Restructuring Rules – Binding Private Ruling 360 rules on rollover relief applying to group consolidation and empowerment investment

At a glance

- Corporate group restructuring can help investors target specific parts of the group and unlock value by consolidating or dividing businesses and assets.

- Rollover relief provisions in tax laws allow for tax-deferred intra-group transfers of assets, facilitating corporate group reorganization.

- Binding Private Ruling 360 (BPR360) demonstrates the flexibility of corporate groups in enabling targeted investments, such as consolidating companies under an intermediate holding company for an empowerment investor.

The rollover relief provisions in Part III of Chapter 2 of the Income Tax Act 58 of 1962 (Act) facilitate the consolidation or division required to appropriately organise a corporate group. These provisions provide mechanisms to conduct intra-group transfers of assets, by deferring the ordinary income and capital gains tax consequences that would otherwise arise from such transfers between distinct taxpayers.

Binding Private Ruling 360 (BPR360) is a good example of the value of flexibility in corporate groups, in enabling targeted investment. Here, a listed holding company (Applicant) – as part of its B-BBEE initiative and to protect and enhance its commercial position – sought to consolidate certain companies operating in the same sector under an intermediate holding company and to sell a 25% interest in the intermediate holding company to an empowerment investor.

The focus of BPR360 is on the asset-for-share & intra-group transactions consolidating the operating companies under the intermediate holding company, in anticipation of an empowerment investment. Here we will briefly cover how the consolidation was achieved and the specific rulings contained in BPR360.

Rationale of the transaction

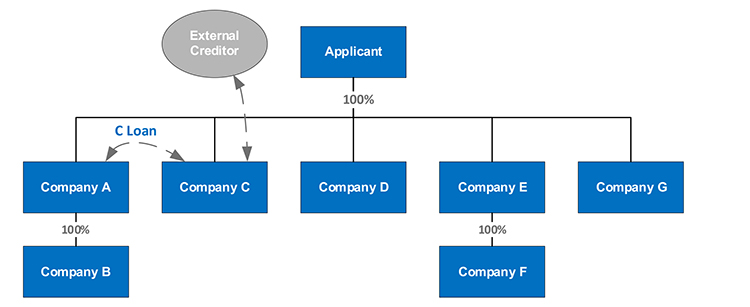

The Applicant for the purposes of BPR360 owned 100% of five companies directly, two of which each 100% owned a subsidiary. The rationale for the transaction was to consolidate Company B and Company C, under Company G. Company G, being the intermediate holding company owning the relevant operating companies would then be the target of investment by the empowerment investor.

The section 42 asset for share transaction

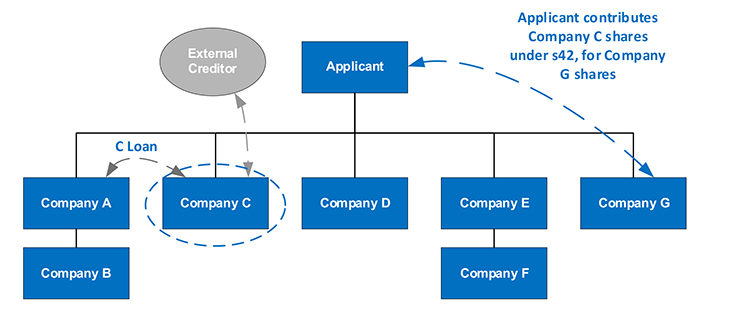

The first step of the transaction would see the Applicant contributing the shares it owned in Company C to Company G, in exchange for shares issued by Company G. This was to be done as an asset-for-share transaction (AFS) under section 42 of the Act.

An AFS meeting the definition in section 42, benefits from deferred tax consequences that would otherwise be triggered immediately where an asset is transferred in exchange for the issue of shares. Section 42 applies to deem the transferor and issuer to be one and the same person, as regards the tax characteristics of the asset transferred – including, the date and cost of acquisition. The shares issued are similarly deemed to have been acquired on the same date and for the same expenditure as the asset transferred was initially acquired.

A precursor to the AFS here was to settle outstanding debt owed by Company C to an external creditor, to be funded by the issue of additional shares in Company C. BPR360 ruled that the subscription price for these shares would constitute contributed tax capital, as defined in section 1 of the Act, and expenditure actually incurred as used in paragraph 20(1)(a) of the Eighth Schedule to the Act (Eighth Schedule), for the purposes of determining the shares’ base cost. BPR 360 states that the contributed tax capital is attributable to the additional shares in Company C.

BPR360 ruled that the AFS was a section 42 transaction. Meaning Company G is deemed to step into the shoes of the Applicant as regards the tax characteristics of the Company C shares and the Applicant would be deemed to have received the Company G shares issued at the same base cost and time as the Applicant initially acquired the Company C shares transferred.

This achieves the first leg of consolidation, with Company G becoming an intermediary holding company of Company C rather than held directly by the Applicant.

The section 45 intra-group sale of Company B

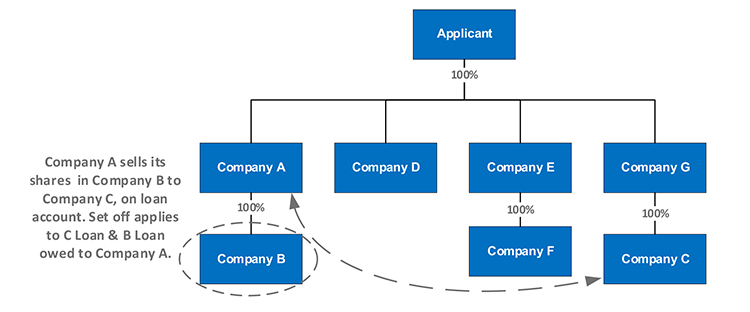

The second step of the consolidation relied on another rollover provision – intra-group transactions under section 45 of the Act. This step saw Company A selling its entire shareholding in Company B to Company C, with the purchase price partially being set off against an existing intra-group loan and the remainder left outstanding as a new intra-group loan.

An intra-group transaction meeting the definition in section 45, will also benefit from tax consequence deferrals. Where a resident company disposes of a capital asset to another resident company forming part of the same group of companies, then:

- the transferor company is deemed to have disposed of the asset for an amount equal to the base cost; and

- the transferee company is deemed to have acquired the asset at the same base cost and on the same date as the transferor initially acquired the asset.

BPR360 ruled that the sale of the Company B shares to Company C would constitute a section 45(1)(a) intra-group transaction. Under which Company A is deemed to have disposed of the Company B shares for an amount equal to their base cost. Company C will further be deemed to be one and the same person as Company A as regards the tax characteristics of the Company B shares.

The transaction is funded partially by set off of a pre-existing loan owed by Company A to Company C and partially by a new loan from Company C to Company A. BPR360 therefore had to rule on the application of section 45(3A)(b)(i) and the debt forgiveness provisions in the Act.

BPR360 ruled that with the application of section 45(3A)(b)(i), the B loan will be acquired by Company C for nil expenditure and therefore nil base cost. Further, section 45(3A)(c) will apply to the set off and any attendant capital gains or taxable income will be disregarded.

Paragraph 12A of the Eighth Schedule, dealing with concessions or compromise of debt, was similarly ruled to not find application to the set off caused by this step of the transaction.

Section 45 as a restructuring tool here enables Company A to dispose of a subsidiary to another group company, in a manner which further consolidates the target companies under the intermediate holding of Company G, but without the immediate tax cost which this would otherwise cause. Further, a commercially useful inversion of the debt relationship between Company A and Company C is also achieved, with Company A becoming a creditor of Company C after the implementation of the step.

Empowerment into final structure

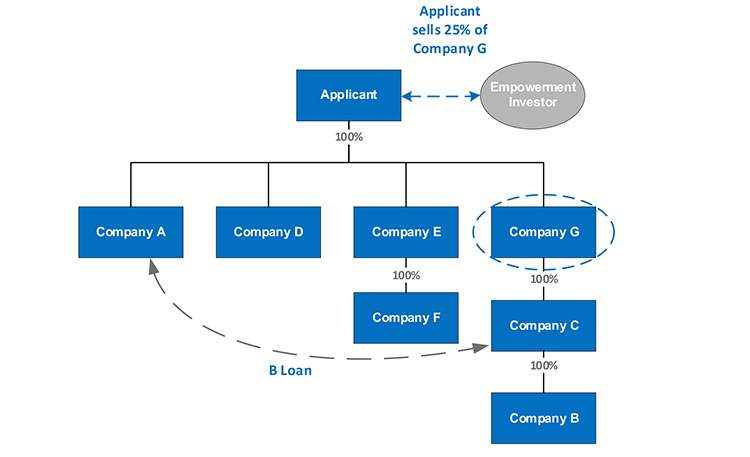

With the Applicant’s corporate group having been appropriately consolidated under the previous steps of the transaction, the empowerment investor is then able to invest into the appropriate part of business held by Applicant – being the intermediary Company G.

BPR360 contains rulings which are important to the successful implementation of the empowerment transaction. These include rulings that:

- Despite the recent acquisition of Company G shares by the Applicant, that the sale of Company G shares to the empowerment investor would be the disposal of a capital asset for the purposes of the Eighth Schedule;

- In determining the base cost of these shares, section 9C(6) would not apply. Rather, paragraph 32(3)(a) requires each share to have its base cost specifically identified;

- The discount to be applied to the investment by the empowerment partner would not constitute a donation under section 55 of the Act, nor would it be appropriate for the Commissioner to exercise his power under section 58 to adjust the pricing of the transaction as a deemed donation; and

- The de-grouping charge under section 45(4)(b) will not apply to any of the steps of the transaction.

Comment

BPR360 provides an excellent example of how agility in the structure of a corporate group can unlock value for potential investors. The rollover relief rules create this agility, by facilitating certain “tax free” transactions in a group context. These include the transfer of assets – including debt – within a group, the injection of assets into new group companies, the unbundling of a junior subsidiary into a par ranking subsidiary within a listed group, and the winding up and distribution of assets owned by companies which are no longer necessary or useful to the corporate structure.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe