I have a dream… But what are the tax implications?

At a glance

- It is essential for entrepreneurs to consider the tax implications of their new ventures.

- There are a number of different types of businesses that have different tax considerations and structuring a business correctly from the start can have beneficial tax implications down the line.

- There are various tax deductions and allowances that can affect the tax liability of a business as it grows, and knowing about these ahead of time can facilitate better tax planning and management.

It goes without saying that starting a new business is a great feat. According to an article published by IOL in December 2022, 70% to 80% of businesses fail in their first five years of trading. This means that perseverance is an important characteristic when considering starting a new business. However, it is rarely noted that having a basic understanding of tax can assist with turning an entrepreneurial dream into reality.

Understanding the tax consequences associated with the different forms of businesses before undertaking a new venture can help set it up for success, but failing to familiarise yourself with the basics beforehand could cause you unnecessary frustrations down the line.

So, what are the basic types of businesses and their tax considerations:

- Sole proprietorship: This is a business that is owned and operated by an individual. The business itself has no existence separate from the owner. As such, the income from the business is included in the owner’s income tax return and the owner is responsible for the payment of taxes thereon. Individuals are taxed on a progressive scale – i.e. the more income you earn the more taxes you will pay. However, unlike companies, individuals are entitled to certain tax rebates and credits which can be used to reduce their overall tax liability.

- Partnership: This is the relationship existing between two or more people who join together to carry on a trade, business, or profession. Similar to a sole proprietorship, a partnership is not a separate legal person or taxpayer. The profits made by the partnership are taxed in the hands of each partner according to the relevant share of the partnership profits.

- Company: A company is a separate legal entity and must be registered with the South African Revenue Service (SARS) as a taxpayer in its own right. The owners of a private company are shareholders, who may or may not be involved in the management of the company. The standard tax on income for registered companies in South Africa is currently a flat rate of 27%, irrespective of the level of earnings. However, in order for the owners (shareholders) to receive their share of the profits, the company needs to declare a dividend. Dividends are taxed at a further 20%.

- Close corporation (CC): Similar to a company, a CC is a legal entity with its own legal personality and must register as a taxpayer in its own right. The owners of a CC are the members of the CC and have a membership interest in the CC. For income tax purposes, a CC is dealt with as if it is a company – i.e. its income is taxed at a flat rate of 27%. However, it should be noted that no new CCs have been permitted to be incorporated since 1 May 2011.

How business types affect tax

Therefore, the type of business selected will affect the overall tax paid. A simple example to illustrate the difference between operating as a sole proprietor and incorporating a company is shown below.

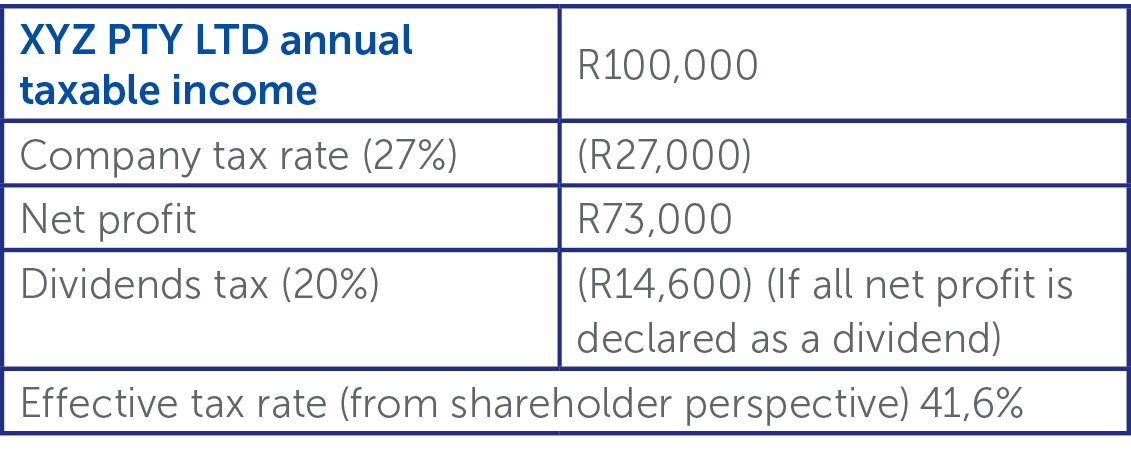

Let’s say your company, of which you are the sole shareholder, generates a profit of R100,000 in 2024 (with a February year-end) and we assume that the company declares a dividend:

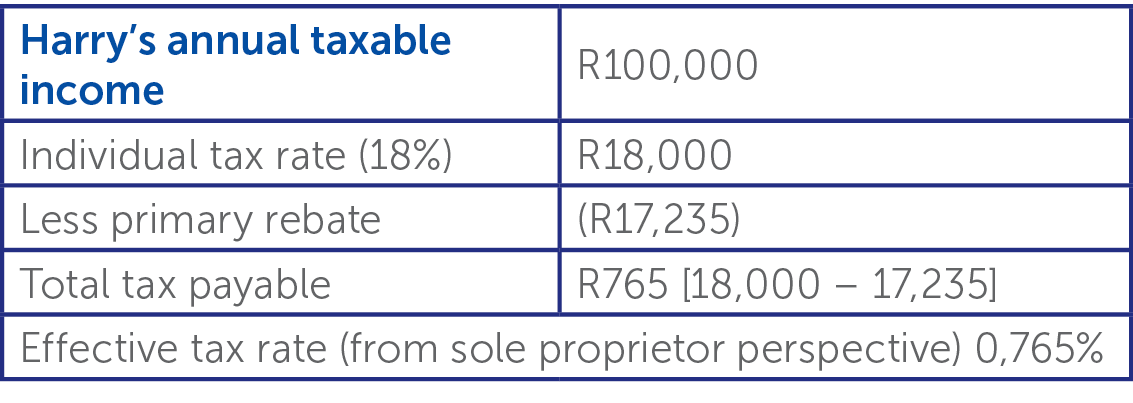

Now, let’s look at the same situation but for a sole proprietor for the 2024 year of assessment:

The above example indicates a much lower effective tax rate for the sole proprietor than for the company on the same amount of taxable income. However, it must be borne in mind that as the profits of the business grow the sole proprietor’s additional income will be taxed at higher tax rates, thereby increasing the effective tax rate. If we were to re-do the above example with profits of R1 million, for example, the sole shareholder of XYZ (Pty) Limited would have the same effective tax rate of 41,6%, however Harry’s effective tax rate would increase to 29,23%.

Other deductions and allowances

Although the effective tax rate for the sole proprietor is still lower than that of the company, it should be noted that the above examples do not take into consideration all the deductions and allowances that may be available for each. Further, the above does not take into account other tax considerations that may affect the tax efficiency of the business structure that is chosen. In this context, it will be important to consider the following:

- Will the business need to employ other people to assist with operations or, will you handle all of the operations of the business yourself? In this context, considerations as to employees’ tax, skills development levy, and unemployment insurance fund contributions will have to be taken into account.

- Is your business expected to make taxable supplies exceeding R1 million in the next 12 months? If so, registering for value-added tax may need to be completed.

- Will your business regularly export or import goods or services? Customs and excise tax will then become an important consideration.

- Will your business be operating in other jurisdictions? In this context, the tax requirements or obligations of that jurisdiction will also have to be borne in mind.

- Depending on the industry in which your business intends to operate, other taxes such as carbon tax, sugar tax (health promotional levy on sugary beverages), or transfer duties may be applicable.

- How do you want to draw profits from the business?

The type of business chosen will therefore likely depend on (i) the big (big) dream – what vision do you have for your business? And (ii) what do you want to achieve through this vision? Is it something to earn a little bit of extra income from, or do you intend to build an empire that will carry from generation to generation – is continuity a consideration?

It goes without saying that choosing the right business structure can have significant tax implications. A tax professional can help you determine the most tax-efficient structure for your specific needs. So why not choose the best legal partner to take your vision and bring it to fruition?

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe