Customs and excise

Excisable products

Of relevance this year in terms of Schedule 1 Part 2A to the Customs Act are the following:

- The guideline excise tax burdens for wine, beer and spirits are 11%, 23% and 36% respectively of the weighted average retail price. Excise duties have increased more than inflation in recent years, resulting in a higher tax incidence. Government proposes to increase excise duties on alcoholic beverages by between 6,7 and 7,2% for 2024/25.

- The guideline excise tax burden as a percentage of the retail selling price of the most popular brand within each tobacco product category is currently 40%. Government proposes to increase tobacco excise duties by 4,7% for cigarettes and cigarette tobacco and by 8,2% for pipe tobacco and cigars for 2024/25.

- Government implemented an excise duty on electronic nicotine and non-nicotine delivery systems, colloquially referred to as vaping, with effect from 1 June 2023 at a flat excise duty rate of R2,90 per millilitre on both nicotine and non-nicotine solutions. Government proposes increasing these excise duties in line with expected inflation to R3,04 per millilitre for 2024/25.

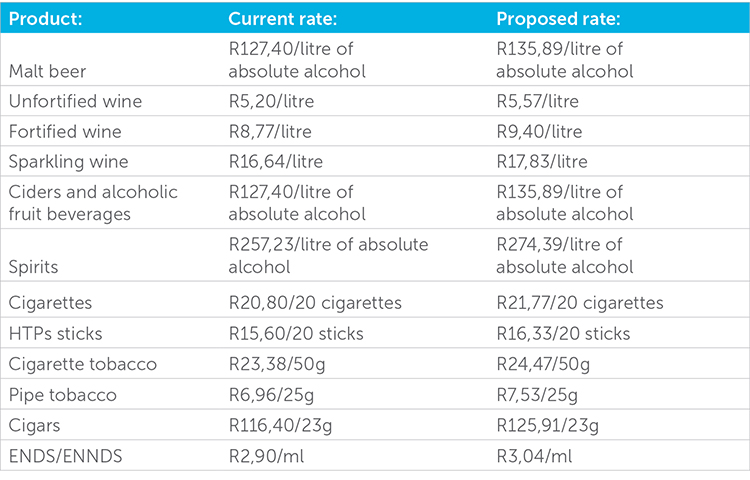

- Government proposes that excise duties in the Customs Act be increased with effect from 21 February 2024 to the extent shown below:

- As was the case last year, there will be no change to the excise duty on Traditional African Beer (umqhombothi) and Traditional African Beer powder.

Plastic bag levy and incandescent globe taxes

- Government proposes increasing the plastic bag levy from 28c/bag to 32c/bag from 1 April 2024.

- To encourage the uptake of more efficient lighting such as light-emitting diode bulbs and reduce electricity demand, it proposes raising the incandescent light bulb levy from R15 to R20 per light bulb from 1 April 2024.

Motor vehicle emissions tax

- Government proposes increasing the motor vehicle emissions tax rate for passenger vehicles from R132 to R146 per gram of CO2 emissions per kilometre and the tax rate for double cabs from R176 to R195 per gram of CO2 emissions per kilometre from 1 April 2024.

Fuel taxes

- The fuel levies will not be increased, resulting in R4 billion in tax forgone, partially offset by above-inflation increases in excise duties on alcohol and certain categories of tobacco products.

- The Road Accident Fund levy and the customs and excise levy will also remain unchanged.

Carbon tax

- The carbon tax increased from R159 to R190 per tonne of CO2 equivalent from 1 January 2024. The carbon fuel levy will increase to 11c/litre for petrol and 14c/litre for diesel effective from 3 April 2024, as required under the Carbon Tax Act. Effective 1 January 2024, the carbon tax cost recovery quantum for the liquid fuels sector increased from 0,66c/litre to 0,69c/litre.

- It is proposed that the density factor for calculation of the carbon fuel levy is changed from 0,75 to 0,7405kg/l for petrol and from 0,845 to 0,82kg/l for diesel. The amendments will take effect from 1 January 2024.

General

- It is proposed that items 12 and 13 of Part B of Schedule 2 of the VAT Act be amended to clarify that the zero-rating of VAT does not apply to pre-cut or prepared fruit or vegetables. Amendments to Schedule 1 Part 1 of the Customs Act may also be needed in order to align both the schedules.

- The approach to packages imported through eCommerce will be reviewed to ensure that the appropriate balance between simplicity and compliance with customs and excise requirements is being maintained.

- Certain exporters face legitimate challenges in complying with the timeframe for submitting export bills of entry. It is proposed that the Customs Act be amended to enable SARS to provide, by rule, for a process by which exporters can be allowed to submit export bills of entry at a different time than what is currently provided for in the Customs Act.

- It is proposed that the Customs Act be amended to simplify the process of substituting a bill of entry in certain circumstances where the bill of entry has been passed in error or where an importer, exporter or manufacturer requested the substitution on good cause shown. A voucher of correction will no longer be required in those circumstances, and it is foreseen that the substituting bill of entry will replace the previous one.

- Every company that carries on business or has an office in South Africa must be represented by a public officer. Given that companies are automatically registered for income tax on formation, it is proposed that the one-month period within which the public officer must first be appointed be removed. A newly formed company will thus have both its directors and public officer in place on formation.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe