Preference share funding: SARS issues binding private ruling on section 8E and 8EA of the Income Tax Act

At a glance

- Section 8E and section 8EA of the Income Tax Act recharacterize exempt dividends as income, subjecting them to tax.

- Ruling BRP 379 states that dividends paid to a preference shareholder after the sale of ordinary shares will not be recharacterized as income under section 8E or 8EA, given certain conditions are met.

- The ruling has implications for taxpayers who meet the specified conditions, but the ruling does not disclose all the relevant facts.

Section 8E and section 8EA of the Income Tax Act

Before discussing BRP 379, it is worthwhile revisiting section 8E and section 8EA of the Income Tax Act 58 of 1962 (ITA). A thorough discussion of these sections falls outside the scope of this article. However, we wish to briefly discuss the effect of these sections before discussing BRP 379.

The effect of section 8E and 8EA of the ITA is that if the requirements of section 8E(2) or section 8EA(2) of the ITA are met, dividends received by a person are deemed to be income. Simply put, section 8E(2) and 8EA(2) serve to recharacterize exempt dividends received by a person as income. The consequence of this recharacterization is that the dividends (which are in the ordinary course usually exempt from income tax) are deemed to be income and therefore subject to tax in the hands of the holder.

Background facts on BRP 379

The factual background to BRP 379:

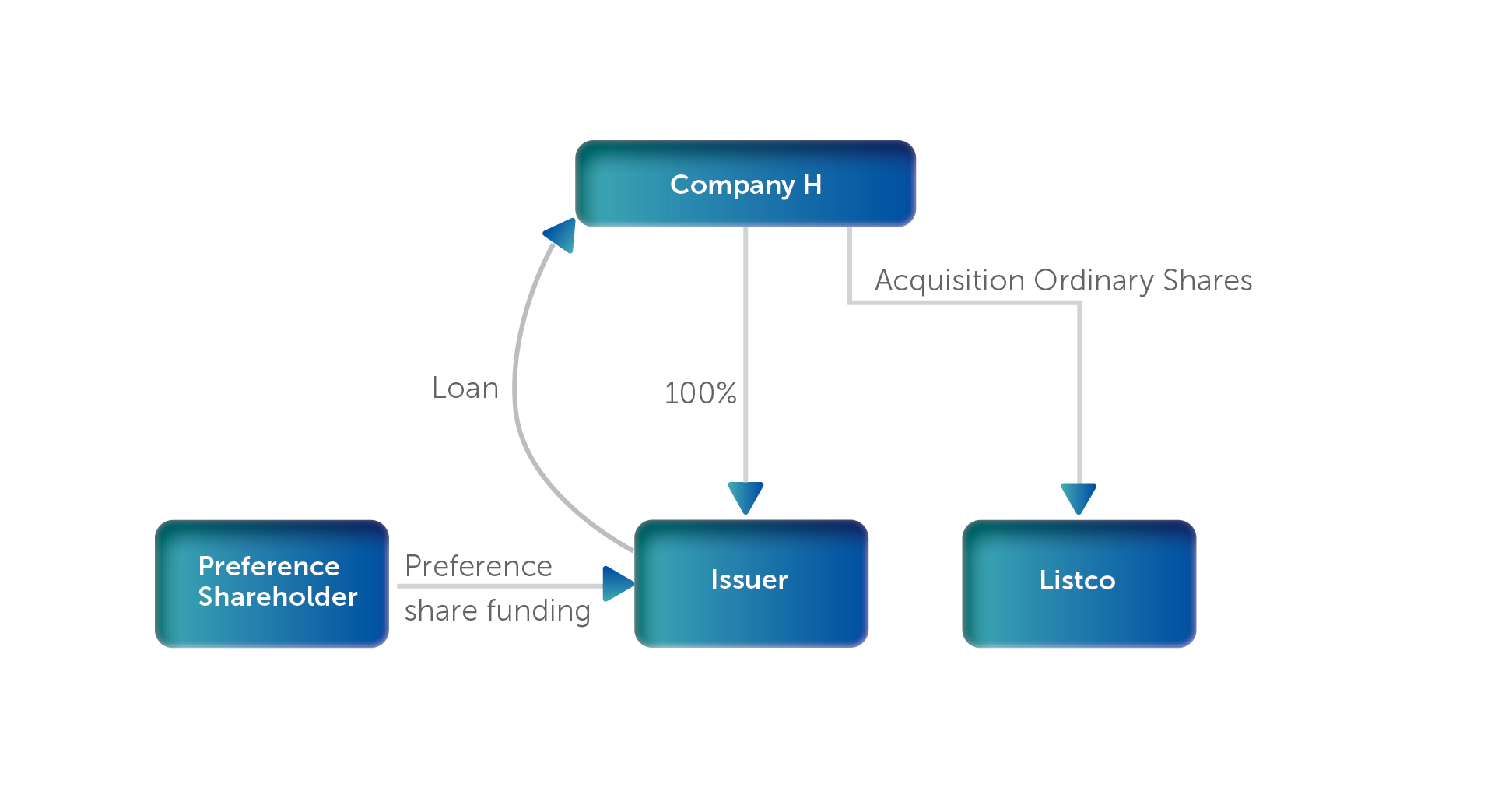

- A company issued cumulative redeemable preference shares to a preference shareholder and used the proceeds of the preference shares to advance a loan to Company H (as indicated below).

- Company H utilised the loan to acquire “ordinary shares” in Listco (a listed company)

- Due to losses sustained on the market value of the shares acquired by Company H, Company H disposed of these ordinary shares.

- Pursuant to the disposal of the shares held by Company H in Listco, the issuer proposed declaring a preference share dividend to the preference shareholder.

Ruling

Based on the specific set of facts and subject to the assumption that Listco is an “operating company” (as such term has been defined in section 8EA(1) of the ITA) on the day that the preference share dividends are paid, the ruling made by SARS was that any dividends paid by the issuer to the preference shareholder after the sale by Company H of the ordinary shares in Listco will not be recharaterised as income in terms of section 8E or 8EA of the ITA.

Implication of BRP 379 for taxpayers

In terms of section 83 of the Tax Administration Act 28 of 2011 (TAA), a binding private ruling applies to a person only if:

- the provision or provisions of the Act at issue are the subject of the “advance ruling”;

- the person’s set of facts or transaction are the same as the particular set of facts or transaction specified in the ruling;

- the person’s set of facts or transaction fall entirely within the effective period of the ruling;

- any assumptions made or conditions imposed by SARS in connection with the validity of the ruling have been satisfied or carried out; and

- the person is an applicant identified in the ruling.

Additionally, BRP 379 does not reveal all the applicable facts. Despite this, it is interesting to note that it appears from BRP 379 that if (i) the proceeds of a preference share are used to acquire equity shares in an operating company and (ii) the equity shares are subsequently disposed of pursuant to the investment not yielding the anticipated returns, after the disposal of the equity shares and provided the operating company is an “operating company” (as defined in section 8EA(1) of the ITA), the dividends received by the preference shareholder will not be recharacterized as income in terms of section 8E or 8EA of the ITA.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe