Part 4 | South Africa’s Road to a Hydrogen Economy

At a glance

- South Africa has the potential to play a significant role in the production and distribution of green hydrogen, with pilot projects already underway and support from the German government.

- The country's hydrogen roadmap, outlined in the Hydrogen Society Roadmap (HSRM), aims to achieve decarbonization in heavy-duty transport, energy-intensive industries, and power sectors, while creating an export market for green hydrogen.

- South Africa's international climate change commitments, such as the Paris Agreement, COP26, and the Just Transition Partnership, are driving the country's transition to a net-zero carbon economy, with hydrogen playing a crucial role in attracting green financing and meeting emission reduction targets. The country's environmental legal framework supports the development of hydrogen projects and emphasizes principles like the polluter pays, duty of care, and consideration of alternatives.

Part 1: The global movement towards green economies and greener technology solutions

The year 2021 saw “green hydrogen” emerging as a popular buzzword associated with solutions to address climate change. Although the full realisation of a hydrogen economy, and green hydrogen specifically, will take time, the potential of hydrogen and the role that South Africa could play in its production and distribution are becoming a reality with several pilot projects already on the go. An exciting development in the green hydrogen space was the recent news of the confirmation of the German Government’s proposed injection of €12,5 million to fund South Africa’s green hydrogen development initiatives. This was announced by the Minister in the Presidency Party Mondli Gungubele on 17 January 2022 during a stakeholder engagement session in the Northern Cape, which is envisioned to be South Africa’s new green hydrogen production hub with Gauteng being the domestic demand hub. These provinces will be the site of catalytic green hydrogen projects that can be realised with Germany’s financial support, particularly in respect of South Africa’s potential to produce sustainable aviation fuel for global export. Closely linked to green hydrogen production is the announcement of South Africa’s first green ammonia project with the proposed establishment of a R75 billion green ammonia export plant in Nelson Mandela Bay in the Eastern Cape.

The kick-starting of South Africa’s hydrogen roadmap, together with ongoing global initiatives to explore hydrogen technologies, could not be more critical in the context of increasing climate change concerns. A key outcome of COP26 was that the world is currently on the path to reach between 1,8 to 2,4ºC heating by 2030. In the same vein, the UN Secretary-General termed the Intergovernmental Panel on Climate Change Report published amid the global COVID-19 pandemic as a “code red for humanity”, with the pandemic having highlighted the climate change crisis and the impacts to vulnerable members of society.

In the context of this global crisis, one of the key enablers of a green economy is a clean energy and greener fuel transition. Sustainable energy in Africa is multifaceted, with financial, technical, political, legal, and practical issues to consider. In this regard, a just transition away from fossil fuels is a material consideration in the African context, and especially the South African context, where measures need to be put in place to ensure that those who are vulnerable and dependent on the fossil-fuel value chain are not burdened by the continent’s clean energy transition.

In the imperative to move away from fossil fuel electrification and reliance by energy-intense large industry, thereon the implementation and expansion of renewable energy production is crucial. Over and above the need for cleaner energy production, there are energy end-uses that themselves require alternatives to fossil-fuel inputs, such as fuelling long-haul aviation and heavy freight transport. A key intervention that allows for a realistic transition from fossil-fuel reliance and still sees the use and sustainable upgrade of existing infrastructure is the advent of hydrogen.

South Africa is well endowed with available land, wind, and solar resources to provide the energy sources for green hydrogen production and has the makings of suitable distribution infrastructure. Existing South African infrastructure will allow for the production of blue, grey, black, and brown hydrogen, with the possibility of pink hydrogen arising in light of existing plans for nuclear power projects. As such, South Africa is in a unique position to gain a competitive advantage in harnessing hydrogen with the added benefit of expanding the green hydrogen opportunities, and therefore carbon-free fuel, to assist in addressing South Africa’s energy crisis and to fulfil South Africa’s international climate change commitments.

Part 2: The road to unlocking the hydrogen economy in South Africa with the HSRM

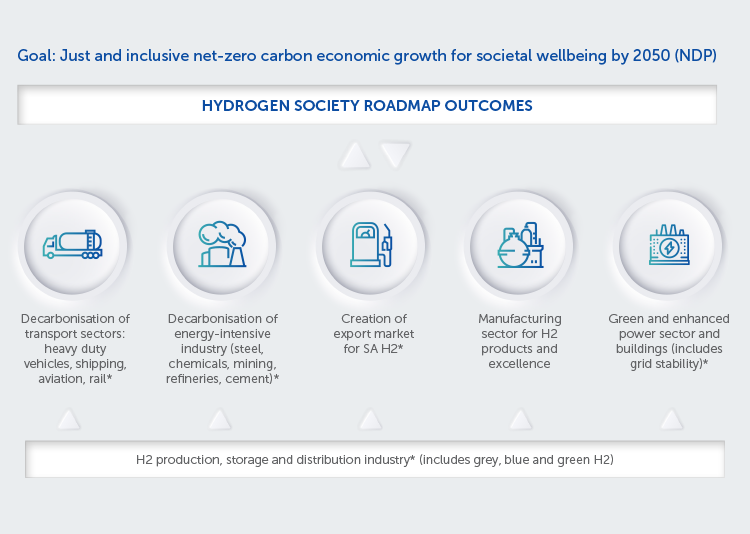

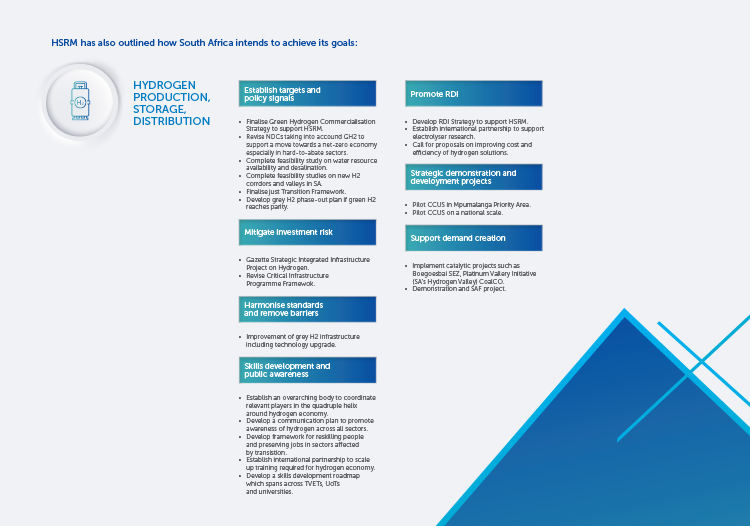

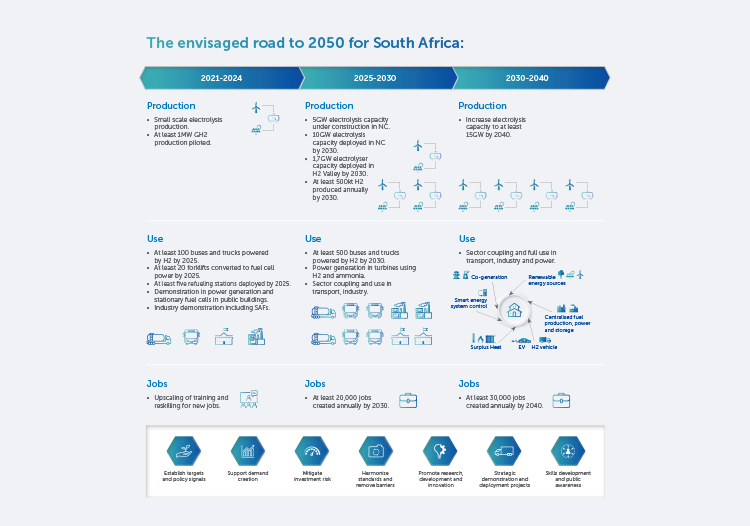

The HSRM set out the South African Government’s official strategy to unlock the hydrogen economy through the following high-level outcomes:

- Decarbonisation of heavy-duty transport.

- Decarbonisation of energy-intensive industry (cement, steel, mining, refineries).

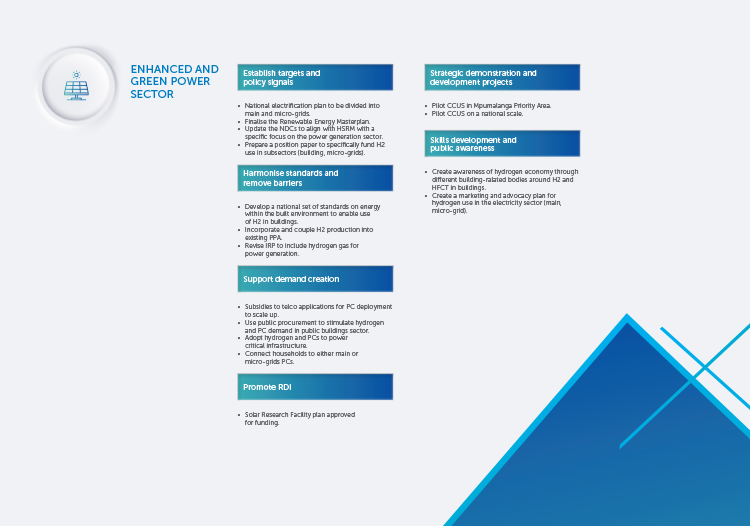

- Enhanced and green power sector (main and micro-grids).

- Centre of Excellence in Manufacturing for hydrogen products and fuel cell components.

- Creating an export market for South African green hydrogen.

- Increasing the role of hydrogen (grey, blue, turquoise and green) in the South African energy system in line with the move towards a net-zero economy.

Should the HSRM be successfully implemented in South Africa it is expected that the country could achieve just and inclusive net-zero carbon economic growth by 2050. A total of 70 priority actions have been identified and classified according to the high-level outcomes. As a lever for the change that will facilitate the realisation of these outcomes the following has been identified as imperative to deal with:

- Local and international demand for green hydrogen and green products.

- Compliance and regulation.

- Enabling infrastructure and policy that support hydrogen adoption and dis-incentivise alternatives.

- Attractive investment environment.

- Cost competitiveness with a focus on the levelised cost of green hydrogen.

- Corporate targets (e.g. carbon budgets).

- International commitments.

- Innovative culture and skilled workforce.

The must be achieved change through the following:

- Market development/business cases.

- Favourable and integrated policy, fiscal measures and regulatory environment.

- Financial framework that provides access to capital markets.

- Raw material availability, ranging from platinum group metals to water.

- National and international partnerships.

- Demonstration of pilot projects including industrial clusters.

- Research, development and innovation.

- Skills development.

Part 3: South Africa’s international climate change commitments, COP26, and their link to hydrogen

South Africa is a signatory to the Paris Agreement, which was the first universal, legally binding global climate deal that seeks to accelerate the reduction in global GHG emissions. South Africa has set its nationally determined contribution (NDC) under the Paris Agreement. The first NDC under the Paris Agreement was published in September 2021, with a 2025 target range that allows for the implementation of South Africa’s national mitigation system that includes the Climate Change Bill, the Integrated Resource Plan, 2019 and a national recovery from COVID-19. The latest updated draft NDC published in March 2021 sets out South Africa’s GHG emission targets, finance support requirements and long-term decarbonisation plans, and makes provision for the implementation of National Climate Change Adaptation Strategy interventions for certain priority sectors. The suite of legal and policy interventions includes the Climate Change Bill, the Low Emissions Development Strategy, and the National Climate Change Adaptation Strategy.

The creation of the Presidential Climate Change Co-ordinating Commission as well as work on climate finance were all done in preparation for COP26, during which South Africa committed to net-zero carbon emissions by 2050. Some of the key outcomes of the conference were the Paris Agreement Work Programme, an annual mitigation ambition work programme, and the Just Transition Partnership, which was set up to balance the need to transition to a low carbon economy by South Africa with France, Germany, the UK, the US, and the European Union (EU). The partnership mobilised an offer of R131 billion to support a just transition over the next three to five years, although the offer remains to be finalised.

The commitments from COP26 implicating green financing will significantly impact South Africa and the rest of the African continent. Considering the land availability and renewable energy potential on the continent, along with the aging existing infrastructure in South Africa, including old mines and coal-fired power stations nearing the end of their lives, hydrogen has significant potential to attract green finance from developed nations. In this regard, Namibia and Germany have already entered a hydrogen partnership where, through co-operation, green hydrogen technologies can be explored in locations where hydrogen technologies already exist. The German Development Bank KfW and the German Government have similarly recognised that South Africa has comparable competitive advantages, which has resulted in their funding of South Africa’s green hydrogen development initiatives in the Northern Cape and Gauteng.

Part 4: An overview of South Africa’s environmental legal framework as an enabler of hydrogen development

The National Environmental Management Act 107 of 1998 (NEMA), South Africa’s primary environmental statute, provides for various principles that align with just transition objectives and its move towards a green economy. The pursuit of environmental justice, equitable access to environmental resources for historically disadvantaged people, and the promotion of community well-being and empowerment are but a few of the principles highlighting the social pillar of sustainable development and what makes a transition “just”, along with the constitutional right to an environment that is not harmful to health and well-being.

The following fundamental principles contained in NEMA are of relevance. First, the “polluter pays principle” provides that the costs of remedying, preventing, controlling, or minimising pollution and environmental degradation must be paid for by those responsible for harming the environment. Second, NEMA places a general duty of care on any person who causes, has caused, or may cause significant environmental pollution or degradation, to take reasonable measures to prevent, minimise and rectify the pollution or degradation. Third, NEMA gives effect to a cautious approach to the assessment and management of environmental risks, known as the precautionary principle. Specifically, NEMA provides that sustainable development requires a consideration of all relevant factors, including that a risk-averse and cautious approach must be applied considering the limits of current knowledge about the consequences of decisions and actions. The introduction of hydrogen production, which will: be used in place of fossil fuels; stimulate renewable energy production and sustainable repurposing of existing infrastructure; and result in the minimisation of atmospheric emissions and GHG emissions, amounts to an observance of the precautionary principle, and a failure to take such precautions in the context of the protection of environmental rights will violate the NEMA duty of care and trigger the polluter pays principle.

The EIA Regulations published in terms of NEMA set out criteria that must be considered in applications for an environmental authorisation (EA), which is a licence that must be obtained if certain listed activities which have been recognised to have a detrimental impact on the environment are triggered by a project (EA Listed Activities). One of the key criteria prescribed by the EIA Regulations is the consideration of alternatives. This criterion encourages hydrogen development as a feasible fuel alternative. In the role hydrogen has in the renewable energy sector, a complementary dynamic arises where, in one vein, a demand for green hydrogen will drive the development of more renewable energy projects required for green hydrogen production and, in another vein, a hydrogen-based electricity storage system can be relied on that allows for the storage of renewable generated energy. In this regard storage technologies involving lithium batteries and pressurised hydrogen tanks are being explored, as well as solely hydrogen-based storage solutions which have a far greater storage capacity than batteries.

There are also various Specific Environmental Management Acts (SEMAs) and their associated suite of legislation that further the NEMA principles and support sustainable hydrogen solutions. The National Environmental Management Act: Air Quality Act 39 of 2004 (NEMAQA), the National Water Act 36 of 1998 (NWA) and the National Environmental Management: Waste Act 59 of 2008 (NEMWA). NEMAQA and its regulations evidence the importance of minimising atmospheric emission generation and the requirement placed on emitting entities to accurately and consistently monitor and report on them, particularly in relation to GHG emissions. As compliance standards become more stringent and enforcement is prioritised, penalties for noncompliance will disincentivise the continuation of existing emitters’ reliance on fossil fuels and incentivise alternatives such as hydrogen production and use. The NWA, which prescribes permissible water uses and the requirements for authorisations and licences, is of relevance in green hydrogen projects which currently use significant amounts of water, as discussed further below. The high water demands of green hydrogen projects in the context of a water-scarce country must therefore be given due consideration, together with the management of waste generated from the production process, which is regulated by NEMWA.

Climate change has become a relevant factor forming part of the EIA process. The Minister of DFFE published the Draft National Guideline for Consideration of Climate Change Implications to be relied on in applications for EAs, atmospheric emission licences, and waste management licences. The guideline will create a consistent approach to climate change impact assessments in all sectors. Although it functions as a guide to best practice, as opposed to being an enforceable statute, it sets out the minimum requirements and generic principles for involving climate change specialists in the EIA process; defines the roles of the environmental assessment practitioner, specialists, and other stakeholders; and outlines the extent and content of climate change impact assessments, and, to this end, it plays an important role in climate change mitigation practices.

The Climate Change Bill forms an integral part of the legislature’s commitment to fostering a green economy and seeks to prescribe climate change mitigation and adaptation measures. The bill, a version of which was first published in 2018 (2018 CC Bill) and further iterations published in 2021 and 2022 (2022 CC Bill), provides for the Minister’s publication of a notice setting out a list of GHGs that are reasonably believed to cause or are likely to cause or exacerbate climate change, as well as a list of activities that emit one or more of the listed GHGs. This notice is envisioned to further determine quantitative GHG thresholds expressed in a “carbon dioxide equivalent” to identify the entities to which a carbon budget must be assigned, who must annually report on the progress against their carbon budget, and the entities that are required to submit GHG mitigation plans. Notably, provisions in the 2018 CC Bill allowing for an extension for carbon budget compliance have been removed in the 2022 CC Bill, which previously envisioned that companies “under extreme circumstances” would be permitted to apply to the Minister to extend the compliance timeframes of their allocated carbon budgets. The 2022 CC Bill prescribes penalties for noncompliance with, amongst other things, greenhouse gas mitigation plan requirements, and if an entity’s GHG emissions exceed the maximum emissions prescribed in its allocated carbon budget during the applicable period, it will be subjected to a higher carbon tax rate on the exceeded emissions as provided for in the Carbon Tax Act 15 of 2019 (Carbon Tax Act). The Climate Change Bill will therefore need to be read together and implemented (once promulgated) with the Carbon Tax Act, NEMA, NEMAQA and the various other SEMAs to achieve a just transition, and points to the integrated nature of South Africa’s environmental legislative framework that will need to be considered during hydrogen project development.

In order to support the creation of demand for clean hydrogen in South Africa, the HSRM proposes that a robust approach be adopted that provides for stringent emissions standards, under NEMAQA, to enable the rapid introduction of clean hydrogen production technologies across the economy and in particular for diesel vehicles, which predominate in heavy-duty transport and have a direct impact on local air quality. With that there must also be linkages between stringent environmental regulations as an incentive for people to buy electric vehicles (e.g. hydrogen fuel cell electric vehicles) in South Africa. Automobile manufacturers in South Africa should also be incentivised to move from exporting of internal-combustion vehicles to exporting electric vehicles for key markets for South Africa (EU, the UK and North America) based on the planned reduction/ceasing of such imports by 2030 by these markets in response to climate change requirements.

With the increase in climate change related laws and policies, there is a greater regulatory burden on high emitters and the general use of fossil fuels. It is expected that the onus of the burden will incentivise a low-carbon economy transition and associated initiatives, with green hydrogen presenting an opportunity to create financial benefits and cost savings from the transition. Notwithstanding that South Africa’s regulatory framework provides an enabling platform for these and other benefits, there are certain regulatory hurdles to consider when looking toward green hydrogen project development.

Part 5: Environmental permit requirements and potential hurdles

The potential legal hurdles in relation to green hydrogen projects will be dependent on the nature of the project, the intended product, and the location, which will require comprehensive project-specific impact assessments. As noted above, the EIA Regulations require that an EA is obtained before the commencement of EA Listed Activities. Various activities associated with the production of green hydrogen will likely trigger the need for an EA, and given the scale of green hydrogen projects, which are significantly larger than renewable energy generation facilities, the EAs issued for green hydrogen projects might include onerous conditions that hamper implementation.

The production of green hydrogen by way of electrolysis will likely require a water use licence (WUL) in accordance with the NWA, as the production requires large volumes of water, and could trigger a number of water uses such as the abstraction and storage of water, and the disposal of waste or water containing waste. The time delays associated with the approval and issuing of WULs also presents a hurdle, although the time constraints may be addressed through the DFFE’s new truncated decision-making period of 90 days. Further, as hydrogen is explosive, it will attract numerous requirements prescribed by national, provincial, and municipal legislation that are associated with the use and storage of hazardous flammable substances.

Depending on the location, type and volume of water used, licences may be required for the treatment of wastewater for inland projects. Coastal desalination projects would require permits triggered by desalination activities, additional zoning requirements, and a coastal water discharge permit in terms of the National Environmental Management: Integrated Coastal Management Act 24 of 2008. Over and above the material environmental permit requirements that will be applicable, other ancillary but important consents will also be applicable which relate to the transportation of dangerous goods and substances by road, as well as permits prescribed by municipal bylaws.

Fossil-fuel related projects such as the development of coal-fired and gas-powered energy facilities as well as exploratory activities such as seismic surveys, are and will continue to be subject to public and private scrutiny and legal challenges. Environmental permitting is particularly susceptible to legal challenges as without these material consents, development cannot be realised. This is not to say that hydrogen related projects won’t face challenges, but their very development is already an observance of preventative measures being observed. Impact assessments and especially the requirement for meaningful public participation will play a vital role in mitigating any challenges and working closely with impacted stakeholders.

Part 6: Environmental benefits, opportunities and risks related to hydrogen production, use and distribution

Novel hydrogen technologies bring new challenges to developers, investors, lenders, environmental assessment practitioners and regulators as the risks and impacts associated with hydrogen production, and specifically green hydrogen, requires further research. Hydrogen is extremely flammable and must be stored in high pressure tanks. Storage requirements are also limiting as hydrogen cannot be transported as easily as petroleum products and gas, and the transporting of hydrogen also presents significant safety risks, particularly in the context of collisions. Further, the production of hydrogen presents unique environmental challenges because it is a water-intensive process that not only requires large volumes of water, but also high-quality treated water. The use of water treatment plants may result in significant brine discharge. The desalination of sea water is considered a viable water resource option for hydrogen production and offers an opportunity not only for further infrastructure development but possible opportunity to mitigate South Africa’s water shortages. One significant by-product associated with desalination, however, is the salt-rich effluent (brine) produced during the process, which is then discharged into the ocean and this effluent generation will need to be weighed up in the impact assessments. The construction of a desalination plant may trigger an EA Listed Activity, subject to the production capacity, while the discharge of the brine may also trigger the coastal water discharge permits mentioned above. The movement to green hydrogen will also allow the desalination process to be powered by renewable energy from which the hydrogen itself is generated, allowing for a clean circular process.

In the move towards green economies, it has become apparent that there is a need to not only introduce new emission reduction technologies and “green” energy sources, but also to find solutions and adopt new practices that allow our existing infrastructure to be repurposed, and which work in parallel with and bolster other green energy generation models. Considering that South Africa has one of the highest renewable energy generation potentials in the world and with existing infrastructure in place, the opportunity exists to invest in electrolysis technology. This would also support the platinum sector as platinum is a required raw material for both fuel cell and electrolyser manufacturing. Given that South Africa holds most of the world’s platinum reserves, and is the world’s largest producer of platinum, there is an opportunity for it to be a leading contributor in the manufacturing of the underlying technology. In terms of repurposing, establishing hydrogen production facilities at existing mines and coal-fired power stations, for instance, may offer the opportunity to treat wastewater and contribute to combatting acid mine drainage where treated contaminated water can be used for green hydrogen production.

The use of hydrogen will play a critical role in the transition of the transport sector, which currently accounts for more than 20% of global carbon emissions. In this regard, hydrogen can be used as fuel for long-haul aviation, maritime shipping, certain road vehicles and heavy freight transportation. Further, hydrogen can be used as an intervention in other industries such as steel production and in cement making; it can be used as a cleaned-up chemical feedstock in processes such as fertilizer production; it can contribute, as mentioned above, to the flexible dispatch and long-duration storage needs of a high-renewables electricity grid; and it can support context-specific decarbonization requirements.

A notable practical benefit to green hydrogen usage is that its distribution and storage can be linked to that of natural gas, as hydrogen can be stored in aboveground tanks and transported in gaseous form via pipelines, liquified for shipment, or even converted into denser forms such as ammonia. Establishing widescale pipeline distribution is key to enabling a high-penetration hydrogen economy. In this regard South Africa’s establishment of and upgrades to national and provincial pipeline infrastructure remain a priority as pipelines are conducive to hydrogen distribution, which can be carried out in a manner similar to, and potentially together with, the existing distribution and use of natural gas. Again, this presents an exciting opportunity in terms of infrastructure expansion and development.

Part 7: Environmental social and governance objectives and green financing in relation to hydrogen opportunities

While ESG standards may initially have seemed somewhat abstract, ESG is becoming an increasingly tangible and vital custom in corporate society, capable of swaying investor appetite and developer innovations towards “greener” and more socially responsible projects. The more investment capital is reserved for “greener” developments, the more developers will focus on projects that align accordingly.

ESG has become the foremost investment consideration and financial institutions are required to weigh up short-term costs (which are often extensive) with long-term benefits (that may likely be unquantifiable). Further, institutions need to design and implement ESG strategies that amount to the “tools” to practically implement ESG objectives, without which the objections may remain nebulous and ineffectual. Considering hydrogen’s versatile application and its emission-reducing potential, it could form a key component of impactful ESG strategies and stimulate investment in hydrogen projects for their ESG potential.

For example, hydrogen could be incorporated into projects with high revenue-generation potential to make them appealing targets for impact investing, which is one of the more common ESG strategies. Examples of such projects include algae farming in South Africa’s coastal waters, as algae growth produces hydrogen as a (green) by-product, or repurposing existing gas transmission infrastructure for green hydrogen distribution. Another strategy is improved data analysis, as one of the main barriers to companies implementing ESG initiatives is the lack of data available regarding its (mainly financial) benefit. By improving data analysis techniques, companies will be better equipped to introduce tailored ESG objectives that also result in financial gains, including those involving hydrogen.

While hydrogen has major potential in terms of technology innovation, sustainable repurposing existing infrastructure, job creation, economic recovery, and overall contribution to reducing GHG emissions, the extent of the potential, the cost, and implementation constraints all require further investigation. By bettering and increasing research and investigation into ESG motivated projects such as hydrogen technology and development, companies can confidently develop and hopefully easily access investment in green hydrogen projects that will bolster their ESG ratings that actually, and not superficially, reflect meaningful impacts.

Although the application of ESG criteria appears to primarily feature at the investment decision level, it also plays a vital role in any company’s day-to-day operations. Offering a competitive advantage, ESG observance at business level will naturally also be more attractive to ESG-committed investors and lenders. ESG implementation may have reputational benefits and risks risk of reputational harm if the ESG goals or outcomes are overstated or otherwise misrepresented. To tie back to the need to be conscious of the appetite for increased civil challenges against the environmental impacts of infrastructure development, stakeholders, including environmental and community interest groups, are already holding investors and corporates accountable, scrutinising environmental and social monitoring reports, publicly criticising failures to provide transparent disclosures and instituting ESG related litigation. In South Africa in particular, with its development needs and just transition approach, these challenges are likely to arise irrespective of the robustness of an ESG-led investment decision.

Ultimately, in all ESG initiatives there needs to be a balance between responsibility and profitability, but there also needs to be a mindset shift to where costs are viewed as investments. The introduction of green hydrogen production technologies will be extremely capital intensive and will not be without challenges and barriers, particularly in the context of South Africa’s economic, political, and social constraints. That notwithstanding, hydrogen presents a key opportunity to synergise sustainability and profitability and is therefore perfectly aligned with South Africa’s just transition goals.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe