Customs And Excise

At a glance

- Excise duties for tobacco products are proposed to be increased in line with expected inflation, while the rate for sparkling wine will be adjusted.

- The health promotion levy will remain unchanged to assist stakeholders in the sugar industry, and a discussion paper will be published to consider extending the levy to pure fruit juices and lowering the threshold.

- Fuel taxes, including the general fuel levy and Road Accident Fund (RAF) levy, will not be changed, and temporary relief measures will be provided to mitigate the impact of power cuts on food prices. The carbon tax rate and carbon fuel levy will be increased to promote greenhouse gas emissions reduction.

[Certain sections quoted from the Budget documents].

Excisable Products

As is the case each year, Government proposes an increase in duties for excisable products in Schedule 1 Part 2A to the Customs and Excise Act 91 of 1964 (Customs Act).

Of relevance this year are the following:

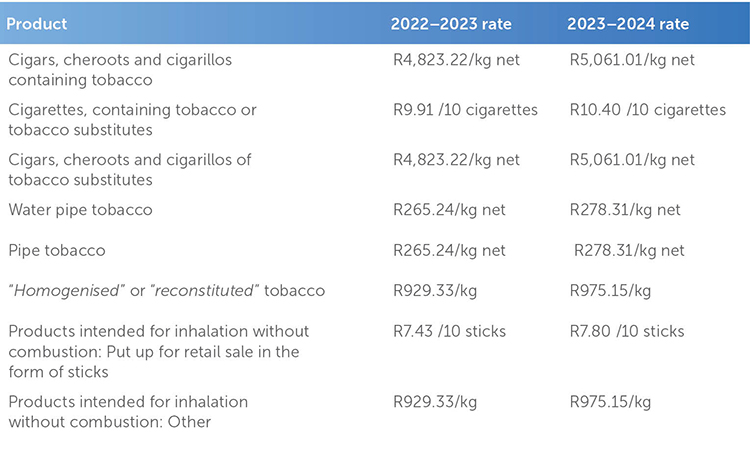

Tobacco

The guideline excise tax burden as a percentage of the retail selling price of the most popular brand within each tobacco product category is currently 40%. Government proposes increasing the excise duties in line with expected inflation of 4,9% for 2023/24.

For example, the following:

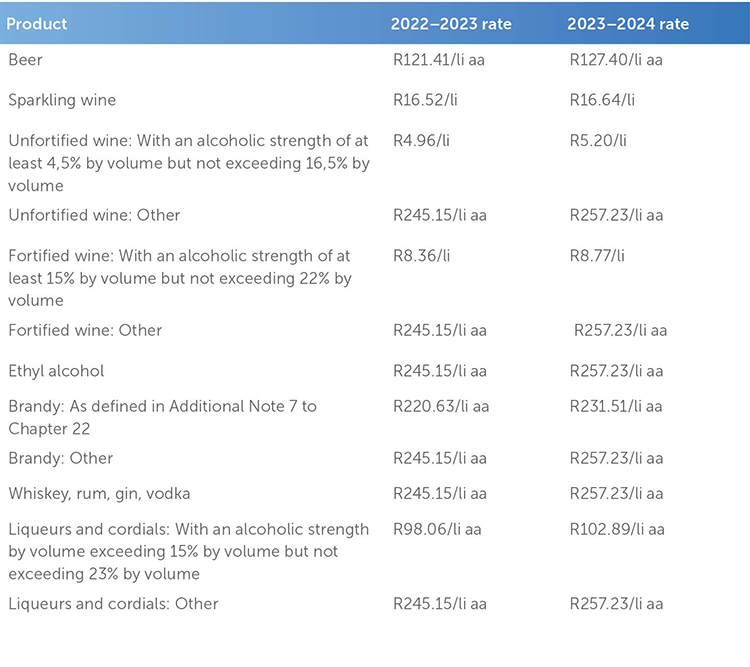

Further, the rate for sparkling wine is realigned to the policy decision taken in 2016 to peg it at 3,2 times that of natural unfortified wine.

For example, the following:

The alcohol review paper will be published soon after the budget.

Traditional African beer

As was the case last year, there will be no change to the excise duty on traditional African beer.

Health Promotion Levy

To enable stakeholders in the sugar industry to restructure, given the challenges from greater regional competitive pressures and the effect of recent floods and public violence, there will be no increase in the health promotion levy in 2023/24 and 2024/25.

Government will soon publish a discussion paper on the levy for consultation on proposals to extend the levy to pure fruit juices and lower the 4g threshold.

Fuel Taxes

No changes were made to the general fuel levy or the Road Accident Fund (RAF) levy in the Budget. Additional temporary relief was provided for four months at a cost of R10,5 billion. In 2023/24, Government will again keep these levies unchanged, leading to revenue of R4 billion being foregone.

Government implemented the diesel refund system in 2000 to provide full or partial relief for the general fuel levy and the RAF levy to primary sectors. The refund system is in place for the farming, forestry, fishing and mining sectors. In light of the current electricity crisis, a similar refund on the RAF levy for diesel used in the manufacturing process (such as for generators) will be extended to the manufacturers of foodstuffs. This will take effect from 1 April 2023, with refund payments taking place once the system is developed and will be in place for two years until 31 March 2025. This relief is implemented to limit the impact of power cuts on food prices.

Carbon Tax

South Africa is committed to achieving its nationally determined contribution to reduce greenhouse gas emissions. The carbon tax plays an important role in mitigation. Effective 1 January 2023, the carbon tax rate increased from R144 to R159 per tonne of carbon dioxide equivalent. To ensure transparency and provide certainty, future adjustments to the tax rate are provided in the Carbon Tax Act 15 of 2019, as outlined in the Taxation Laws Amendments Act 20 of 2022. In line with the carbon tax rate increase, the carbon fuel levy for 2023/24 will increase by 1c to 10c/l for petrol and 11c/l for diesel from 5 April 2023. The carbon tax cost recovery quantum for the liquid fuels refinery sector increased from 0.63c/l to 0.66c/l, effective from 1 January 2023.

General

Standard 4.15 of the General Annex of the Revised Kyoto Convention provides that “where national legislation provides for the deferred payment of duties and taxes, it shall specify the conditions under which such facility is allowed.” It is proposed that the SARS Commissioner be enabled to prescribe conditions under which deferment of duties will be allowed by rules.

Following an assessment of South Africa’s approach to collecting advance passenger information (API) and passenger name record (PNR) data, it is proposed that a single window be established to collect API and PNR data. As the Department of Home Affairs is responsible for the collection of such data, carriers will be allowed to submit the required data to the Department of Home Affairs, which will distribute the information to other relevant government entities, such as SARS. An amendment is also proposed to ensure the protection of personal information in this regard.

SARS is implementing a modern online traveller management system, which has been piloted on a voluntary basis at King Shaka International Airport since November 2022. The system is aimed at strengthening SARS’s capability to facilitate legitimate traveller movements, providing travellers with clarity and certainty regarding their obligations, easing compliance, detecting non-compliance and improving enforcement of legislation by SARS and other agencies. It is proposed that the Customs Act be amended to provide for the declaration of the required information before arrival in or departure from South Africa.

There are currently no provisions in the act relating to the liquidation of provisional payments that serve as security in certain circumstances and that are not claimed back by the trader. Government proposes amending the act to enhance the current processes and procedure for such payments below a specified amount or that remain unliquidated after a specified period and to introduce a prescription period for unclaimed amounts.

SARS makes it hard and costly for those taxpayers who remain wilfully non-compliant. There has been steady progress over the past three years. For the year to date up to the end of January 2023 more than 4,742 customs seizures amounting to R2,9 billion took place. Overall, customs compliance efforts secured R10,4 billion through compliance efforts, made up of R3,8 billion cash and prevented leakages of R6,6 billion. SARS has handed over 178 cases to the National Prosecuting Authority. There are 94 finalised cases with 92 guilty verdicts, of which 10 had sentences of direct imprisonment, totalling 75,5 years to be served, with two acquittals. The conviction rate is 97,8%.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe