a glance

- Following a petition seeking various declarations, orders of prohibition and injunctions in relation to the Social Health Insurance Act, 2023 (SHIA) and two other statutes, the High Court issued conservatory orders restraining the implementation of the SHIA until 7 February 2024.

- The Cabinet Secretary for Health, however, approached the Court of Appeal (CoA) seeking a stay of implementation of the orders. The CoA suspended the orders of the High Court restraining implementation of the SHIA, with the exception of three sections, which remain suspended pending hearing and determination of the main appeal.

- The impact of the CoA's ruling is that households with income from salaried employment will begin to part with a portion of their income each month, at a rate to be determined once enactment of the associated regulations is finalised.

The SHIA abolishes the National Health Insurance Fund (NHIF) and establishes three new funds: (i) the Primary Healthcare Fund (PHF), (ii) the Social Health Insurance Fund (SHIF), and (iii) the Emergency, Chronic and Critical Illness Fund (ECCIF).

The draft Social Health Insurance (General) Regulations, 2024 (Regulations) which are currently undergoing public participation indicate that households with income from salaried employment will pay a monthly contribution to SHIF at a rate of 2,75% of their gross salary each month. They further stipulate that the minimum amount payable in this regard shall not be less than KES 300.

Our alert of 5 December 2023 which you can find here discusses additional features of the SHIA in detail.

High Court’s ruling that suspended implementation of the SHIA

On 24 November 2023, Mr Enock Aura filed a petition at the High Court seeking various declarations, orders of prohibition and injunctions in relation to the SHIA and two other statutes. He claimed that they were invalid because their enactment did not comply with the constitutional requirement of public participation. Aura further contended that some of the sections of the SHIA were inconsistent with the Constitution.

Justice Mwita heard the petition and accompanying notice of motion ex-parte on 27 November 2023. He subsequently issued conservatory orders restraining the implementation of the SHIA until 7 February 2024.

In response, the Health CS filed a notice of motion application seeking a stay or suspension of the conservatory orders. She argued that the High Court’s orders would have a significant impact on over 17 million former NHIF members, who could no longer access pre-treatment authorisation on account of the repeal of the National Hospital Insurance Fund Act, and this could potentially cause a monumental crisis within the health sector.

The court maintained its position in the earlier ruling, directing parties to comply with the orders issued therein.

The appeal

Dissatisfied with the High Court’s determination, the Health CS approached the Court of Appeal (CoA). She sought a stay of implementation of the orders pending the hearing and determination of the intended appeal.

It was her case that the High Court had misdirected itself by issuing ex-parte orders against her, without giving her an opportunity to be heard. She also urged the CoA to consider the plight of patients who faced the potential suspension of their treatment till 7 February 2024.

Aura contended that the appeal was incompetent and amounted to an abuse of the court process. He argued that no evidence of a potential health crisis had been tendered. He maintained that no harm or loss would accrue as the regulations operationalising the implementation of the SHIA had not been enacted.

The Court of Appeal’s ruling

The CoA found the appeal to be arguable as the conservatory orders that the High Court had issued were too wide in scope and final in effect. The High Court had suspended three statutes ex-parte and failed to accord the respondents an opportunity to be heard contrary to their constitutional right to fair trial, and the principle of natural justice.

As to whether the intended appeal would be rendered irrelevant, the CoA considered the existence of an imminent danger to the health of millions of Kenyans who stood the chance of being denied treatment. Through its orders, the High Court had created a regulatory vacuum that would result in the inability to grant pre-treatment authorisation to former members of the NHIF.

The CoA suspended the orders of the High Court restraining implementation of the SHIA, with the exception of the following sections which remain suspended pending hearing and determination of the main appeal:

- Section 26(5), which makes registration and contribution a precondition for dealing with or accessing public services from the national and county Governments or their entities.

- Section 27(4), which provides that a person shall only access healthcare services where their contributions to the SHIF are up-to-date and active.

- Section 47(3), which obligates every Kenyan to be uniquely identified for purposes of the provision of health services.

Conclusion

The impact of the CoA’s ruling is that households with income from salaried employment will begin to part with a portion of their income each month, at a rate to be determined once enactment of the Regulations is finalised. The draft Regulations currently provide for a rate of 2,75% of an employee’s monthly gross salary with no cap.

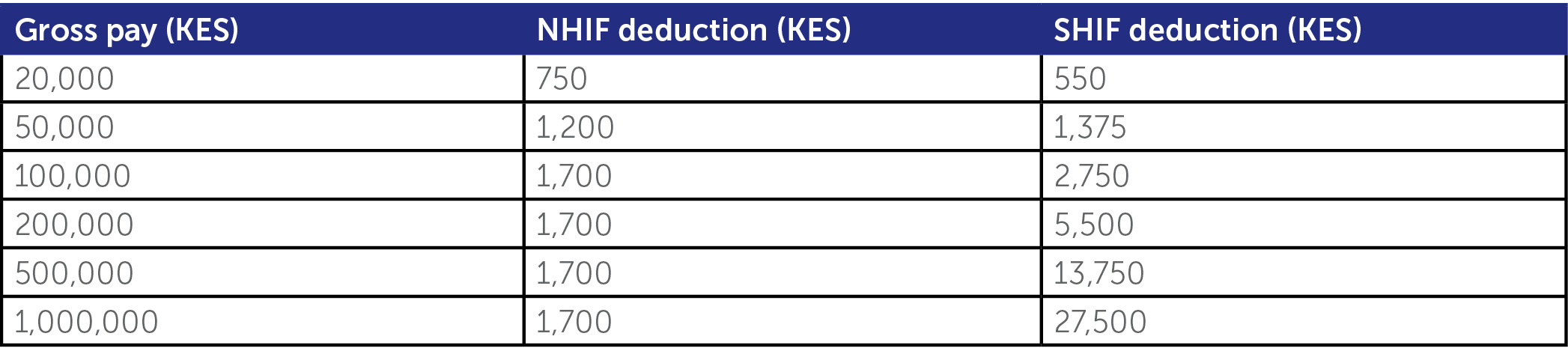

The table below compares the amounts that will be deductible under the 2,75% rate provided for in the draft Regulations, versus the amounts that employees were contributing under NHIF:

The Ministry of Health is currently receiving comments in relation to the draft Regulations and this will continue until 9 February 2024. Thereafter, it should be clear whether the 2,75% will be the applicable rate for deductions.

Overall, we are of the view that proper implementation of the SHIA will potentially transform Kenya’s health sector by ensuring equitable access to quality healthcare for all. It is noteworthy, however, that the SHIF rates appear to disproportionately focus on employed Kenyans in comparison to those in other sectors of the economy.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe