Benefit sharing in carbon projects: Reflections on recent legal developments in Kenya

At a glance

- Three bills that could have a bearing on benefit sharing in carbon projects, have been proposed: the Climate Change (Amendment) Bill, 2023, the Carbon Credit Trading and Benefit Sharing Bill, 2023 and the Natural Resources (Benefit Sharing) Bill, 2022.

- Development of a legal and regulatory framework to enhance Kenya's engagement with the carbon markets is important, and the existence of these three proposed bills, all of which have a bearing on benefit sharing, is evidence of the weight with which this issue is held.

- All proposals related to benefit sharing require adequate public comment and stakeholder engagement to ensure that they are well informed by experiences on the ground and best practice approaches that meet Kenya's constitutional imperative for public participation, equity and fairness.

These include the world’s first registered REDD+ project issued with Verified Carbon Units under the Verified Carbon Standard, the world’s first community-led blue carbon project aimed at restoring and protecting mangrove forests through the sale of carbon credits, and more recently, the Global South’s first direct air capture company intending to sell carbon credits certified by removals platform Puro.earth, once the carbon capture and storage process begins.

As the worldwide push to enhance the integrity of carbon markets gains momentum, questions surrounding benefit sharing should be significantly reflected on. Who benefits from carbon projects and how they benefit, is issue increasingly under discussion amongst stakeholders, including investors, Government and local communities. However, Kenya’s legal framework currently provides no clear-cut answers to the question.

Though the Constitution of Kenya sets out equity as a key principle of governance and requires equitable sharing of natural resources, the modalities of how this relates to carbon projects is not set out in law. As such, benefit sharing is reflected variously. Land-based carbon projects have often relied on contractual agreements between parties to determine the benefit sharing arrangements for both monetary and non-monetary benefits, while non-land-based projects, such as improved cookstove projects, have used carbon revenue to subsidise the cost of the low carbon products, enabling affordability for households.

In a complex twist of legislative development, three bills that could have a bearing on benefit sharing in carbon projects, have been proposed. Below, we highlight the salient provisions of these bills and reflect on their likely implications.

The Climate Change (Amendment) Bill, 2023

The Ministry of Environment, Climate Change and Forestry formulated the Climate Change (Amendment) Bill, 2023 (Bill) to incorporate carbon markets in the Climate Change Act and govern the participation in these markets. The Bill defines a carbon market as a “mechanism that enables and allows public and private entities to transfer and transact emission reduction units, mitigation outcomes or offsets generated through carbon initiatives, programmes and projects”.

One of the significant provisions of the Bill is the obligation that it imposes on all entities undertaking carbon projects to specify the environmental, economic and social benefits that they anticipate. It also requires that all projects be implemented through a community development agreement that stipulates the obligations and relationships of project proponents with the community. The Bill tasks the National Government and the respective County Governments where the projects are situated with the responsibility of overseeing and monitoring the negotiation of community development agreements with stakeholders and project proponents, and a community development agreement is required to provide for:

- sharing of benefits from the carbon markets and carbon credits between project proponents and the impacted communities;

- the provision of an annual social contribution of at least 25% of the aggregate earnings of the previous year to the community;

- a list of stakeholders of a project including: project proponents, the impacted communities, the National Government and the County Government where the project is undertaken; and

- the proposed development of communities around the project.

The Ministry of Environment, Climate Change and Forestry opened the Bill for public comment between 27 March and 26 May 2023. Upon consideration of stakeholder comments, the Cabinet Secretary for matters environment presented the Bill to Cabinet, and on 18 July 2023, Cabinet considered the Bill as one of the legislative proposals aimed at gearing the administration towards achieving the Bottom-Up Economic Transformation Agenda and approved it. The Bill currently awaits tabling in Parliament, and it will be important to see whether, following stakeholder comments, the updated Bill addresses concerns on benefit sharing and the difference between land-based carbon projects and non-land-based carbon projects; provides clarity on the payment of the required annual social contributions; and clearly defines the beneficiary community.

The Carbon Credit Trading and Benefit Sharing Bill, 2023

The Carbon Credit Trading and Benefit Sharing Bill, 2023 (Carbon Credit Bill) is a Private Member’s Bill that seeks to regulate carbon credit trading and facilitate equitable benefit sharing. Proposed by Joseph Lekuton, the Member of Parliament for Laisamis (Marsabit County), the Carbon Credit Bill provides for the establishment of a:

- Regulatory framework for the trading of carbon credits, including the registration of carbon trading business.

- Regulatory framework for benefit sharing in carbon trading with a set out benefit sharing ratio.

- Carbon Credit Trading and Benefit Sharing Authority that is charged with an array of responsibilities, including the task of ensuring that benefits are shared fairly and equitably among stakeholders.

- Carbon Credit Trading Tribunal to hear disputes and appeals on the trading of carbon credits and benefit sharing.

The Bill defines benefit sharing to mean “fair and equitable sharing of monetary and non-monetary benefits from the use of natural resources”. The Bill defines a community as “a group of people living around the area where carbon credit trading business is conducted or a group of people who may be displaced to make way for carbon credit trading business”.

It provides for community development and benefit sharing agreements through which every carbon credit trading business project must be implemented. These are defined as agreements entered into between an entity engaged in the carbon credit trading business and a community, and that stipulate the manner in which revenue accruing from the use of natural resources shall be shared out among the National Government, County Government, local community and stakeholders.

Notably, the community and benefit sharing agreements are required to outline the terms of benefit sharing among the National Government, the respective County Government, local community and other relevant stakeholders; the rights and obligations of parties; the monetary benefits that accrue from a project as well as the initial contribution of the private or public entity engaged in the carbon credit trading business; and rules and procedure of engagement with the local community including public participation, public awareness and consultation.

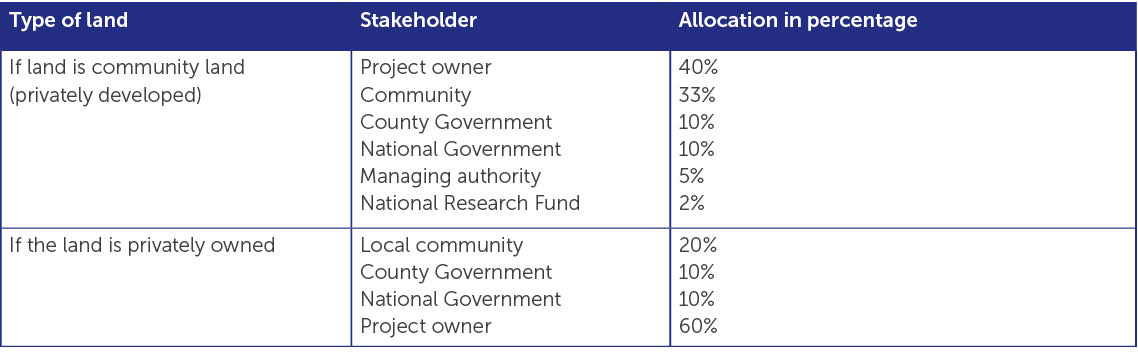

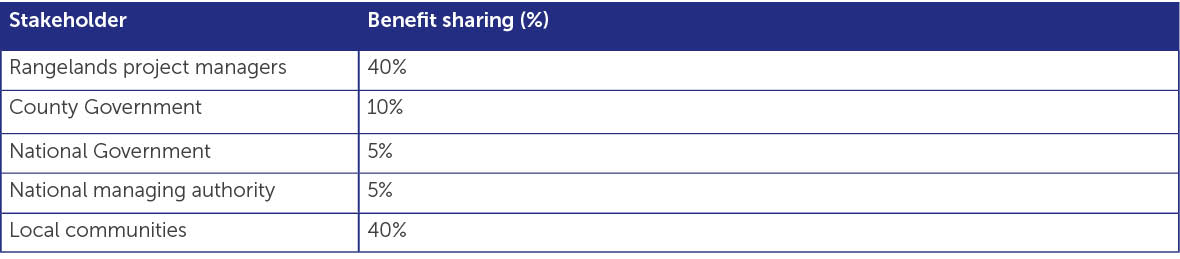

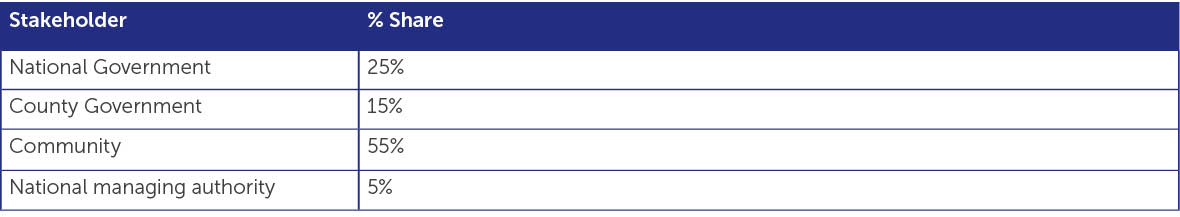

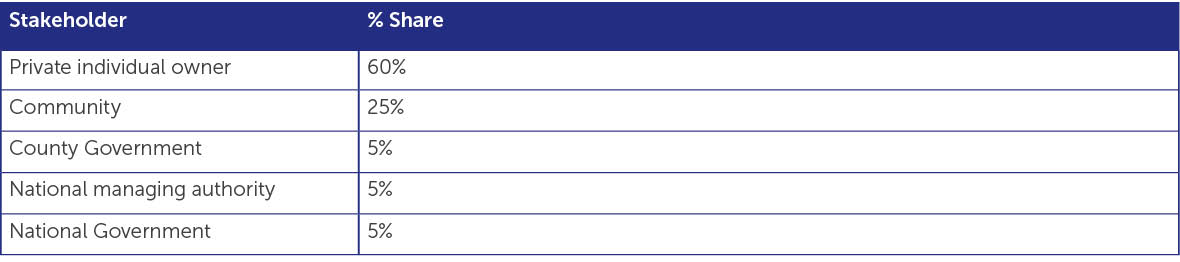

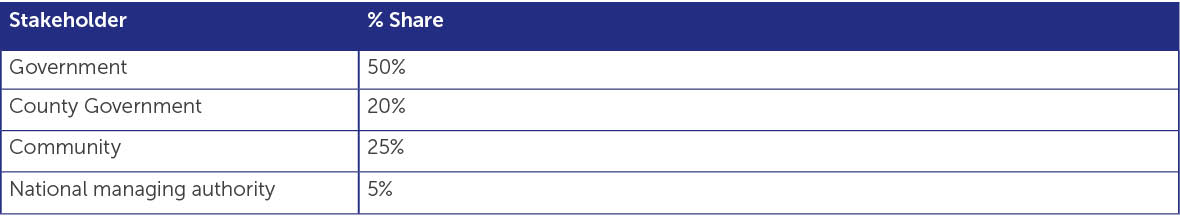

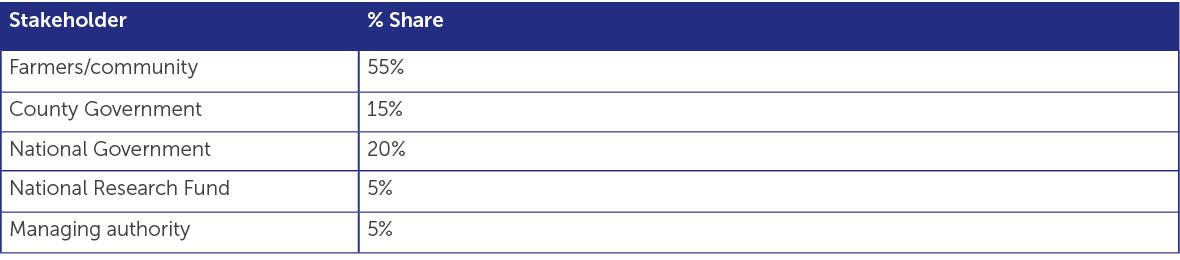

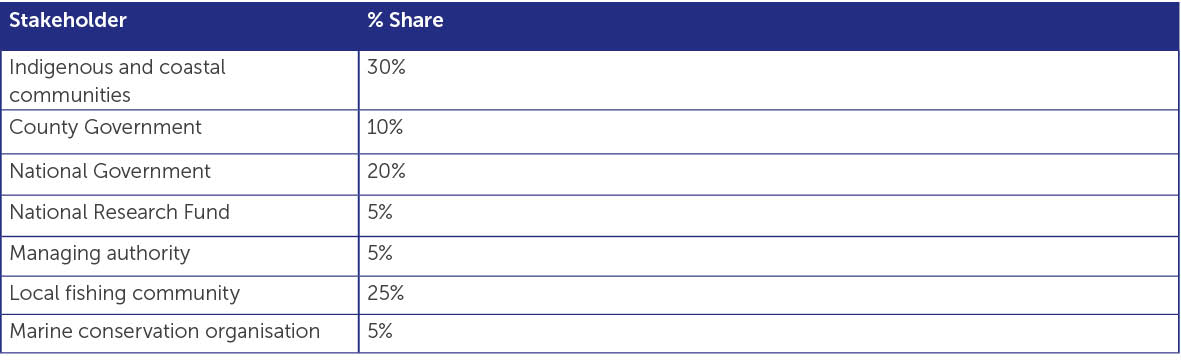

According to the Bill, every community development and benefit sharing agreement requires recording in the proposed Carbon Credit Trading Register. The Carbon Credit Bill’s Third Schedule expounds on the benefit sharing ratio by setting out the percentages of benefits that are to be allocated to various stakeholders, as highlighted below:

All renewable energy carbon projects

Rangelands

Community forest

Private forest/individual

Government/protected forest

Soil as a carbon resource

Blue carbon

In July 2023, the Carbon Credit Bill was presented to Parliament’s Budget and Appropriations Committee to assess whether it has any financial implications for the country, and a fiscal and policy brief has been shared with the committee to enable this determination to be made. It will be important to monitor the Carbon Credit Bill’s development as it progresses in Parliament as it overlaps with the Climate Change (Amendment) Bill 2023 discussed in above. Further, it contains benefit sharing ratios that do not carefully consider and reflect the role of private investment in the development of carbon projects. The Bill is in the early stages of development and has yet to be subjected to public participation.

In July 2023, the Carbon Credit Bill was presented to Parliament’s Budget and Appropriations Committee to assess whether it has any financial implications for the country, and a fiscal and policy brief has been shared with the committee to enable this determination to be made. It will be important to monitor the Carbon Credit Bill’s development as it progresses in Parliament as it overlaps with the Climate Change (Amendment) Bill 2023 discussed in above. Further, it contains benefit sharing ratios that do not carefully consider and reflect the role of private investment in the development of carbon projects. The Bill is in the early stages of development and has yet to be subjected to public participation.

The Natural Resources (Benefit Sharing) Bill, 2022

The Natural Resources (Benefit Sharing) Bill, 2022 (Natural Resources Bill) is sponsored by Tana River County Senator Danson Mungatana and is intended to apply to natural resources such as sunlight, water resources, wildlife resources, wind, industrial fishing, forests, biodiversity, and genetic resources.

It defines the term benefit sharing as the “sharing of any benefits arising from the exploitation of natural resources in a fair and equitable manner”. Exploitation, on the other hand, is defined to mean “the extraction or utilisation of a natural resource for commercial purposes.” As such, though not explicitly mentioning carbon projects, the use of sunlight, water or forests for commercial purposes such as to earn carbon credits through the establishment of relevant carbon projects, may be read as falling within the provisions of the Natural Resources Bill.

The Natural Resources Bill requires that before any natural resource is exploited in a county, the entity carrying out the exploitation must enter a benefit sharing agreement with the relevant County Government. Such an agreement must include non-monetary benefits that may accrue to the county and the contribution of the organisation carrying out the exploitation.

The Natural Resources Bill does not prescribe specific sharing ratios that must be reflected in the agreement, but proposes the establishment of a County Benefit Sharing Committee that:

- negotiates the terms of a benefit sharing agreement on behalf of the County Government;

- determines the amount of money that is allocated to local communities from monies that accrue under a benefit sharing agreement;

- assists in convening public forums to aid public participation regarding community projects in relation to proposed benefit sharing agreements during negotiations prior to execution by the County Government.

Prior to execution, every benefit sharing agreement is to be approved by the respective county assembly of the affected county. Additionally, within 30 days of its execution, every benefit sharing agreement is to be deposited with the Commission of Revenue Allocation and a copy of it must simultaneously be submitted to the Senate.

Once the Natural Resources Bill comes into force, an entity lawfully authorised to exploit a natural resource shall be required to comply with Natural Resources Bill’s provisions within two years of its commencement. This leaves carbon projects with two years within which to align their benefit sharing arrangements with the requirements of the Natural Resources Bill, once it is enacted.

Importantly, the Natural Resources Bill provides that where a written law prescribes the benefit sharing in a particular natural resource sector, the relevant written law specific to that sector shall apply. The implication of this is that should the proposed Climate Change (Amendment) Bill, 2023 or the Carbon Credit Trading and Benefit Sharing Bill, 2023 be passed, the Natural Resources (Benefit Sharing) Bill, 2022 would not be applicable to carbon projects, as far as issues of benefit sharing are contained in these other laws. Nonetheless the Natural Resources Bill is clear that once it is passed into law, the Commission of Revenue Allocation shall monitor legal compliance and implementation of all benefit sharing agreements in Kenya, meaning that going forwards, the Commission will be a key stakeholder in carbon projects.

The Natural Resources Bill, which has been a long time in the making, having first being introduced to Parliament in 2014, is currently before the Senate. It passed through the second reading stage on 13 April 2023. On 7 June 2023, it was taken before the Committee of the Whole House which is yet to finish considering and reviewing it. It will be pertinent to monitor the Natural Resources Bill’s progress and the extent to which it will be applicable to benefit sharing in carbon projects.

The way forward

Development of a legal and regulatory framework to enhance Kenya’s engagement with the carbon markets is important, and the existence of these three proposed bills, all of which have a bearing on benefit sharing, is evidence of the weight with which this issue is held. While the Climate Change (Amendment) Bill, 2023 and the Carbon Credit Trading and Benefit Sharing Bill, 2023 are directly concerned with the carbon trading, the Natural Resources (Benefit Sharing) Bill, 2022 implicitly enters this space by virtue of its focus on natural resources that form the basis for many carbon projects.

While it is not novel for lawmakers to introduce bills that are similar in purpose, it is crucial that there is coherence in the approach to law-making. All proposals related to benefit sharing require adequate public comment and stakeholder engagement to ensure that they are well informed by market realities and practices as well as good practice examples that meet Kenya’s constitutional imperative for equity and fairness. Additionally, current overlaps as they relate to the requirements for benefits sharing agreements, procedures for entering into such agreements, the requisite benefit sharing ratios, the resolution of arising disputes, and the overarching institutional framework for benefit sharing, require alignment.

Kenya’s legislative process is robust enough to chart a path forward that enables consideration and harmonisation of the three bills. The ball is now in the hands of lawmakers, who will need to carefully scrutinise the proposed Bills before them and as applicable, invite public comments to help craft an effective benefit sharing regime for carbon projects in Kenya.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2024 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe